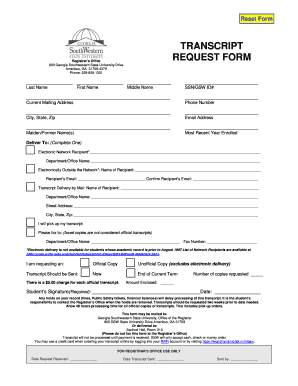

Ga State Tax Transcript Form

What is the Georgia State Tax Transcript?

The Georgia State Tax Transcript is an official document that provides a summary of a taxpayer's tax return information. It includes details such as income, deductions, and tax liabilities reported to the Georgia Department of Revenue. This transcript is essential for individuals who need to verify their tax history for various purposes, including loan applications, financial aid, or tax compliance. It serves as a reliable source of information about a taxpayer's financial standing with the state.

How to Obtain the Georgia State Tax Transcript

To obtain a Georgia State Tax Transcript, individuals can follow a straightforward process:

- Visit the Georgia Department of Revenue website.

- Navigate to the 'Taxpayer Services' section.

- Select 'Request a Transcript' from the available options.

- Provide the necessary personal information, including your Social Security number, date of birth, and tax year for which you need the transcript.

- Choose your preferred method of delivery, which may include email or physical mail.

Transcripts can also be requested via phone or by submitting a written request to the appropriate department.

Key Elements of the Georgia State Tax Transcript

A Georgia State Tax Transcript contains several critical components:

- Taxpayer Information: This includes the taxpayer's name, address, and Social Security number.

- Tax Year: The specific year for which the transcript is being requested.

- Income Details: A summary of the taxpayer's reported income for the year.

- Deductions and Credits: Information on any deductions or credits claimed.

- Tax Liability: The total amount of tax owed or refunded for that year.

These elements provide a comprehensive overview of an individual's tax situation and are crucial for various financial transactions.

Steps to Complete the Georgia State Tax Transcript

Completing the Georgia State Tax Transcript involves several steps to ensure accuracy and compliance:

- Gather all necessary documentation, including previous tax returns and supporting financial records.

- Fill out the required forms accurately, ensuring all personal information is correct.

- Review the completed transcript for any discrepancies or missing information.

- Submit the transcript through the chosen method, ensuring that it is sent to the correct department.

Following these steps can help minimize errors and expedite the processing of the transcript.

Legal Use of the Georgia State Tax Transcript

The Georgia State Tax Transcript is legally recognized and can be used for various purposes, including:

- Applying for loans or mortgages, where proof of income is required.

- Filing for financial aid or scholarships that necessitate tax information.

- Verifying income for legal proceedings or disputes.

As a legally binding document, it is essential to ensure that the information provided is accurate and up to date.

Examples of Using the Georgia State Tax Transcript

There are several scenarios where a Georgia State Tax Transcript may be utilized:

- A student applying for federal financial aid may need to submit their tax transcript to demonstrate their family's financial situation.

- A small business owner seeking a loan may provide their tax transcript to lenders as proof of income and financial stability.

- Individuals undergoing a divorce may need to present their tax transcripts during negotiations to establish financial obligations.

These examples illustrate the importance of having access to accurate tax information when navigating various financial and legal situations.

Quick guide on how to complete ga state tax transcript

Complete Ga State Tax Transcript effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Ga State Tax Transcript on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Ga State Tax Transcript with ease

- Locate Ga State Tax Transcript and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign feature, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or mislaid documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Edit and eSign Ga State Tax Transcript and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ga state tax transcript

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax transcript example?

A tax transcript example is a document provided by the IRS that summarizes your tax return information, including income, deductions, and other tax-related data. This example helps you understand the format and content of a typical transcript, which can be essential for various financial applications.

-

How does airSlate SignNow help with tax transcripts?

airSlate SignNow simplifies the process of signing and sending tax transcript documents electronically. With our platform, you can easily upload a tax transcript example for eSigning, ensuring that all parties can securely sign and receive the document without delay.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed for both individuals and businesses. Depending on your needs, you can choose from various subscription options that provide access to features suitable for handling documents like tax transcript examples easily and efficiently.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with a variety of applications and platforms, including Google Drive, Salesforce, and more. This integration capability allows users to enhance their workflow while managing documents such as tax transcript examples within their preferred ecosystem.

-

What are the key features of airSlate SignNow?

airSlate SignNow includes essential features such as fast eSigning, document templates, team collaboration, and audit trails for secure document handling. These attributes make it easier for users to manage tax transcript examples and ensure their documents are legally binding and traceable.

-

Is airSlate SignNow secure for handling tax transcripts?

Absolutely! airSlate SignNow prioritizes user security, employing strong encryption protocols and secure cloud storage. This ensures that sensitive documents like tax transcript examples are handled with the utmost care, providing peace of mind to users.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, your business can benefit from faster document turnaround times and improved efficiency in managing signatures. This is particularly useful when dealing with important documents like tax transcript examples, as it streamlines processes and enhances overall productivity.

Get more for Ga State Tax Transcript

- Free ucc financing statement ucc financin findformscom

- Instructions for national ucc1 financing statement form ucc1

- Colorado ucc financing statementeffective form

- Learn more about the taxes fees and other charges on your form

- Termination effectiveness of the financing statement identified above is terminated with respect to security interests of the form

- National ucc financing statement amendment addendum form

- Ucc3adp65 ucc financing statement amendment form

- Filing fee 18 form

Find out other Ga State Tax Transcript

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed