T776e Form

What is the T776e?

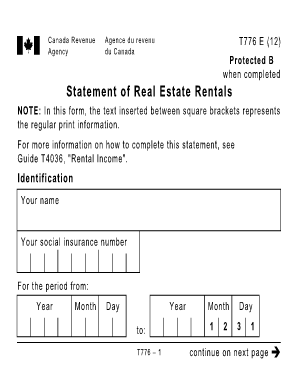

The T776e form, also known as the Statement of Real Estate Rentals, is a tax document used by individuals in Canada to report income earned from rental properties. This form is specifically designed for taxpayers who are renting out real estate and need to declare their rental income and associated expenses. The T776e is essential for accurately calculating taxable income and ensuring compliance with Canadian tax regulations.

How to use the T776e

To effectively use the T776e form, individuals must gather all relevant financial information related to their rental properties. This includes details about rental income, operating expenses, and any capital expenditures. The form allows users to input this information systematically, ensuring that all income and deductions are accurately reported. It is important to follow the guidelines provided by the Canada Revenue Agency (CRA) to complete the form correctly.

Steps to complete the T776e

Completing the T776e involves several key steps:

- Gather all necessary documentation, including rental agreements, receipts for expenses, and any relevant financial statements.

- Start filling out the form by providing your personal information and details about the rental properties.

- Report all rental income received during the tax year.

- List all eligible expenses related to the rental properties, such as maintenance costs, property taxes, and insurance.

- Calculate the net rental income by subtracting total expenses from total income.

- Review the form for accuracy before submission.

Legal use of the T776e

The T776e form is legally recognized by the Canada Revenue Agency as a valid document for reporting rental income. To ensure its legal standing, it is essential to complete the form accurately and submit it by the designated tax deadlines. Failure to comply with the requirements can result in penalties or legal issues. Using a reliable electronic signature solution, like airSlate SignNow, can further enhance the legal validity of the submitted form.

Required Documents

When completing the T776e form, it is important to have the following documents on hand:

- Rental agreements or leases for each property.

- Receipts for all expenses related to the rental properties.

- Financial statements that detail income and expenses.

- Any prior year tax documents that may affect current reporting.

Form Submission Methods

The T776e form can be submitted through various methods, allowing for flexibility in how taxpayers choose to file. Options include:

- Online submission through the CRA's secure portal.

- Mailing a paper copy of the completed form to the CRA.

- In-person submission at designated CRA offices.

Quick guide on how to complete t776e

Accomplish T776e effortlessly on any gadget

Digital document management has grown prevalent among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle T776e on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to alter and electronically sign T776e without hassle

- Locate T776e and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your adjustments.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from any gadget of your choice. Alter and electronically sign T776e and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t776e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t776e feature of airSlate SignNow?

The t776e feature of airSlate SignNow provides a streamlined process for managing signatures and approvals. This intuitive functionality allows users to create, send, and manage documents digitally, ensuring secure eSignature transactions. With t776e, users benefit from enhanced efficiency and reduced turnaround time for document processing.

-

How much does airSlate SignNow with t776e cost?

airSlate SignNow offers competitive pricing plans that include access to the t776e feature. Pricing depends on the plan you choose, which can vary based on user accounts and additional functionalities. For the best value, consider selecting a plan that aligns with your business needs while leveraging the capabilities of t776e.

-

What are the key benefits of using airSlate SignNow's t776e?

Using the t776e feature in airSlate SignNow enhances document management and increases operational efficiency. Key benefits include reduced paper usage, faster transaction times, and improved accuracy in document handling. By utilizing t776e, businesses can also streamline compliance and record-keeping processes.

-

Can I integrate airSlate SignNow's t776e with other software?

Yes, airSlate SignNow’s t776e seamlessly integrates with various third-party applications, improving overall workflow. Popular integrations include CRM systems, project management tools, and cloud storage solutions. This flexibility allows users to enhance their existing processes while utilizing the t776e feature.

-

Is airSlate SignNow’s t776e secure for document handling?

Absolutely, the t776e feature of airSlate SignNow is designed with high-level security standards to ensure document protection. It includes advanced encryption, secure access controls, and audit trails for every transaction. Users can trust that their confidential information is safeguarded while using the t776e feature.

-

How does airSlate SignNow ensure compliance with t776e?

airSlate SignNow’s t776e feature is built to comply with various legal standards and regulations for eSignatures, including the ESIGN Act and UETA. This ensures that all signed documents are legally binding and compliant. Users can have peace of mind knowing that their eSignatures through t776e meet necessary legal requirements.

-

What types of documents can I send using t776e in airSlate SignNow?

You can send a wide range of documents using the t776e feature in airSlate SignNow, including contracts, agreements, forms, and more. The platform supports various file formats, making it easy to manage different document types. Regardless of your industry, t776e can handle your document signing needs efficiently.

Get more for T776e

- Three 3 individuals to two 2 individuals form

- Affidavits state bar of michigan form

- Sworn statement state of michigan ss county form

- The undersigned an individual aan form

- Upon billing by the health care provider form

- The lessor shall pay all ad valorem taxes assessed against the leased property form

- Fillable online michigan notice of hearing form fax email print

- Fillable online michigan notice of entry of judgment form fax email

Find out other T776e

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe