Michigan Department of Treasury Form 4632

What is the Michigan Department of Treasury Form 4632

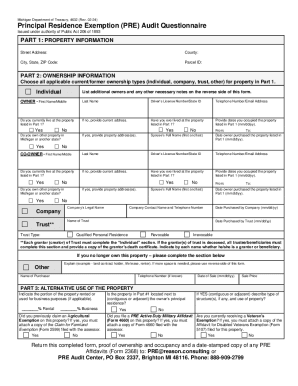

The Michigan Department of Treasury Form 4632 is officially known as the Principal Residence Exemption Audit Questionnaire. This form is essential for property owners in Michigan who wish to confirm their eligibility for the principal residence exemption. This exemption allows qualifying homeowners to reduce their property taxes by exempting a portion of their home's value from taxation. Completing this form accurately is crucial for maintaining the exemption status and ensuring compliance with state regulations.

How to use the Michigan Department of Treasury Form 4632

Using the Michigan Department of Treasury Form 4632 involves several steps. First, property owners must download the form from the Michigan Department of Treasury website or obtain a physical copy from their local tax assessor's office. Once in possession of the form, homeowners need to provide accurate information regarding their property, including ownership details, residency status, and any other relevant data. After filling out the form, it should be submitted to the appropriate local tax authority for review. Keeping a copy for personal records is also advisable.

Steps to complete the Michigan Department of Treasury Form 4632

Completing the Michigan Department of Treasury Form 4632 requires careful attention to detail. Here are the steps to follow:

- Obtain the form from the Michigan Department of Treasury or your local tax office.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal information, including your name, address, and property details.

- Provide any additional information requested, such as previous exemptions or changes in residency.

- Review the completed form for accuracy.

- Submit the form to your local tax authority, either online or by mail.

Legal use of the Michigan Department of Treasury Form 4632

The legal use of the Michigan Department of Treasury Form 4632 is grounded in state law, which mandates that property owners must provide accurate information to qualify for the principal residence exemption. Misrepresentation or failure to submit the form can result in penalties, including the loss of the exemption and potential back taxes owed. It is important for homeowners to understand their legal obligations when completing and submitting this form to avoid any legal repercussions.

Form Submission Methods

The Michigan Department of Treasury Form 4632 can be submitted through various methods, ensuring convenience for property owners. These methods include:

- Online Submission: Many local tax authorities offer an online portal for submitting the form electronically.

- Mail: Property owners can print the completed form and send it via postal mail to their local tax office.

- In-Person: Homeowners may also choose to deliver the form in person at their local tax office during business hours.

Key elements of the Michigan Department of Treasury Form 4632

Understanding the key elements of the Michigan Department of Treasury Form 4632 is vital for accurate completion. The form includes sections for:

- Property Information: Details about the property for which the exemption is being claimed.

- Owner Information: Personal details of the homeowner, including name and contact information.

- Residency Status: Questions regarding the homeowner's primary residence status and any changes that may affect eligibility.

- Signature: A declaration that the information provided is true and accurate, requiring the homeowner's signature.

Quick guide on how to complete michigan department of treasury form 4632

Complete Michigan Department Of Treasury Form 4632 effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the right form and safely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your papers swiftly without holdups. Manage Michigan Department Of Treasury Form 4632 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Michigan Department Of Treasury Form 4632 with ease

- Locate Michigan Department Of Treasury Form 4632 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow manages your document administration needs in just a few clicks from any device of your preference. Modify and eSign Michigan Department Of Treasury Form 4632 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan department of treasury form 4632

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Michigan Dept of Treasury forms?

Michigan Dept of Treasury forms are official documents required by the state of Michigan for various tax and financial reporting purposes. These forms are essential for businesses and individuals to comply with state regulations. Using airSlate SignNow, you can easily access, fill, and eSign these forms digitally.

-

How can airSlate SignNow assist with Michigan Dept of Treasury forms?

airSlate SignNow streamlines the process of completing Michigan Dept of Treasury forms by allowing users to fill out and eSign documents electronically. This not only speeds up the workflow but also reduces errors associated with manual entry. Our platform ensures that your forms are completed accurately and swiftly.

-

Is there a cost associated with using airSlate SignNow for Michigan Dept of Treasury forms?

Yes, airSlate SignNow offers various subscription plans that cater to different needs, including the processing of Michigan Dept of Treasury forms. The pricing is competitive and designed to be cost-effective for businesses of all sizes. You can choose a plan that best fits your requirements and budget.

-

Can I integrate airSlate SignNow with other applications for Michigan Dept of Treasury forms?

Absolutely! airSlate SignNow supports integrations with numerous applications, making it easy to manage your Michigan Dept of Treasury forms alongside other tools you use. Whether you need to connect with CRM systems or file storage solutions, our integration capabilities ensure a smooth experience.

-

What features does airSlate SignNow offer for managing Michigan Dept of Treasury forms?

airSlate SignNow provides built-in templates, electronic signatures, and automated workflows specifically for Michigan Dept of Treasury forms. These features help you organize, manage, and store your forms securely. Additionally, you can track the status of each document in real-time.

-

How does using airSlate SignNow benefit businesses handling Michigan Dept of Treasury forms?

Using airSlate SignNow for Michigan Dept of Treasury forms helps businesses save time and reduce paperwork hassle. The electronic signing process enhances efficiency and compliance, ensuring forms are submitted on time. Additionally, digital records improve accessibility and security.

-

Are there any compliance measures in place while using airSlate SignNow for Michigan Dept of Treasury forms?

Yes, airSlate SignNow adheres to strict compliance regulations, ensuring the security and authenticity of your Michigan Dept of Treasury forms. We implement advanced encryption and authentication measures to protect your sensitive information. You can trust our platform to maintain compliance with state regulations.

Get more for Michigan Department Of Treasury Form 4632

- Georgia statutory financial power of attorney division of form

- How to get a quick divorcelegalzoom form

- Control number nm p010 pkg form

- Zip desiring to execute a limited power of attorney hereby appoint form

- Declarant having executed a statutory power of attorney form

- Control number nm p011 pkg form

- Control number nm p012 pkg form

- Control number nm p017 pkg form

Find out other Michigan Department Of Treasury Form 4632

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF