Irs 2290 Form Printable

What is the IRS 2290 Form Printable

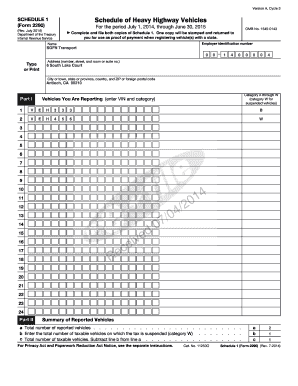

The IRS 2290 form, also known as the Heavy Highway Vehicle Use Tax Return, is a tax form used by businesses and individuals who operate heavy vehicles on public highways. This form is essential for reporting and paying the federal highway use tax for vehicles weighing 55,000 pounds or more. The printable version of the IRS 2290 form allows users to fill out the necessary information manually or digitally, ensuring compliance with federal tax regulations. Completing this form accurately is crucial, as it helps maintain proper records for tax purposes and vehicle registration.

Steps to Complete the IRS 2290 Form Printable

Filling out the IRS 2290 form requires careful attention to detail. Here are the key steps to complete the form:

- Gather necessary information, including your Employer Identification Number (EIN), vehicle identification numbers (VINs), and the total number of vehicles you are reporting.

- Download the IRS 2290 form printable from a reliable source, ensuring you have the correct version for the current tax year.

- Fill in the required fields, including your personal information, vehicle details, and tax calculations based on the weight of your vehicles.

- Review the form for accuracy, ensuring all information is complete and correct.

- Sign and date the form, confirming that the information provided is accurate to the best of your knowledge.

How to Obtain the IRS 2290 Form Printable

The IRS 2290 form printable can be obtained directly from the IRS website or through various tax preparation services that offer downloadable forms. To ensure you are using the most current version, it is advisable to check the IRS website periodically, especially as the tax year approaches. Additionally, many online platforms provide the option to fill out the form electronically, which can streamline the process and reduce errors.

Legal Use of the IRS 2290 Form Printable

The IRS 2290 form is legally required for individuals and businesses operating heavy vehicles on public roads. Filing this form ensures compliance with federal tax laws and helps avoid penalties associated with non-compliance. When completed accurately and submitted on time, the form serves as proof of tax payment and is essential for maintaining proper vehicle registration. Using a reliable platform to eSign the form can further enhance its legal standing by providing a digital certificate and ensuring compliance with eSignature regulations.

Filing Deadlines / Important Dates

Filing the IRS 2290 form is subject to specific deadlines that must be adhered to in order to avoid penalties. The deadline for filing the form is typically the last day of the month following the end of the tax period. For example, if you are filing for the tax year that begins in July, the form must be filed by August 31. Additionally, if you are operating a vehicle during the tax year, you must file the form by the due date to ensure compliance and avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

The IRS 2290 form can be submitted through various methods, including online e-filing, mailing a paper form, or submitting it in person at designated IRS offices. E-filing is often the most efficient method, as it allows for quicker processing and confirmation of receipt. When mailing the form, it is important to send it to the correct address specified by the IRS to avoid delays. If submitting in person, ensure you have all necessary documentation and identification to facilitate the process.

Quick guide on how to complete irs 2290 form printable

Access Irs 2290 Form Printable effortlessly on any gadget

Web-based document management has gained traction among companies and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can discover the correct form and securely file it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents instantly without delays. Manage Irs 2290 Form Printable on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Irs 2290 Form Printable effortlessly

- Find Irs 2290 Form Printable and click Get Form to commence.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or redact sensitive information with specialized tools offered by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information thoroughly and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Adjust and eSign Irs 2290 Form Printable while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs 2290 form printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS 2290 form 2024 printable used for?

The IRS 2290 form 2024 printable is used to report and pay the Heavy Highway Vehicle Use Tax. Truck owners must file this form annually to ensure compliance with federal regulations. Using airSlate SignNow, you can easily prepare and eSign your IRS 2290 form 2024 printable, simplifying the filing process.

-

How can I access the IRS 2290 form 2024 printable?

You can access the IRS 2290 form 2024 printable through our platform. airSlate SignNow allows users to generate, fill out, and print the form directly from our site. This feature simplifies the tax filing process and ensures you have the latest version of the IRS 2290 form 2024 printable.

-

Is there a cost associated with using airSlate SignNow for the IRS 2290 form 2024 printable?

Yes, airSlate SignNow offers various pricing plans to cater to your needs. Whether you're a small business or a fleet owner, our plans are designed to provide cost-effective solutions for sending and signing documents, including the IRS 2290 form 2024 printable.

-

What features does airSlate SignNow offer for the IRS 2290 form 2024 printable?

airSlate SignNow provides a user-friendly interface for preparing and eSigning the IRS 2290 form 2024 printable. Additionally, our platform offers secure document storage, tracking, and the ability to collect signatures electronically, making your tax filing process efficient.

-

Can I integrate airSlate SignNow with other tools for handling the IRS 2290 form 2024 printable?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications such as Google Drive and Dropbox. This allows you to streamline your workflow and manage the IRS 2290 form 2024 printable more effectively across different platforms.

-

What are the benefits of using airSlate SignNow for the IRS 2290 form 2024 printable?

Using airSlate SignNow for the IRS 2290 form 2024 printable offers numerous benefits such as time savings, improved accuracy, and enhanced security. Our platform simplifies the eSigning process and provides a reliable way to manage your tax documents efficiently.

-

What support options are available if I have questions about the IRS 2290 form 2024 printable?

airSlate SignNow offers comprehensive customer support to assist with any queries regarding the IRS 2290 form 2024 printable. You can access our help center, chat with support representatives, or email us for prompt assistance. We're here to ensure you have all the resources you need.

Get more for Irs 2290 Form Printable

- 2021 schedule 500fed corporation schedule of federal line items virginia schedule 500fed 2021 corporation schedule of federal form

- Wwwvagovvaformsmedicalinstructions for completing health benefits update form

- Forms social security

- Wwwpdffillercom557920614 proppraprocurement2021 form usps ps 17 g fill online printable fillable

- 2015 form usps ps 3541 1 fill online printable fillable

- 2015 form usps ps 3600 ez fill online printable fillable

- You are not required to respond to a collection of information sponsored by the federal government and the government may

- Waiver of your right to personal appearancebefore a judge waiver of your right to personal appearancebefore a judge form

Find out other Irs 2290 Form Printable

- eSign Form for Sales Teams Computer

- eSign Form for Sales Teams Later

- eSign Form for Sales Teams Free

- How To eSign Document for Sales Teams

- How To eSign Form for Sales Teams

- eSign Form for Sales Teams Simple

- How To eSign PPT for Sales Teams

- eSign PPT for Sales Teams Online

- eSignature PDF for HR Online

- eSignature PDF for HR Computer

- eSign PPT for Sales Teams Computer

- eSign PPT for Sales Teams Now

- eSign Presentation for Sales Teams Online

- eSign Presentation for Sales Teams Computer

- eSignature PDF for HR Fast

- eSign PPT for Sales Teams Later

- eSign Presentation for Sales Teams Mobile

- eSign PPT for Sales Teams Myself

- eSign Presentation for Sales Teams Secure

- eSignature Word for HR Online