Printable Mileage Log Form

What is the Printable Mileage Log

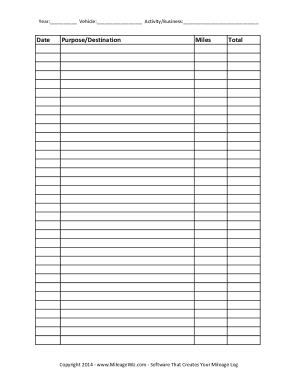

The printable mileage log is a structured document used to record the miles driven for business purposes. It serves as an essential tool for individuals and businesses to track vehicle usage accurately, especially when it comes to tax deductions. By maintaining a detailed log, users can substantiate their mileage claims, ensuring compliance with IRS regulations. This log typically includes fields for the date, starting and ending odometer readings, purpose of the trip, and total miles driven.

How to use the Printable Mileage Log

Using the printable mileage log involves a straightforward process. First, download and print the mileage form vehicle template. Each time you use your vehicle for business, fill out the required fields, including the date, purpose, and odometer readings. It is important to be consistent and detailed to ensure accuracy. At the end of the reporting period, total the miles driven and retain the log for your records and tax filing purposes.

Steps to complete the Printable Mileage Log

Completing the mileage log involves several key steps:

- Download the mileage form vehicle template from a reliable source.

- Fill in the date of each trip.

- Record the starting and ending odometer readings for accurate mileage calculation.

- Document the purpose of each trip to justify the business use.

- Total the mileage at the end of the reporting period.

- Keep the completed log in a safe place for reference during tax preparation.

Legal use of the Printable Mileage Log

The legal use of the printable mileage log is crucial for claiming deductions on your taxes. The IRS requires that mileage logs be kept accurately and consistently. A well-maintained log can serve as evidence in case of an audit. To ensure legal compliance, it is advisable to follow IRS guidelines regarding what constitutes acceptable documentation for business mileage.

IRS Guidelines

The IRS has specific guidelines regarding the use of mileage logs for tax deductions. According to IRS Publication 463, taxpayers must keep records that include the date, mileage, and purpose of each trip. The log must be maintained in a timely manner, ideally at the time of each trip. Additionally, the IRS allows for the standard mileage rate method or actual expense method for calculating deductions, making accurate logging essential for maximizing potential tax benefits.

Examples of using the Printable Mileage Log

Examples of using the printable mileage log include tracking mileage for various business activities such as client meetings, travel to conferences, or running business errands. For instance, a self-employed consultant might use the log to document trips to meet clients or attend workshops. By categorizing trips and maintaining clear records, individuals can substantiate their mileage claims and ensure they receive the appropriate deductions during tax season.

Quick guide on how to complete printable mileage log

Complete Printable Mileage Log effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources you require to create, edit, and electronically sign your documents quickly without delays. Handle Printable Mileage Log on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process right away.

How to edit and eSign Printable Mileage Log with ease

- Obtain Printable Mileage Log and click Get Form to commence.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the features airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click the Done button to retain your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, the frustration of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Printable Mileage Log to ensure superb communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable mileage log

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mileage form vehicle printable?

A mileage form vehicle printable is a document designed to track and report mileage expenses for business use of vehicles. It provides an easy way for users to record distances traveled, making it ideal for expense reimbursement and tax deduction purposes.

-

How can I obtain a mileage form vehicle printable?

You can easily access a mileage form vehicle printable through the airSlate SignNow platform. Simply visit our website, navigate to the forms section, and download the template that suits your needs for tracking mileage.

-

Is the mileage form vehicle printable customizable?

Yes, the mileage form vehicle printable can be customized to meet your specific requirements. You can add logos, adjust fields, and modify the layout to ensure it aligns with your business branding and reporting needs.

-

What are the benefits of using a mileage form vehicle printable?

Using a mileage form vehicle printable streamlines the process of tracking vehicular expenses, simplifies reporting, and can enhance accuracy in mileage logs. It helps save time and reduces the chances of errors in expense reporting.

-

Can I eSign my mileage form vehicle printable documents?

Absolutely! The airSlate SignNow platform allows you to eSign your mileage form vehicle printable documents easily and securely. This feature ensures that your forms are legally binding and can be sent electronically for convenient file management.

-

Are there any costs associated with the mileage form vehicle printable?

The mileage form vehicle printable itself is available for download at no cost through our platform. However, using the complete airSlate SignNow service may involve subscription fees depending on the features you choose.

-

Does airSlate SignNow integrate with other software for mileage tracking?

Yes, airSlate SignNow offers integrations with various accounting and mileage tracking software. This compatibility allows seamless data transfer and enhances the overall efficiency of managing your mileage forms vehicle printable and financial records.

Get more for Printable Mileage Log

- Control number fl sdeed 8 16 form

- Two individuals to two individuals as joint form

- Now therefore be it ordained by the board of aldermen of form

- Husband and wife to two individuals as joint form

- Individual to two individuals with a reserved form

- Life estate interest from trust to individual form

- Harper family genealogy notes pdf form

- One individual to two individuals as form

Find out other Printable Mileage Log

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement