Dr0252 Form

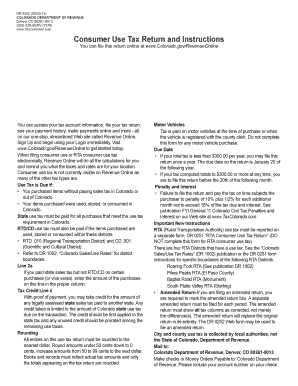

What is the DR0252?

The DR0252 is a form issued by the Colorado Department of Revenue, primarily used for vehicle registration and title transactions. This form is essential for individuals and businesses looking to register their vehicles or transfer ownership. Understanding the purpose of the DR0252 is crucial for ensuring compliance with state regulations and facilitating smooth vehicle transactions.

How to Use the DR0252

Using the DR0252 involves several straightforward steps. First, gather all necessary information, including vehicle details and the personal information of the buyer and seller. Next, fill out the form accurately, ensuring all sections are complete. Once completed, the form can be submitted either online through the Colorado Department of Revenue's website or in person at designated locations. It is important to keep a copy of the submitted form for your records.

Steps to Complete the DR0252

Completing the DR0252 requires attention to detail. Here are the steps to follow:

- Obtain the DR0252 form from the Colorado Department of Revenue's website or a local office.

- Fill in the vehicle information, including make, model, year, and VIN.

- Provide the seller's and buyer's information, including names, addresses, and signatures.

- Include any necessary supporting documents, such as proof of insurance or identification.

- Review the form for accuracy before submission.

Legal Use of the DR0252

The DR0252 is legally recognized for vehicle registration and title transfers in Colorado. To ensure its legal validity, it must be filled out completely and accurately. Additionally, signatures from both the buyer and seller are required to confirm the transaction. Compliance with state laws regarding vehicle registration is essential to avoid potential penalties or delays.

Required Documents

When submitting the DR0252, certain documents may be required to support the registration or title transfer process. These typically include:

- A valid form of identification for both the buyer and seller.

- Proof of insurance coverage for the vehicle.

- Any previous title documents if applicable.

- Payment for any associated fees or taxes.

Form Submission Methods

The DR0252 can be submitted through various methods to accommodate different preferences. Options include:

- Online submission via the Colorado Department of Revenue's website.

- Mailing the completed form to the appropriate department.

- In-person submission at designated DMV offices across Colorado.

Quick guide on how to complete dr0252

Complete Dr0252 effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-conscious substitute for traditional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents quickly and without holdups. Handle Dr0252 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Dr0252 with ease

- Locate Dr0252 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select key sections of the documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that reason.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Decide how you prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Dr0252 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr0252

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dr0252 feature in airSlate SignNow?

The dr0252 feature in airSlate SignNow enhances the eSigning experience by allowing users to customize their documents with various templates. This feature streamlines the signing process, making it more efficient for organizations to manage their paperwork.

-

How does airSlate SignNow's pricing compare for dr0252 users?

AirSlate SignNow offers competitive pricing plans for users leveraging the dr0252 feature. Our plans are designed to accommodate businesses of all sizes, ensuring that you receive a cost-effective solution for sending and signing documents.

-

What integrations are available with dr0252 in airSlate SignNow?

The dr0252 feature seamlessly integrates with various tools and platforms, including CRMs, cloud storage services, and productivity apps. This enhances workflow efficiency by allowing users to access and manage their documents directly from their preferred tools.

-

What benefits does using the dr0252 feature provide?

Using the dr0252 feature provides several benefits, such as improved efficiency in document management and enhanced collaboration among users. It simplifies the eSigning process, making it easy for teams to get documents signed in a timely manner.

-

Is the dr0252 feature easy to use for first-time users?

Absolutely! The dr0252 feature in airSlate SignNow is designed with user-friendliness in mind. First-time users can quickly navigate the platform and start sending documents for eSignature without any prior training.

-

Does the dr0252 feature support mobile users?

Yes, the dr0252 feature is fully optimized for mobile devices, allowing users to send and sign documents from their smartphones or tablets. This mobile compatibility ensures that your signing capabilities are convenient and accessible anywhere, anytime.

-

Can the dr0252 feature enhance compliance in document management?

Yes, the dr0252 feature in airSlate SignNow helps enhance compliance by keeping track of all document activities. It provides a clear audit trail and ensures that all signatures are legally binding, which is crucial for regulatory adherence.

Get more for Dr0252

- Control number co p027 pkg form

- This template is consistent with rules adopted by the colorado state board of health at 6 ccr 1015 2 form

- Access to personnel file request university of northern form

- Control number co p032 pkg form

- Control number co p033 pkg form

- Control number co p037 pkg form

- Control number co p038 pkg form

- Control number co p039 pkg form

Find out other Dr0252

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word