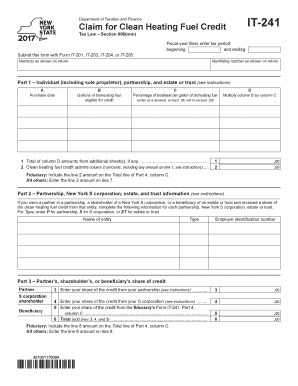

It 241 Form

What is the IT-241?

The IT-241 form, also known as the New York State IT-241, is a tax form used for claiming a credit for taxes paid to other jurisdictions. This form is particularly relevant for New York State taxpayers who have earned income in another state and are subject to double taxation. By filing the IT-241, taxpayers can reduce their New York State tax liability, ensuring they are not taxed twice on the same income.

How to Use the IT-241

To effectively use the IT-241 form, taxpayers must first determine their eligibility for the credit. This involves reviewing the income earned in other jurisdictions and the taxes paid to those states. Once eligibility is confirmed, the taxpayer can complete the form by providing necessary details such as income amounts, tax rates, and the jurisdictions involved. Accurate documentation of taxes paid is essential to support the claim. After filling out the form, it should be submitted along with the taxpayer's New York State tax return.

Steps to Complete the IT-241

Completing the IT-241 involves several key steps:

- Gather all relevant documentation, including W-2 forms and tax returns from other states.

- Determine the total income earned in other jurisdictions and the taxes paid.

- Fill out the IT-241 form, ensuring all sections are completed accurately.

- Attach supporting documents that verify the taxes paid to other states.

- Submit the completed IT-241 with your New York State tax return.

Legal Use of the IT-241

The IT-241 form is legally binding when completed and submitted according to New York State tax regulations. It is essential that taxpayers provide accurate information, as any discrepancies can lead to penalties or audits. The form must be filed within the designated tax year to qualify for the credit, ensuring compliance with state laws regarding tax claims.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing the IT-241. The form should be submitted by the same deadline as the New York State personal income tax return, typically April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to stay informed of any changes in tax deadlines to avoid penalties.

Required Documents

When filing the IT-241, taxpayers need to provide several documents to support their claim. These include:

- W-2 forms from all employers.

- Tax returns from other states where income was earned.

- Proof of taxes paid to other jurisdictions, such as tax payment receipts.

- Any additional documentation that verifies income and tax obligations.

Who Issues the Form

The IT-241 form is issued by the New York State Department of Taxation and Finance. This agency is responsible for overseeing the administration of state taxes and ensuring compliance with tax laws. Taxpayers can obtain the form directly from the department's website or through authorized tax preparation software that includes New York State tax forms.

Quick guide on how to complete it 241

Effortlessly prepare It 241 on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any delays. Manage It 241 on any device using the airSlate SignNow applications for Android or iOS and enhance your document-based workflows today.

The easiest way to modify and eSign It 241 effortlessly

- Locate It 241 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Select your preferred method for providing your form, whether by email, text message (SMS), an invitation link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you select. Edit and eSign It 241 and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 241

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow that relate to IT 241 instructions?

airSlate SignNow offers a range of features that align with IT 241 instructions, including customizable templates, secure eSigning, and automated workflows. These features simplify document management and enhance collaboration within teams. With airSlate SignNow, users can easily streamline their processes while adhering to IT requirements.

-

How does airSlate SignNow ensure compliance with IT 241 instructions?

airSlate SignNow is designed with compliance in mind, ensuring that all eSigned documents meet the standards outlined in IT 241 instructions. The platform includes security features like encryption and audit trails that protect sensitive information. By using airSlate SignNow, businesses can stay compliant while improving their document workflows.

-

What is the pricing structure for airSlate SignNow regarding IT 241 instructions?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes while supporting their needs related to IT 241 instructions. Each plan includes various features that meet compliance and operational requirements. It's essential to choose a plan that aligns with your organization's needs for document management and eSigning.

-

Can airSlate SignNow integrate with other software useful for IT 241 instructions?

Yes, airSlate SignNow can integrate seamlessly with various software applications commonly used in tandem with IT 241 instructions. This includes CRM, project management, and cloud storage solutions. These integrations enhance productivity and ensure a smooth workflow for businesses utilizing airSlate SignNow.

-

What are the benefits of using airSlate SignNow for IT 241 instructions?

Using airSlate SignNow for IT 241 instructions provides numerous benefits, such as increased efficiency, reduced turnaround time for document approvals, and improved security. The platform simplifies the entire signing process, allowing teams to focus on core tasks instead of getting bogged down with paperwork. Overall, it enhances collaboration and ensures compliance.

-

Is there a mobile app for airSlate SignNow that supports IT 241 instructions?

Yes, airSlate SignNow offers a mobile app that supports users in managing documents and eSignatures in line with IT 241 instructions. This app allows for on-the-go access to critical functions, ensuring that users can send and sign documents anytime, anywhere. The mobile app retains all the essential features available on the desktop version.

-

How can I get started with airSlate SignNow for IT 241 instructions?

Getting started with airSlate SignNow for IT 241 instructions is easy. Simply visit the website, sign up for a free trial, and explore the platform's features. You can set up your account and begin integrating airSlate SignNow into your existing processes quickly to enhance your documentation workflows.

Get more for It 241

- Ch 518 mn statutes form

- Notice of filing and form

- Keep calm and file an emergency motion minnesota cle form

- Full text of ampquotthe history and antiquities of bicester a form

- Motion for amendment to form

- Washington county district court minnesota judicial branch form

- You are hereby notified that attorneys name has been retained as attorney for form

- Please take notice that the findings of fact conclusions of law order for form

Find out other It 241

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online