Farm Income and Expense Worksheet 2014

What is the Farm Income and Expense Worksheet

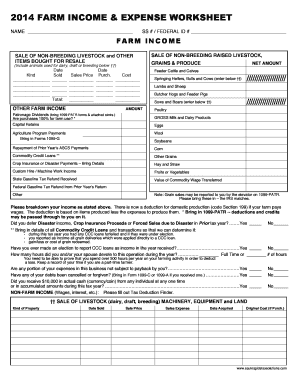

The Farm Income and Expense Worksheet is a vital document used by farmers and agricultural businesses to track their income and expenses throughout the year. This worksheet helps in organizing financial data, making it easier to prepare for tax filings and assess overall financial health. It typically includes sections for various types of income, such as sales of crops and livestock, as well as expenses related to supplies, labor, and equipment. By maintaining accurate records, farmers can gain insights into their profitability and make informed decisions for future operations.

How to use the Farm Income and Expense Worksheet

Using the Farm Income and Expense Worksheet involves several straightforward steps. First, gather all relevant financial documents, including receipts and invoices. Next, categorize your income and expenses into the appropriate sections of the worksheet. Be sure to include all sources of income, such as crop sales and government subsidies, as well as all expenses, including feed, utilities, and maintenance costs. Regularly updating the worksheet throughout the year can help ensure accuracy and ease during tax season. Finally, review the completed worksheet to identify trends and areas for improvement in your farming operations.

Steps to complete the Farm Income and Expense Worksheet

Completing the Farm Income and Expense Worksheet can be accomplished in a few organized steps:

- Collect all financial documents, including receipts, invoices, and bank statements.

- Begin by filling in the income section, detailing all revenue sources related to your farming activities.

- Next, move to the expense section, listing all costs incurred during the farming year.

- Ensure that each entry is accurate and categorized correctly to facilitate easier analysis later.

- Review and double-check all entries for completeness and accuracy before finalizing the worksheet.

Key elements of the Farm Income and Expense Worksheet

The Farm Income and Expense Worksheet consists of several key elements that are essential for effective financial tracking. These include:

- Income Categories: Sections for different income sources, such as crop sales, livestock sales, and government payments.

- Expense Categories: Areas for various expenses, including operating costs, labor, and equipment maintenance.

- Total Income and Expenses: Summaries at the end of each section to provide a clear overview of financial performance.

- Net Profit or Loss: A calculation that shows the difference between total income and total expenses, helping to assess overall profitability.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Farm Income and Expense Worksheet. It is essential for farmers to adhere to these guidelines to ensure compliance during tax filings. According to the IRS, all income must be reported, and all expenses must be ordinary and necessary for the operation of the farm. Additionally, farmers should retain all documentation supporting the entries on the worksheet for at least three years in case of an audit. Understanding these guidelines can help farmers avoid penalties and ensure that they maximize their eligible deductions.

Digital vs. Paper Version

Both digital and paper versions of the Farm Income and Expense Worksheet are available, each offering unique advantages. The digital version allows for easy updates, calculations, and storage, making it convenient for farmers who prefer technology. It can also be easily shared with accountants or financial advisors. On the other hand, the paper version may be preferred by those who enjoy traditional methods or lack access to digital tools. Regardless of the format chosen, maintaining accurate records is crucial for effective financial management.

Quick guide on how to complete farm income and expense worksheet 448096106

Complete Farm Income And Expense Worksheet effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without complications. Handle Farm Income And Expense Worksheet on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Farm Income And Expense Worksheet with ease

- Obtain Farm Income And Expense Worksheet and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Farm Income And Expense Worksheet while ensuring outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct farm income and expense worksheet 448096106

Create this form in 5 minutes!

How to create an eSignature for the farm income and expense worksheet 448096106

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a farm income and expense worksheet?

A farm income and expense worksheet is a tool designed to help farmers track their income and expenditures over a specific period. It provides a clear overview of financial performance, enabling farmers to make informed decisions about their operations. Using this worksheet can enhance financial planning and tax preparation.

-

How can airSlate SignNow assist with managing a farm income and expense worksheet?

AirSlate SignNow simplifies the process of creating, signing, and sharing your farm income and expense worksheet. With our user-friendly interface, you can easily customize your worksheet, ensuring it meets your specific accounting needs. Plus, you can obtain eSignatures from stakeholders quickly and efficiently.

-

Is the farm income and expense worksheet easy to use?

Yes, our farm income and expense worksheet is designed to be intuitive and user-friendly. Even those with minimal accounting experience can quickly understand how to input data and generate reports. The worksheet is tailored to assist farmers in managing their finances effectively.

-

What features are included in the farm income and expense worksheet?

The farm income and expense worksheet includes features such as customizable templates, automatic calculations, and data visualization tools. These features help you easily monitor income sources and expenses, allowing for better financial management. Additionally, it integrates seamlessly with airSlate SignNow for quick eSigning.

-

Can I access the farm income and expense worksheet on different devices?

Absolutely! The farm income and expense worksheet is cloud-based, allowing you to access it from any device with internet connectivity. Whether you're on your computer, tablet, or smartphone, you can easily update and manage your worksheet on the go.

-

What are the benefits of using an electronic farm income and expense worksheet?

Using an electronic farm income and expense worksheet provides several benefits, including enhanced accuracy, easier collaboration, and quick data retrieval. Electronic worksheets reduce the risk of errors associated with manual calculations and allow you to share and update information in real-time with your team. Additionally, they simplify financial reporting and compliance.

-

Is there a cost associated with using the farm income and expense worksheet?

The cost of using our farm income and expense worksheet varies based on the features and subscription plan you choose. We offer various pricing tiers to fit different budgets, ensuring that our solution remains cost-effective for all farmers. Visit our pricing page for detailed information on plans.

Get more for Farm Income And Expense Worksheet

- Motion of defendant requesting a form

- Covering civil casesjournalists guideunited states courts form

- Amendment of claim of lien priority of liens justia law form

- Mississippi plaintiffs master interrogatories request for form

- Authorization to satisfy lien notice form

- Complaint against the defendant form

- This day this case came on to be heard on the motion of form

- Show as follows form

Find out other Farm Income And Expense Worksheet

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure