Form 4562 Worksheet

What is the Form 4562 Worksheet

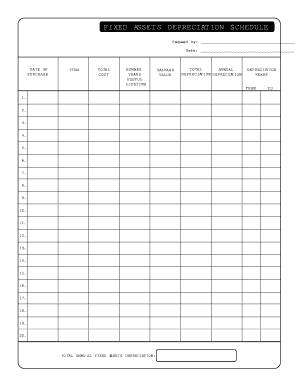

The Form 4562 depreciation and amortization worksheet is a crucial document used by businesses and individuals to report depreciation and amortization expenses to the IRS. This form helps taxpayers calculate the allowable depreciation deductions for their assets, ensuring compliance with federal tax regulations. It covers various types of property, including machinery, vehicles, and buildings, allowing users to detail their depreciation schedules accurately.

How to use the Form 4562 Worksheet

To effectively use the Form 4562 worksheet, taxpayers should first gather all relevant information regarding their assets. This includes the date of acquisition, cost basis, and the method of depreciation chosen. Users should carefully follow the instructions provided on the form to input data accurately. Each section of the worksheet corresponds to specific asset categories, facilitating organized reporting. It is essential to review all entries for accuracy before submission to avoid any issues with the IRS.

Steps to complete the Form 4562 Worksheet

Completing the Form 4562 worksheet involves several key steps:

- Gather necessary information about your assets, including purchase dates and costs.

- Choose the appropriate depreciation method, such as straight-line or declining balance.

- Fill out the worksheet by entering details for each asset under the correct sections.

- Calculate the total depreciation for each asset and ensure all figures align with IRS guidelines.

- Review the completed worksheet for accuracy and completeness before filing.

IRS Guidelines

The IRS provides specific guidelines for using the Form 4562 worksheet, which include instructions on eligibility, allowable depreciation methods, and reporting requirements. Taxpayers should familiarize themselves with these guidelines to ensure compliance. The IRS outlines the types of property that can be depreciated and the necessary documentation required to support claims. Adhering to these guidelines is essential for avoiding penalties and ensuring a smooth filing process.

Legal use of the Form 4562 Worksheet

The legal use of the Form 4562 worksheet is governed by IRS regulations, which stipulate how depreciation and amortization should be reported. To be considered legally binding, the completed form must be accurate and submitted in accordance with IRS deadlines. Additionally, using a reliable electronic signature solution, such as signNow, can enhance the legitimacy of the document, ensuring that it meets all legal standards for electronic filing.

Examples of using the Form 4562 Worksheet

Examples of using the Form 4562 worksheet include scenarios such as a small business owner claiming depreciation on a new delivery vehicle or a real estate investor reporting depreciation on rental property improvements. Each example illustrates how different asset types are reported and the specific calculations involved. These practical applications help taxpayers understand the importance of accurate reporting and the potential tax benefits associated with proper depreciation claims.

Quick guide on how to complete form 4562 worksheet

Facilitate Form 4562 Worksheet effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it in the cloud. airSlate SignNow equips you with all the resources necessary to generate, edit, and eSign your documents swiftly without any holdups. Handle Form 4562 Worksheet on any device using airSlate SignNow applications for Android or iOS and enhance any document-based workflow today.

The simplest method to modify and eSign Form 4562 Worksheet effortlessly

- Find Form 4562 Worksheet and then click Get Form to begin.

- Use the features we provide to complete your document.

- Select important sections of the documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your updates.

- Select your preferred method to send your form, either by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, frustrating form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 4562 Worksheet and guarantee seamless communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4562 worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 4562 depreciation and amortization worksheet?

The form 4562 depreciation and amortization worksheet is a critical document used by businesses to calculate depreciation and amortization expenses for tax purposes. It allows for the reporting of property assets and ensures compliance with IRS regulations. Having accurate information on this worksheet can help maximize deductions and minimize tax liabilities.

-

How can airSlate SignNow assist with the form 4562 depreciation and amortization worksheet?

With airSlate SignNow, users can easily create and digitally sign the form 4562 depreciation and amortization worksheet. The platform streamlines the document workflow, ensuring that all necessary information is gathered efficiently. This not only saves time but also enhances accuracy in the reporting process.

-

What are the pricing plans for using airSlate SignNow for form 4562 depreciation and amortization worksheet?

airSlate SignNow offers flexible pricing plans designed to fit the needs of businesses of all sizes. Whether you’re a small startup or an established enterprise, you can find a plan that allows you to manage your form 4562 depreciation and amortization worksheet seamlessly. Additionally, there are often promotional discounts available for new users.

-

Can I integrate airSlate SignNow with other financial software for managing the form 4562 depreciation and amortization worksheet?

Yes, airSlate SignNow offers integrations with popular financial and accounting software, enhancing your ability to manage the form 4562 depreciation and amortization worksheet. This connectivity allows for smooth data transfer and reduces the risk of errors associated with manual entry. Check our integration options to find the best fit for your business.

-

What are the key features of airSlate SignNow that support form 4562 depreciation and amortization worksheet management?

Key features of airSlate SignNow include document templates, automated reminders, and advanced eSignature capabilities, all of which facilitate the effective management of the form 4562 depreciation and amortization worksheet. These tools ensure that your documents are always up-to-date and compliant with tax regulations. Additionally, the user-friendly interface makes it accessible for all team members.

-

Is electronic signing of the form 4562 depreciation and amortization worksheet legally binding?

Absolutely! Electronic signatures provided by airSlate SignNow are legally binding and in compliance with the ESIGN Act and UETA. This means that when you eSign the form 4562 depreciation and amortization worksheet, it holds the same weight and validity as a handwritten signature. This feature provides convenience and security for your business transactions.

-

What benefits does using airSlate SignNow for form 4562 depreciation and amortization worksheet provide?

Using airSlate SignNow for managing your form 4562 depreciation and amortization worksheet offers numerous benefits, including enhanced efficiency, improved accuracy, and reduced turnaround time for document signing. Additionally, the platform's secure storage ensures that all your financial documents are protected. This allows businesses to focus their efforts on growth rather than paperwork.

Get more for Form 4562 Worksheet

- Srnc fc addendum quotaquot americans with disabilities act form

- Fillable online academics uww what led to desegregation in form

- Tr 500 info instructions to defendant for remote video proceeding judicial council forms

- 2015 2019 form ca tr 505 fill online printable fillable

- Tr inst notice to appear and related forms judicial council forms

- Form ucc 5 download printable pdf information statement

- Notice of change new ucc filing formscalifornia

- Fees if submitting online the filing fee for a financing statement is 5 form

Find out other Form 4562 Worksheet

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure