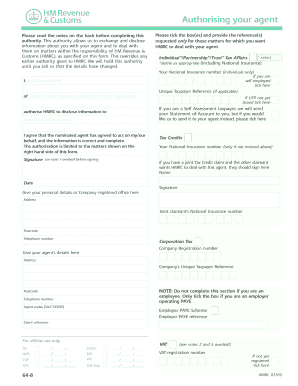

64 8 Authorising Your Agent Form

What is the 64 8 Authorising Your Agent

The 64 8 Authorising Your Agent form is a critical document used in the United States to designate an individual or organization to act on behalf of a taxpayer. This form is particularly relevant for those who need assistance in managing their tax matters, including filing returns and communicating with the Internal Revenue Service (IRS). By completing the 64 8 form, taxpayers can ensure that their chosen representative has the authority to discuss their tax affairs and receive sensitive information on their behalf.

How to Use the 64 8 Authorising Your Agent

Using the 64 8 Authorising Your Agent form involves several straightforward steps. First, you need to obtain a copy of the form, which is typically available in PDF format. Once you have the form, fill in the required information, including your name, address, and the details of the agent you wish to authorize. It is essential to provide accurate information to avoid any delays. After completing the form, submit it to the IRS either electronically or via mail, depending on your preference and the specific instructions provided on the form.

Steps to Complete the 64 8 Authorising Your Agent

Completing the 64 8 Authorising Your Agent form involves a series of clear steps:

- Download the 64 8 form PDF from a reliable source.

- Fill in your personal information, including your full name, address, and taxpayer identification number.

- Provide the details of the agent you are authorizing, including their name and contact information.

- Sign and date the form to validate your authorization.

- Submit the completed form to the IRS through the preferred method indicated on the form.

Legal Use of the 64 8 Authorising Your Agent

The legal use of the 64 8 Authorising Your Agent form is governed by IRS regulations, which stipulate that taxpayers must provide explicit consent for another party to act on their behalf. This form serves as a formal declaration of that consent, ensuring that the designated agent can legally access and manage your tax information. Compliance with these regulations is crucial to avoid potential issues with the IRS and to maintain the integrity of your tax filings.

Key Elements of the 64 8 Authorising Your Agent

Several key elements must be included in the 64 8 Authorising Your Agent form to ensure its validity:

- Taxpayer Information: Accurate personal details of the taxpayer, including name and address.

- Agent Information: Complete information about the authorized agent, including their name and contact details.

- Signature: The taxpayer’s signature is essential for validating the authorization.

- Date: The date on which the form is signed is also required for record-keeping purposes.

Form Submission Methods

The 64 8 Authorising Your Agent form can be submitted to the IRS through various methods. Taxpayers may choose to file the form electronically using approved e-filing systems or submit a paper version via mail. It is important to follow the submission guidelines outlined on the form to ensure timely processing. Each method has its own advantages, such as faster processing times for electronic submissions, making it crucial to select the one that best fits your needs.

Quick guide on how to complete 64 8 authorising your agent

Manage 64 8 Authorising Your Agent effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to retrieve the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 64 8 Authorising Your Agent on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign 64 8 Authorising Your Agent with ease

- Find 64 8 Authorising Your Agent and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential parts of your documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form navigation, or mistakes that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 64 8 Authorising Your Agent and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 64 8 authorising your agent

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 64 8 form and why do I need it?

The 64 8 form is a crucial document used for tax-related purposes in certain jurisdictions. It enables businesses to authorize a tax representative to act on their behalf, ensuring compliance and efficiency in managing tax affairs.

-

How does airSlate SignNow simplify the 64 8 form process?

airSlate SignNow streamlines the process of preparing and signing the 64 8 form with its user-friendly interface. You can quickly fill out the form electronically, gather signatures, and send it securely, saving time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for the 64 8 form?

Yes, airSlate SignNow offers competitive pricing plans tailored to different business needs. You can choose a plan that best fits your requirements, and it ensures that your investment in managing the 64 8 form is cost-effective.

-

Can I integrate airSlate SignNow with other software to manage the 64 8 form?

Absolutely! airSlate SignNow supports various integrations with popular software platforms. This feature allows you to manage your 64 8 form alongside other business processes seamlessly.

-

What features does airSlate SignNow offer for the 64 8 form?

airSlate SignNow provides features such as templates, real-time tracking, and secure cloud storage for the 64 8 form. These tools enhance the efficiency of document management and help ensure everything is organized.

-

Are there any security measures in place for the 64 8 form with airSlate SignNow?

Yes, airSlate SignNow prioritizes security by employing encryption and secure access protocols. When using the 64 8 form, you can be assured that your sensitive information is protected.

-

Can I track the status of the 64 8 form when using airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking that allows you to monitor the progress of the 64 8 form. You will receive notifications when the form is viewed and signed, enhancing communication and efficiency.

Get more for 64 8 Authorising Your Agent

- Decision on request for continuance form

- Forms self help name change california divorce legal

- Kitchen ampamp laundry appliancesfisher ampamp paykel usa form

- Qanonresearch q research general 9443 john durham form

- Petitioner in propria persona check applicable box form

- In the matter of the petition of type or print name of person whose name is being changed form

- Proof of service by personal service change of name form

- Pretrial services division los angeles county probation form

Find out other 64 8 Authorising Your Agent

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile