Cc Sms Fr Conférence Eit Form

What is the Cc Sms Fr Conférence Eit

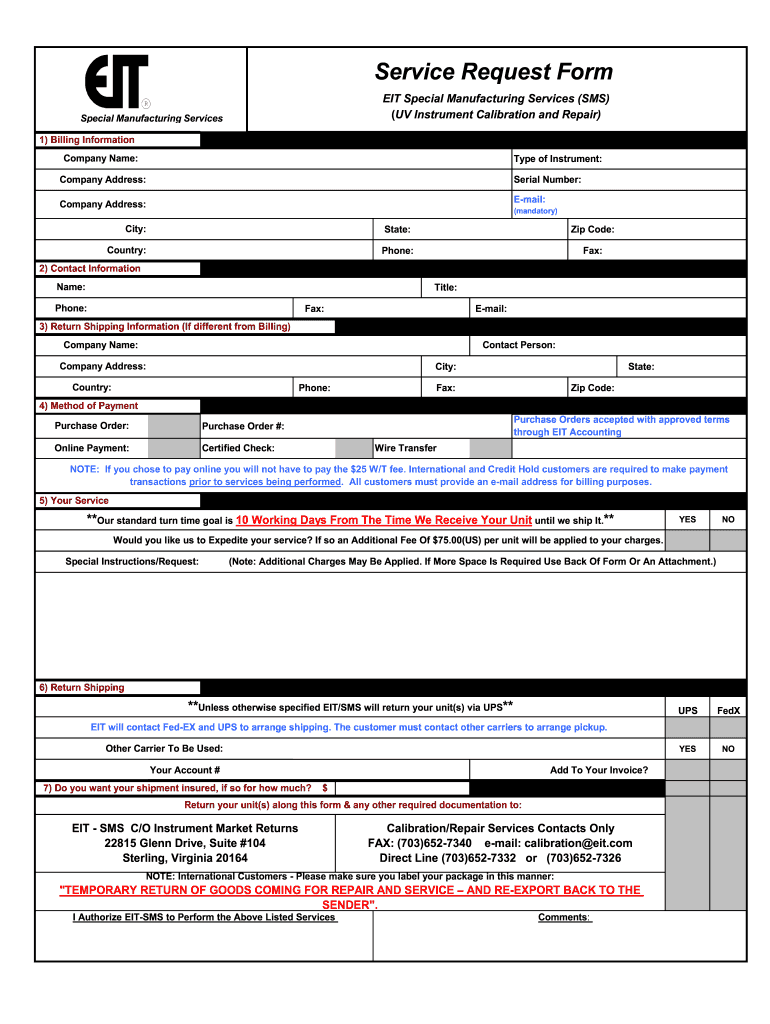

The Cc Sms Fr Conférence Eit is a specific form used in various business and tax-related applications. This form serves as a request for an EIT (Economic Incentive Tax) service, allowing businesses to apply for specific benefits or services under the EIT program. Understanding this form is crucial for businesses looking to navigate the complexities of tax incentives and ensure they meet all necessary requirements.

Steps to Complete the Cc Sms Fr Conférence Eit

Completing the Cc Sms Fr Conférence Eit involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather necessary information, including business identification details and any relevant financial data.

- Carefully fill out each section of the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the appropriate channels, whether online or by mail.

Legal Use of the Cc Sms Fr Conférence Eit

The legal use of the Cc Sms Fr Conférence Eit is governed by specific regulations and laws that outline how businesses can utilize this form. Compliance with these laws is essential to ensure that the submitted requests are valid and admissible. Businesses must be aware of the legal implications of their submissions and maintain accurate records to support their claims.

Required Documents

When submitting the Cc Sms Fr Conférence Eit, certain documents are typically required to support the application. These may include:

- Proof of business registration and identification.

- Financial statements or tax returns that demonstrate eligibility for the EIT services.

- Any additional documentation requested by the issuing authority.

Form Submission Methods

The Cc Sms Fr Conférence Eit can be submitted through various methods, depending on the preferences of the business and the requirements set by the issuing authority. Common submission methods include:

- Online submission through an official portal, which allows for quicker processing.

- Mailing a physical copy of the completed form to the designated office.

- In-person submission at local government offices, if applicable.

Eligibility Criteria

Eligibility for the Cc Sms Fr Conférence Eit is determined by specific criteria that businesses must meet. These criteria often include:

- Type of business entity, such as LLC or corporation.

- Location of the business and its operational status.

- Compliance with local and federal tax regulations.

IRS Guidelines

Understanding IRS guidelines related to the Cc Sms Fr Conférence Eit is essential for businesses to ensure compliance. The IRS provides detailed instructions on how to fill out the form, what information is required, and the deadlines for submission. Adhering to these guidelines helps prevent potential penalties and ensures that businesses can take full advantage of available tax incentives.

Quick guide on how to complete service request form eit llc

Discover how to smoothly navigate the Cc Sms Fr Conférence Eit completion with this simple guide

Submitting and verifying forms digitally is becoming increasingly favored and is the primary choice for many users. It provides various advantages over traditional printed materials, including convenience, time savings, enhanced precision, and improved security.

With resources like airSlate SignNow, you can find, modify, endorse, enhance, and transmit your Cc Sms Fr Conférence Eit without the hassle of endless printing and scanning. Follow this brief guide to begin and complete your form.

Follow these steps to obtain and complete Cc Sms Fr Conférence Eit

- Begin by clicking on the Get Form button to access your document in our editor.

- Pay attention to the green markers on the left that indicate required fields to ensure you don’t miss them.

- Utilize our professional features to annotate, modify, endorse, secure, and optimize your document.

- Protect your document or convert it into a fillable form using the features on the right panel.

- Review the document thoroughly and check for mistakes or inconsistencies.

- Click DONE to complete your editing.

- Rename your form or keep it as is.

- Choose the storage service you prefer to save your document, send it via USPS, or click the Download Now button to retrieve your file.

If Cc Sms Fr Conférence Eit isn’t what you needed, you can explore our extensive library of pre-uploaded templates that you can fill out with ease. Visit our platform today!

Create this form in 5 minutes or less

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

Do military personnel need money to fill out a leave request form?

It’s great that you asked. The answer is NO. Also, whatever you are doing with this person, STOP!Bloody hell, how many of these “I need your money to see you sweetheart” scammers are there? It’s probably that or someone totally misunderstood something.All military paperwork is free! However, whether their commander or other sort of boss will let them return or not depends on the nature of duty, deployment terms, and other conditions. They can’t just leave on a whim, that would be desertion and it’s (sorry I don’t know how it works in America) probably punishable by firing (as in termination of job) or FIRING (as in execution)!!!Soldiers are generally paid enough to fly commercial back to home country.Do not give these people any money or any contact information! If you pay him, you’ll probably get a receipt from Nigeria and nothing else.

Create this form in 5 minutes!

How to create an eSignature for the service request form eit llc

How to make an eSignature for your Service Request Form Eit Llc online

How to make an eSignature for the Service Request Form Eit Llc in Google Chrome

How to generate an electronic signature for signing the Service Request Form Eit Llc in Gmail

How to create an electronic signature for the Service Request Form Eit Llc from your smart phone

How to make an eSignature for the Service Request Form Eit Llc on iOS

How to make an electronic signature for the Service Request Form Eit Llc on Android OS

People also ask

-

What is the Atlantic City service request form?

The Atlantic City service request form is a streamlined document designed to simplify the process of submitting requests to city services. By using this form, residents can efficiently communicate their needs, ensuring a prompt response from the appropriate city department.

-

How can I fill out the Atlantic City service request form?

Filling out the Atlantic City service request form is simple. You can access it online, fill in the required fields, and submit it electronically using airSlate SignNow. This ensures that your request is received quickly and processed in a timely manner.

-

Is there a cost associated with using the Atlantic City service request form?

No, utilizing the Atlantic City service request form is completely free for residents. AirSlate SignNow provides an easy-to-use platform that allows users to submit their requests without any charges, making it a cost-effective solution for all citizens.

-

What features does airSlate SignNow offer for the Atlantic City service request form?

AirSlate SignNow offers several features for the Atlantic City service request form, including real-time collaboration, electronic signatures, and mobile access. These features enhance the user experience and ensure that all requests are processed efficiently and securely.

-

Can I track the status of my Atlantic City service request form submission?

Yes, when you submit your Atlantic City service request form through airSlate SignNow, you can track its status. The platform provides notifications and updates, allowing you to stay informed about your request's progress every step of the way.

-

What are the benefits of using the Atlantic City service request form online?

Using the Atlantic City service request form online offers numerous benefits, including convenience, speed, and accessibility. You can submit your requests from anywhere, at any time, ensuring that your concerns are addressed quickly by city officials.

-

Are there integrations available with the Atlantic City service request form?

Yes, airSlate SignNow allows integrations with various applications to streamline the process of using the Atlantic City service request form. Integrating with project management tools or CRM systems can enhance workflow and improve communication with city services.

Get more for Cc Sms Fr Conférence Eit

Find out other Cc Sms Fr Conférence Eit

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document