It 560 C Georgia Department of Revenue Form

What is the IT 560 C Georgia Department Of Revenue

The IT 560 C is a tax form used by the Georgia Department of Revenue. It is designed for corporations and partnerships that are subject to Georgia income tax. This form is essential for reporting income, deductions, and credits that apply to Georgia tax obligations. By accurately completing the IT 560 C, businesses can ensure compliance with state tax laws and avoid potential penalties.

Steps to complete the IT 560 C Georgia Department Of Revenue

Completing the IT 560 C involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form by entering your business's total income, allowable deductions, and any credits. It is important to review the instructions provided by the Georgia Department of Revenue to ensure that all sections are completed correctly. Finally, double-check your entries and calculations before submitting the form to avoid errors that could lead to delays or penalties.

Legal use of the IT 560 C Georgia Department Of Revenue

The IT 560 C serves as a legally binding document when filed with the Georgia Department of Revenue. To ensure its legal validity, it must be completed accurately and submitted by the specified deadlines. The form must also comply with relevant state tax laws, including any specific requirements set forth by the Georgia Department of Revenue. Proper use of this form helps businesses meet their tax obligations and maintain good standing with state authorities.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the IT 560 C. Typically, the form is due on the fifteenth day of the fourth month following the end of the tax year. For corporations operating on a calendar year, this means the deadline is April 15. Missing this deadline can result in penalties and interest charges, so timely submission is essential for compliance.

Form Submission Methods (Online / Mail / In-Person)

The IT 560 C can be submitted through various methods, providing flexibility for businesses. It can be filed online through the Georgia Department of Revenue's e-filing system, which offers a convenient and efficient way to submit tax forms. Alternatively, businesses can mail the completed form to the appropriate address provided by the department. In-person submissions are also an option for those who prefer direct interaction with tax officials. Each method has its own guidelines, so it is important to follow the instructions carefully to ensure successful submission.

Required Documents

To complete the IT 560 C, businesses must prepare several required documents. These typically include financial statements, such as profit and loss statements, balance sheets, and any relevant supporting documentation for deductions and credits claimed. Additionally, businesses should have their federal tax return on hand, as information from this document may be necessary for accurate reporting on the state form. Ensuring that all required documents are ready will facilitate a smoother filing process.

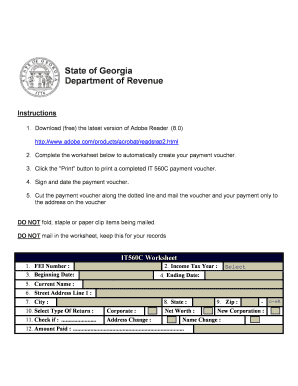

Quick guide on how to complete it 560 c georgia department of revenue

Complete IT 560 C Georgia Department Of Revenue effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage IT 560 C Georgia Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and simplify any document-focused process today.

How to modify and eSign IT 560 C Georgia Department Of Revenue easily

- Obtain IT 560 C Georgia Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Choose your preferred method to send your form, via email, text (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Revise and eSign IT 560 C Georgia Department Of Revenue to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 560 c georgia department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form it 560c?

Form it 560c is a specific document template available in airSlate SignNow that facilitates the electronic signing and management of forms. This form helps streamline your document processes and ensures that you can collect signatures quickly and efficiently. Using this template can signNowly enhance your workflow by minimizing delays associated with traditional signing methods.

-

How does airSlate SignNow support form it 560c?

AirSlate SignNow fully supports form it 560c by providing users with an intuitive interface to complete and eSign forms. The platform allows you to customize the form according to your business needs, making it easier to collect the necessary information. With built-in tracking features, you can always stay updated on the status of your form it 560c completions.

-

What are the pricing options for using form it 560c?

AirSlate SignNow offers flexible pricing plans that accommodate businesses of all sizes looking to use form it 560c. You can choose from monthly or annual subscriptions, which grant access to all features and templates, including form it 560c. Contact our sales team for more detailed information on pricing and available discounts.

-

What features does the form it 560c template include?

The form it 560c template includes features such as customizable fields, automatic notifications, and cloud storage options. These features allow users to tailor the document to their specific needs while ensuring secure data handling. Users can also benefit from the ease of multi-party signing and real-time tracking of the signing process.

-

Can I integrate form it 560c with other applications?

Yes, airSlate SignNow lets you integrate form it 560c with a variety of applications, including CRM systems, cloud storage, and project management tools. These integrations can help enhance your document management processes and allow for seamless data import/export. Explore our integration options to find the best fit for your business.

-

What are the benefits of using form it 560c for my business?

Using form it 560c can streamline document management within your organization, signNowly reducing the time it takes to get forms signed. The template helps improve accuracy by minimizing manual entry errors, leading to increased efficiency. Additionally, you can enhance your customer experience by providing a fast and user-friendly signing process.

-

Is form it 560c secure for sensitive information?

Absolutely, form it 560c in airSlate SignNow is designed with security in mind. The platform complies with industry standards for data protection, ensuring that your sensitive information is encrypted and securely stored. You can eSign documents with peace of mind, knowing that your data is well-protected.

Get more for IT 560 C Georgia Department Of Revenue

- Maine deed formsquit claim warranty and special

- Control number me 02 78 form

- Small claims appeals appealsselfhelp california courts form

- County state of maine form

- The source of income including the type of income and name and address form

- Sc 003 request for disclosure hearing rev 1116doc form

- Briefly describe your claim including relevant dates form

- City maine form

Find out other IT 560 C Georgia Department Of Revenue

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application