401k Opt Out Form Template

What is the 401k Opt Out Form Template

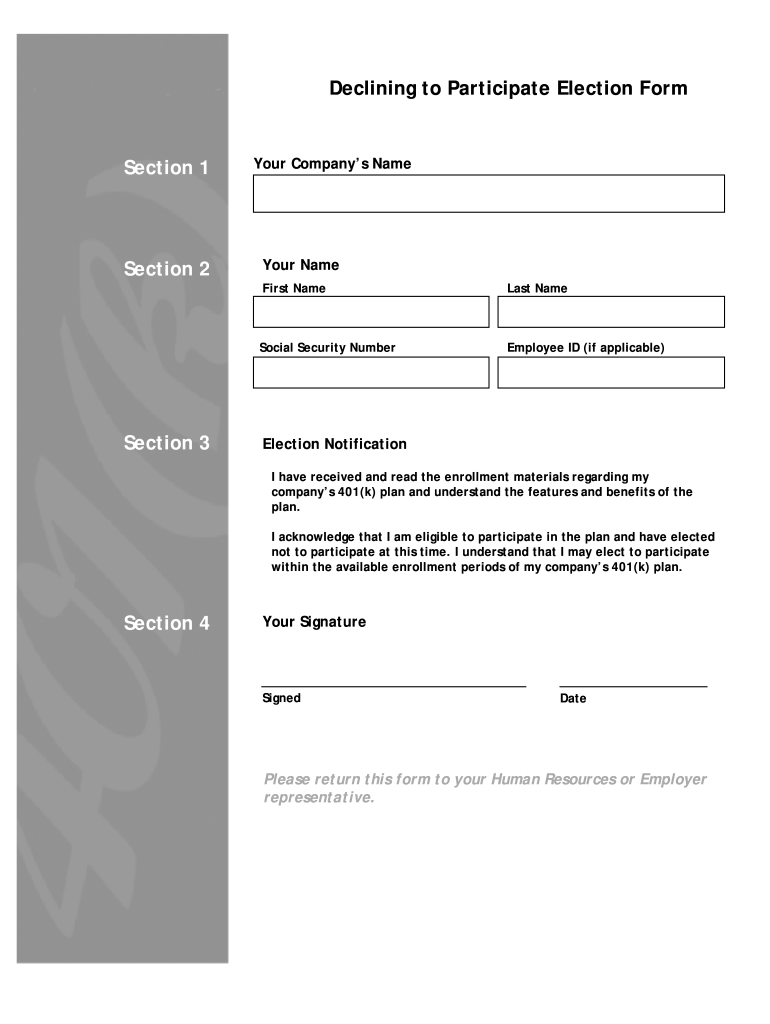

The 401k opt out form template is a standardized document that allows employees to formally decline participation in their employer's 401k retirement savings plan. This form is essential for individuals who wish to opt out of automatic enrollment or discontinue contributions to their 401k account. By completing this form, employees communicate their decision to their employer, ensuring that their choice is documented and respected. The template typically includes sections for personal information, a declaration of intent to opt out, and spaces for signatures and dates.

How to Use the 401k Opt Out Form Template

Using the 401k opt out form template involves several straightforward steps. First, download the template from a reliable source. Next, fill in your personal details, including your name, employee ID, and contact information. Clearly indicate your choice to opt out of the 401k plan. Ensure that you review the form for accuracy before signing and dating it. Once completed, submit the form to your HR department or the designated personnel responsible for managing retirement plans within your organization. This process ensures that your decision is officially recorded.

Key Elements of the 401k Opt Out Form Template

To ensure that the 401k opt out form template is effective, it must contain several key elements. These include:

- Employee Information: Name, employee ID, and contact details.

- Opt Out Declaration: A clear statement indicating the employee's intention to opt out of the 401k plan.

- Signature and Date: The employee's signature and the date of submission to validate the request.

- Employer Acknowledgment: A section for the employer's acknowledgment of the opt-out request, which may include a signature line for HR personnel.

Steps to Complete the 401k Opt Out Form Template

Completing the 401k opt out form template requires careful attention to detail. Follow these steps:

- Download the 401k opt out form template from a trusted source.

- Fill in your personal information accurately.

- Clearly state your intention to opt out of the 401k plan.

- Sign and date the form to confirm your decision.

- Submit the completed form to your HR department or the designated contact.

Legal Use of the 401k Opt Out Form Template

The 401k opt out form template is legally binding when it meets specific requirements. It must be filled out correctly and signed by the employee to be considered valid. Employers are required to maintain these forms as part of their records, ensuring compliance with federal regulations governing retirement plans. By using a reliable digital platform for signing and submitting the form, employees can enhance the legal standing of their request, as electronic signatures are recognized under the ESIGN and UETA Acts in the United States.

Form Submission Methods

Employees can submit the 401k opt out form template through various methods, depending on their employer's policies. Common submission methods include:

- Online Submission: Many companies allow employees to submit forms electronically through their HR portals.

- Mail: Employees may choose to print the completed form and send it via postal mail to their HR department.

- In-Person: Submitting the form in person can provide immediate confirmation of receipt.

Quick guide on how to complete 401k opt out form template

Complete 401k Opt Out Form Template effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage 401k Opt Out Form Template on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign 401k Opt Out Form Template without any hassle

- Locate 401k Opt Out Form Template and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that reason.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign 401k Opt Out Form Template and guarantee effective communication throughout your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 401k opt out form template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 401k opt out form template?

A 401k opt out form template is a standardized document that allows employees to formally decline participation in a 401k retirement plan. Using an effective template ensures compliance with regulations and simplifies the opt-out process for both employers and employees.

-

How can I create a 401k opt out form template?

You can create a 401k opt out form template using airSlate SignNow's user-friendly interface. Simply choose a template, customize it to fit your needs, and save it for easy access. This makes it quick and efficient to have the form ready for your employees.

-

Is there a cost associated with using the 401k opt out form template?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective compared to other e-signature solutions. Once you're on a plan, you have access to create and manage various templates, including the 401k opt out form template, without additional charges.

-

What features does the 401k opt out form template include?

The 401k opt out form template includes customizable fields, electronic signatures, and automated workflows. These features streamline the process of opting out, saving time and reducing potential errors in paperwork.

-

Can I track the status of my 401k opt out form template?

Absolutely! airSlate SignNow provides tracking capabilities for your 401k opt out form template. You can see when the document is viewed, signed, and completed, ensuring you stay updated on each employee's opt-out status.

-

How does the 401k opt out form template integrate with other tools?

The 401k opt out form template can seamlessly integrate with several other business applications through airSlate SignNow's API. This means you can enhance your existing workflows, making it easier to manage documents and employee data across platforms.

-

What are the benefits of using a 401k opt out form template?

Using a 401k opt out form template offers numerous benefits such as ensuring compliance, reducing administrative workload, and improving employee experience. It standardizes the process, making it easy for employees to opt-out while maintaining accurate records for the company.

Get more for 401k Opt Out Form Template

- Possession of firearm having altered form

- Criminal tax manual 26 usc7201 department of justice form

- The politics of fossil fuel subsidies and their reform

- Public finance public finance in china reform and growth

- 26 us code7206 fraud and false statementsus form

- 4267 bank secrecy act penaltiesinternal revenue service form

- Title 48 us code territories and insular possessions form

- United states of america plaintiff appellee v albert form

Find out other 401k Opt Out Form Template

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form