Scotiabank Payout Request 2015

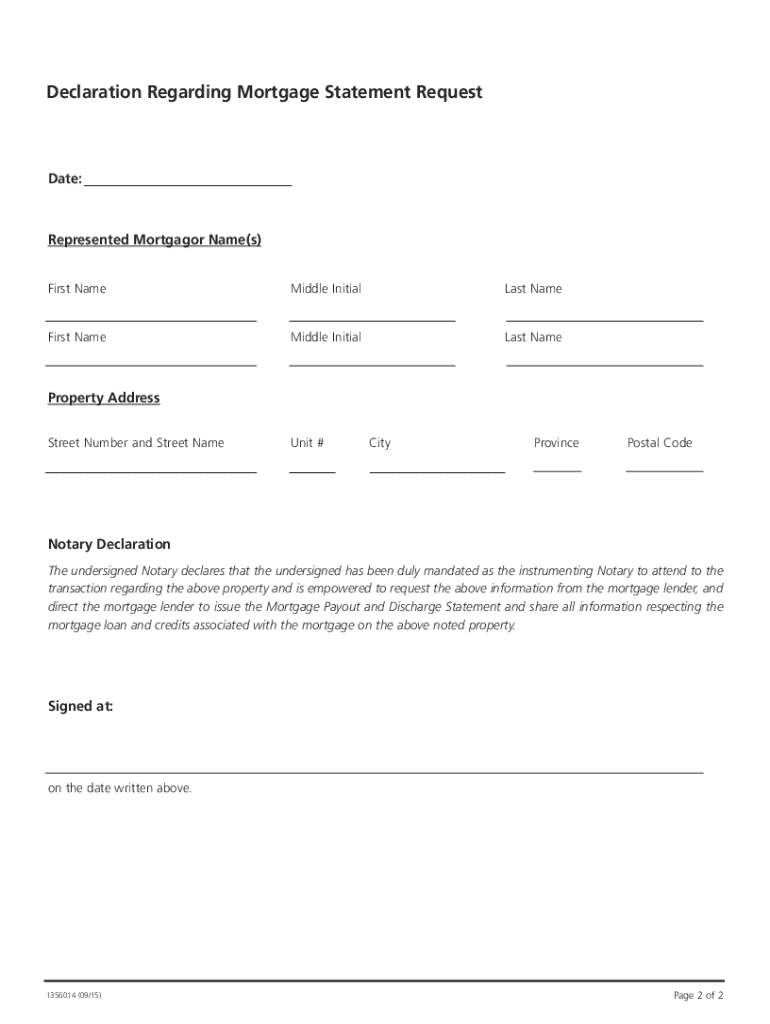

What is the Scotiabank Mortgage Statement Request

The Scotiabank mortgage statement request is a formal document that allows borrowers to obtain a detailed statement of their mortgage account. This statement typically includes information such as the outstanding balance, payment history, interest rates, and any fees associated with the mortgage. It is essential for borrowers who need to review their mortgage details for personal finance management, refinancing, or other financial planning purposes.

How to Obtain the Scotiabank Mortgage Statement Request

To obtain the Scotiabank mortgage statement request, borrowers can follow several methods. One option is to visit the Scotiabank website and log into their online banking account. From there, users can navigate to the mortgage section to request a statement. Alternatively, borrowers can contact Scotiabank customer service directly via phone or in person at a local branch. It is advisable to have personal identification and account details ready to expedite the request process.

Steps to Complete the Scotiabank Mortgage Statement Request

Completing the Scotiabank mortgage statement request involves a few straightforward steps:

- Gather necessary information, such as your mortgage account number and personal identification.

- Choose your preferred method of submission: online through the Scotiabank portal, by phone, or in person.

- If submitting online, log into your account and navigate to the mortgage section to fill out the request form.

- For phone requests, provide the required information to the customer service representative.

- Submit the request and wait for confirmation from Scotiabank regarding the processing of your statement.

Legal Use of the Scotiabank Mortgage Statement Request

The Scotiabank mortgage statement request is legally recognized as a formal request for documentation regarding your mortgage. It is important to ensure that the request is completed accurately and submitted through the proper channels to maintain compliance with legal standards. This documentation can be crucial in various scenarios, such as loan refinancing, tax assessments, or legal proceedings related to property ownership.

Required Documents for the Scotiabank Mortgage Statement Request

When submitting a Scotiabank mortgage statement request, certain documents may be required to verify identity and account ownership. Commonly required documents include:

- Government-issued identification, such as a driver's license or passport.

- Proof of address, like a utility bill or bank statement.

- Your mortgage account number and any relevant loan details.

Form Submission Methods for the Scotiabank Mortgage Statement Request

Borrowers can submit the Scotiabank mortgage statement request through various methods. The options typically include:

- Online submission via the Scotiabank website, where users can fill out the request form directly.

- Phone requests made by contacting Scotiabank customer service.

- In-person visits to a local Scotiabank branch, where staff can assist in completing the request.

Examples of Using the Scotiabank Mortgage Statement Request

There are several scenarios where a borrower might need to use the Scotiabank mortgage statement request:

- When refinancing a mortgage, lenders often require a current mortgage statement to assess the borrower's financial situation.

- For tax purposes, individuals may need to provide mortgage statements to accurately report interest paid or deductions claimed.

- During a divorce or estate settlement, a mortgage statement can clarify outstanding balances and financial obligations.

Quick guide on how to complete scotiabank payout request

Effortlessly Prepare Scotiabank Payout Request on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely keep it online. airSlate SignNow equips you with everything necessary to create, modify, and eSign your documents swiftly without interruptions. Handle Scotiabank Payout Request on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to amend and eSign Scotiabank Payout Request effortlessly

- Find Scotiabank Payout Request and click Retrieve Form to begin.

- Utilize the tools available to fill out your form.

- Mark relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Complete button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or sharing link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Scotiabank Payout Request and guarantee exceptional communication throughout the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct scotiabank payout request

Create this form in 5 minutes!

How to create an eSignature for the scotiabank payout request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Scotiabank mortgage statement request?

A Scotiabank mortgage statement request is a formal procedure where you ask Scotiabank for a detailed statement of your mortgage account. This statement typically includes payment history, interest rates, and outstanding balances. It's essential for managing your mortgage effectively and can assist in refinancing decisions.

-

How can I submit a Scotiabank mortgage statement request?

To submit a Scotiabank mortgage statement request, you can log into your online banking account or contact Scotiabank's customer service directly. You may be required to provide personal information for verification. For a quicker process, utilize the online request options available on their website.

-

Are there any fees associated with a Scotiabank mortgage statement request?

Generally, Scotiabank does not charge a fee for providing mortgage statements upon request. However, it is advisable to check directly with Scotiabank as policies may change. If you are enrolled in an account that requires membership or service fees, additional charges might apply.

-

What information will I find in a Scotiabank mortgage statement?

A Scotiabank mortgage statement typically includes important information like payment due dates, remaining principal balance, interest rate, and total interest paid year-to-date. You may also find information regarding any late payments or current offers from Scotiabank related to your mortgage. This detailed overview helps you stay informed about your financial obligations.

-

How often can I request a Scotiabank mortgage statement?

You can request a Scotiabank mortgage statement as often as needed, but it is recommended to do so annually or whenever you require up-to-date information. Regular requests can help you keep track of your mortgage status and aid in financial planning. Always check with Scotiabank for specific guidelines regarding frequency.

-

Can I access my mortgage statement online without a request?

Yes, Scotiabank customers can access their mortgage statements through their online banking portal at any time. This feature allows you to review your mortgage details conveniently without needing to submit a request. Simply log in to your account, navigate to the mortgage section, and you will find your statements available for download.

-

Does airSlate SignNow integrate with Scotiabank for mortgage statement requests?

Yes, airSlate SignNow facilitates integration with various financial institutions, including Scotiabank, to streamline the mortgage statement request process. By using SignNow, you can easily eSign any documents needed for formal requests and ensure they are sent securely. This integration enhances efficiency, allowing for quicker responses from Scotiabank.

Get more for Scotiabank Payout Request

- Ch13 form of contracts flashcardsquizlet

- Ky do 3a form

- Section 271b14 050 effect of dissolution ky rev stat form

- Section 275285 dissolution of company ky rev stat form

- Except as otherwise provided herein upon the death of the trustor form

- This trust is an individual residing at 490142943 form

- Kentucky form

- Date by name of form

Find out other Scotiabank Payout Request

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement