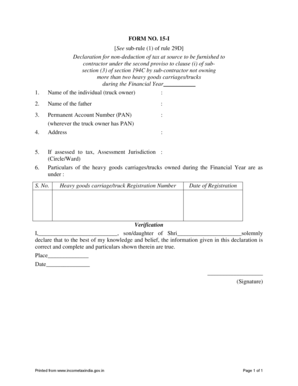

Form 29d

Understanding the Declaration Under Section 194C 6

The declaration under section 194C 6 is a crucial document for individuals and businesses involved in transport services in the United States. This form is primarily used by truck owners to declare certain details related to the Tax Deducted at Source (TDS) applicable to their earnings. It helps streamline the tax deduction process, ensuring that the correct amount is withheld by the payer. This declaration is essential for maintaining compliance with tax regulations and avoiding unnecessary penalties.

How to Use the Declaration Under Section 194C 6

Using the declaration under section 194C 6 involves several steps to ensure accuracy and compliance. First, truck owners must gather relevant information, including their tax identification number and details about the transport services provided. Next, they need to fill out the form accurately, providing all required information. Once completed, the form should be submitted to the payer, who will use it to determine the appropriate TDS deduction. It is important to keep a copy of the declaration for personal records and future reference.

Steps to Complete the Declaration Under Section 194C 6

Completing the declaration under section 194C 6 involves a systematic approach:

- Gather necessary documents, including your tax ID and any previous TDS declarations.

- Fill in your personal and business details accurately on the form.

- Provide information about the transport services rendered, including dates and amounts.

- Review the form for accuracy to prevent errors that could lead to compliance issues.

- Submit the completed form to the payer before the specified deadline.

Legal Use of the Declaration Under Section 194C 6

The declaration under section 194C 6 has legal significance as it serves as a formal record of the transport services provided and the corresponding TDS obligations. It is essential for truck owners to ensure that the declaration is filled out correctly to comply with IRS regulations. Failure to submit a correct declaration can lead to penalties, including fines or increased scrutiny from tax authorities. Therefore, understanding the legal implications of this declaration is vital for all parties involved.

Key Elements of the Declaration Under Section 194C 6

Several key elements must be included in the declaration under section 194C 6 to ensure its validity:

- Tax Identification Number: Essential for identifying the taxpayer.

- Details of Transport Services: A clear description of the services provided.

- Payment Details: Information about the amounts charged for services.

- Signature: The declaration must be signed to confirm its accuracy.

Filing Deadlines for the Declaration Under Section 194C 6

Timely submission of the declaration under section 194C 6 is critical. The IRS sets specific deadlines for when this declaration must be filed to ensure compliance with tax regulations. Typically, truck owners should submit their declarations at the beginning of the tax year or whenever there is a change in their transport service details. Missing these deadlines can result in penalties and interest on unpaid taxes, making it essential to stay informed about filing dates.

Quick guide on how to complete form 29d

Effortlessly prepare Form 29d on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as it allows you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle Form 29d on any device using airSlate SignNow's Android or iOS applications and enhance any document-related activity today.

The simplest method to modify and eSign Form 29d hassle-free

- Obtain Form 29d and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it onto your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 29d and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 29d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the declaration under section 194c 6?

The declaration under section 194c 6 is a tax-related document that organizations use to claim lower withholding tax rates on certain payments. It is particularly relevant for businesses that work with contractors and service providers. Understanding this declaration can help organizations manage their tax liabilities more effectively.

-

How does airSlate SignNow facilitate the declaration under section 194c 6?

airSlate SignNow provides a seamless platform to create, send, and eSign declarations under section 194c 6 effortlessly. With user-friendly templates and an intuitive interface, users can ensure their documents are compliant and accurate. This simplifies the process of handling tax declarations for your business.

-

Is there a cost associated with using airSlate SignNow for managing declarations under section 194c 6?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Depending on the features required, the costs may vary. Investing in airSlate SignNow can yield signNow time and cost savings when managing declarations under section 194c 6.

-

What features does airSlate SignNow offer for declarations under section 194c 6?

AirSlate SignNow includes features such as electronic signatures, document templates, and real-time tracking. These functionalities streamline the creation and management of the declaration under section 194c 6. Additionally, users benefit from legally binding signatures and comprehensive audit trails.

-

How can I ensure my declaration under section 194c 6 is secure with airSlate SignNow?

AirSlate SignNow prioritizes security with robust encryption and secure cloud storage. Your declaration under section 194c 6 will be protected against unauthorized access while maintaining compliance with relevant regulations. Users can trust that their sensitive information is safeguarded throughout the process.

-

Can airSlate SignNow be integrated with accounting software for declarations under section 194c 6?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software systems. This allows for streamlined processing of the declaration under section 194c 6 and correlating financial documents. Integrations enhance efficiency and reduce the potential for errors.

-

What are the benefits of using airSlate SignNow for my business's declaration under section 194c 6?

Using airSlate SignNow for your declaration under section 194c 6 enhances efficiency and reduces paperwork. The platform enables quick eSigning, minimal turnaround times, and better organization of documents. Ultimately, this leads to improved compliance and satisfaction for your business.

Get more for Form 29d

- Jd cv 77 form

- Uniform procedures for foreclousre judgment presentation instructions

- Foreclosure by sale form

- Notice to bidders connecticut judicial branch ctgov form

- Foreclosure by sale standing orders connecticut judicial form

- Civil short calendar standing order ct judicial branch form

- Motion for judgment of foreclosure by market sale form

- Tour the ct supreme court ct judicial branch form

Find out other Form 29d

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement

- How To Sign Arizona Amendment to an LLC Operating Agreement

- Sign Florida Amendment to an LLC Operating Agreement Now

- How To Sign Florida Amendment to an LLC Operating Agreement

- How Do I Sign Illinois Amendment to an LLC Operating Agreement

- How Do I Sign New Hampshire Amendment to an LLC Operating Agreement

- How To Sign New York Amendment to an LLC Operating Agreement

- Sign Washington Amendment to an LLC Operating Agreement Now

- Can I Sign Wyoming Amendment to an LLC Operating Agreement

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure

- Sign Alabama Affidavit of Identity Myself