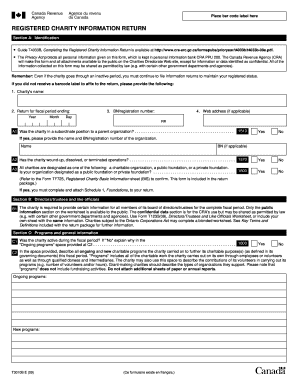

T3010 Form

What is the T3010?

The T3010 is the Registered Charity Information Return, a form required by the Canada Revenue Agency (CRA) for registered charities in Canada. This form provides essential information about a charity's activities, financial status, and governance. It is crucial for maintaining transparency and compliance with Canadian regulations governing charitable organizations. The T3010 allows the CRA to assess whether charities are adhering to the rules and regulations that govern their operations.

How to use the T3010

Using the T3010 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and balance sheets. Next, fill out the form with detailed information about the charity's activities, governance, and financials. It is essential to provide accurate and complete information to avoid penalties. Once completed, the T3010 can be submitted electronically or by mail, depending on the charity's preference and compliance requirements.

Steps to complete the T3010

Completing the T3010 requires careful attention to detail. Follow these steps:

- Gather financial statements and records of charitable activities.

- Fill out the identification section with the charity's name, registration number, and contact information.

- Provide financial information, including revenue, expenses, and assets.

- Detail the charity's programs and activities, ensuring to highlight how they align with the organization's mission.

- Review the completed form for accuracy and completeness.

- Submit the T3010 electronically through the CRA's online portal or mail it to the appropriate address.

Legal use of the T3010

The T3010 must be completed and submitted in accordance with the legal requirements set forth by the CRA. It serves as a legal document that outlines a charity's compliance with regulations governing charitable organizations. Accurate reporting is essential to maintain the charity's registered status and avoid penalties. Charities must ensure that the information provided is truthful and reflects their activities and financial status accurately.

Filing Deadlines / Important Dates

Registered charities must be aware of specific deadlines for filing the T3010. The return is due six months after the end of the charity's fiscal year. For example, if a charity's fiscal year ends on December 31, the T3010 must be filed by June 30 of the following year. Timely submission is crucial to avoid penalties and maintain compliance with CRA regulations.

Required Documents

To complete the T3010, several documents are required:

- Financial statements for the fiscal year.

- Records of charitable activities conducted during the year.

- Governance documents, including bylaws and board meeting minutes.

- Any additional documentation that supports the information provided in the T3010.

Form Submission Methods

The T3010 can be submitted through various methods, ensuring flexibility for charities. Options include:

- Online submission via the CRA's online services, which is the preferred method for many organizations.

- Mailing a paper copy of the completed form to the appropriate CRA address.

- In-person submission at designated CRA offices, if applicable.

Quick guide on how to complete t3010

Prepare T3010 effortlessly on any device

Web-based document management has gained increased popularity among businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to construct, alter, and electronically sign your documents quickly without delays. Manage T3010 on any device with airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The easiest way to modify and electronically sign T3010 without any hassle

- Locate T3010 and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive data with tools specifically designed for that purpose provided by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you want to send your form, through email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign T3010 and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t3010

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t3010b form used for?

The t3010b form is utilized by registered charities in Canada to report their financial information and activities to the Canada Revenue Agency. It includes details about the charity's revenues, expenditures, and programs, ensuring transparency and compliance. Using airSlate SignNow, charities can easily eSign and submit their t3010b forms securely and efficiently.

-

How can airSlate SignNow help with completing the t3010b?

airSlate SignNow simplifies the process of completing the t3010b by allowing users to collaborate and fill out forms electronically. The platform provides templates and easy-to-use tools that guide users through the required fields, ensuring that all necessary information is captured for compliance. This greatly reduces the time spent on paperwork and helps ensure accuracy.

-

Is there a pricing plan for using airSlate SignNow to sign t3010b forms?

Yes, airSlate SignNow offers flexible pricing plans tailored to suit various business needs, including those using the t3010b. You can choose from several options based on the number of users and the features required. Each plan ensures you have access to robust tools for eSigning and managing your t3010b documents effortlessly.

-

Can airSlate SignNow integrate with other software for handling t3010b?

Absolutely! airSlate SignNow comes with various integrations that enable you to connect with software like CRM systems and project management tools. This allows for a streamlined workflow when managing your t3010b and other business documents. Integrating your platforms helps save time and ensures all relevant data is seamlessly shared.

-

What are the key benefits of using airSlate SignNow for t3010b forms?

Using airSlate SignNow for your t3010b forms provides numerous benefits, including enhanced efficiency and security. The platform ensures your documents are signed and submitted swiftly while maintaining compliance with regulations. Additionally, it offers tracking features so you can monitor the status of your t3010b submissions.

-

Is airSlate SignNow user-friendly for newcomers working on t3010b?

Yes, airSlate SignNow is designed to be user-friendly, making it accessible for newcomers working on t3010b forms. The intuitive interface allows users to easily navigate through features without needing extensive training. Quick tutorials and support are also available to help users get started promptly.

-

How does airSlate SignNow ensure the security of t3010b documents?

airSlate SignNow employs high-level security measures to protect your t3010b documents during the eSigning process. Data encryption and secure servers are standard protocols, ensuring that sensitive information remains confidential. Users can confidently manage their t3010b forms knowing that their data is secure.

Get more for T3010

Find out other T3010

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document