Legal Domestic Partner Form

What is the Legal Domestic Partner Form

The legal domestic partner form is a crucial document that establishes the legal recognition of a domestic partnership. This form is often used by couples who choose to live together in a committed relationship without marrying. It provides various legal rights and responsibilities similar to those of marriage, including matters related to healthcare, inheritance, and taxation. Understanding the implications of this form is essential for couples seeking legal acknowledgment of their partnership.

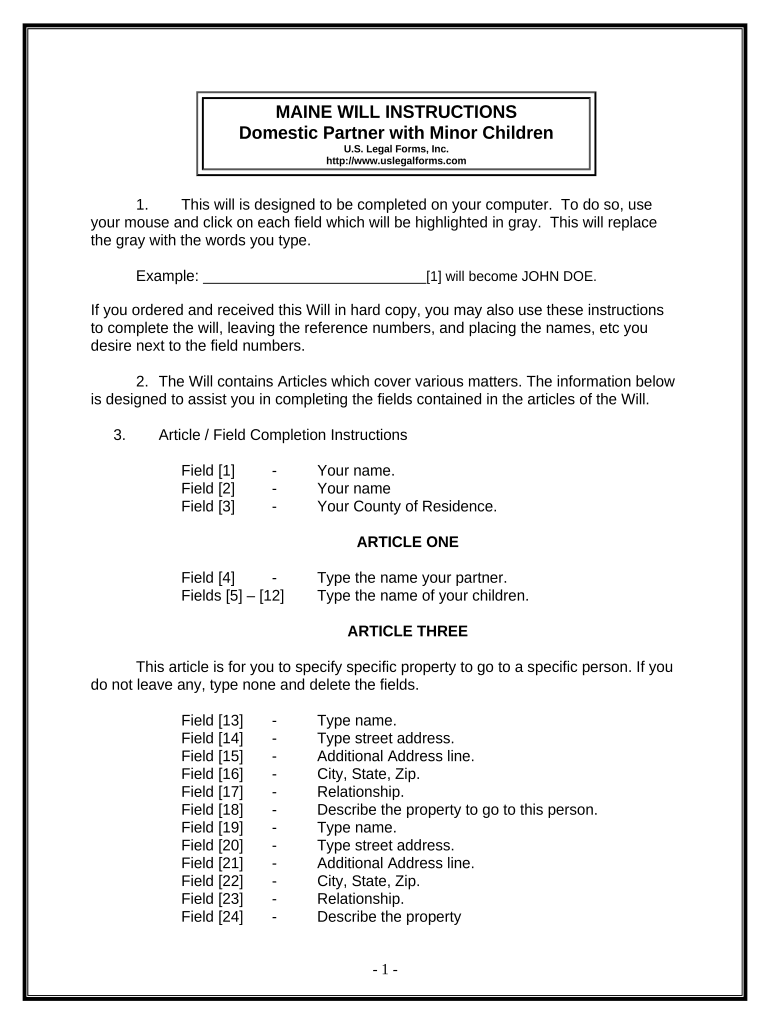

How to Use the Legal Domestic Partner Form

Using the legal domestic partner form involves several steps to ensure that it is completed correctly and legally binding. First, both partners must review the form to understand the information required. Next, they should fill out the necessary details, including personal information and the date of the partnership. It is important to ensure that both partners sign the form in the presence of a notary public or other authorized official, as required by state laws. Once completed, the form should be submitted to the appropriate government office for registration.

Steps to Complete the Legal Domestic Partner Form

Completing the legal domestic partner form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, such as identification and proof of residency.

- Fill out the form with accurate personal information for both partners.

- Review the completed form for any errors or omissions.

- Sign the form in front of a notary public or authorized official.

- Submit the form to the designated office, either online or in person, depending on state requirements.

Legal Use of the Legal Domestic Partner Form

The legal domestic partner form serves to formalize the partnership under state law, granting couples specific rights and responsibilities. These may include rights related to property ownership, healthcare decisions, and tax benefits. It is essential for couples to understand that the legal recognition provided by this form can vary by state, so consulting local laws is advisable to ensure compliance and full understanding of the rights conferred.

State-Specific Rules for the Legal Domestic Partner Form

Each state in the U.S. has its own regulations regarding the legal domestic partner form. Some states may require additional documentation or have specific eligibility criteria for couples wishing to register as domestic partners. It is important for couples to research their state’s requirements to ensure that they complete the form correctly and meet all legal obligations. This may include understanding residency requirements, age restrictions, and any necessary waiting periods before the partnership is recognized.

Eligibility Criteria

To complete the legal domestic partner form, couples must meet certain eligibility criteria. Generally, both partners must be at least eighteen years old, not currently married to another person, and capable of entering into a legal contract. Some states may also require that partners share a common residence and demonstrate a committed relationship. Reviewing these criteria before beginning the application process can help ensure a smooth experience.

Quick guide on how to complete legal domestic partner form

Effortlessly Prepare Legal Domestic Partner Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without any holdups. Manage Legal Domestic Partner Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to Edit and eSign Legal Domestic Partner Form with Ease

- Find Legal Domestic Partner Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the information and then click the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form hunting, or corrections that require reprinting new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choosing. Edit and eSign Legal Domestic Partner Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a legal domestic partner form and why do I need it?

A legal domestic partner form is a crucial document that formalizes the relationship between domestic partners, ensuring recognition of rights and responsibilities. This form can be essential for legal benefits and obligations in areas such as healthcare, taxation, and inheritance. Utilizing airSlate SignNow to create and manage your legal domestic partner form streamlines the process and maintains legal compliance.

-

How does airSlate SignNow simplify the process of creating a legal domestic partner form?

airSlate SignNow provides an intuitive platform that allows users to easily create legal domestic partner forms without extensive legal knowledge. With customizable templates and an easy-to-navigate interface, users can tailor the document to their specific needs. This reduces the time and effort needed compared to traditional methods.

-

Are there any costs associated with using airSlate SignNow for a legal domestic partner form?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, starting with affordable options for individuals and small businesses. Each plan grants access to features that can help you manage your legal domestic partner form efficiently. To determine the best plan for your needs, you can explore our pricing page.

-

Can I eSign my legal domestic partner form through airSlate SignNow?

Absolutely! airSlate SignNow allows you to electronically sign your legal domestic partner form seamlessly, ensuring a legally binding agreement. The platform complies with electronic signature laws, providing you with the assurance that your document is valid and secure. This feature enhances convenience while safeguarding your legal rights.

-

What features are included with the legal domestic partner form on airSlate SignNow?

When using airSlate SignNow for your legal domestic partner form, you'll benefit from features like collaboration tools, document tracking, and customizable templates. These features save time and help ensure that all parties can easily provide input and sign the form. Additionally, our secure cloud storage keeps your documents safe and accessible whenever you need them.

-

Does airSlate SignNow support integrations with other software for managing my legal domestic partner form?

Yes, airSlate SignNow offers integrations with a variety of software solutions, making it easy to manage your legal domestic partner form alongside your existing applications. Whether you're using accounting software or project management tools, our integrations allow for smooth workflows and efficient document handling. This flexibility ensures that your document management is as cohesive as possible.

-

Is my legal domestic partner form securely stored with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. Your legal domestic partner form is securely encrypted and stored in compliance with industry standards. We implement robust security measures to ensure that your sensitive information is protected from unauthorized access and data bsignNowes.

Get more for Legal Domestic Partner Form

Find out other Legal Domestic Partner Form

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy