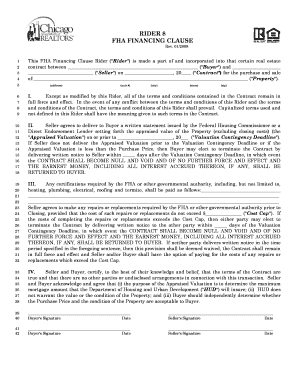

Fha Rider Form

What is the FHA Rider?

The FHA Rider is a specific document used in real estate transactions involving properties financed through the Federal Housing Administration (FHA). This rider outlines additional terms and conditions that apply to the sale of a property, particularly when it comes to the resale of homes purchased with FHA loans. The FHA Rider is designed to protect both buyers and lenders by ensuring compliance with FHA regulations, including the flipping rule, which restricts the resale of properties within a certain timeframe.

How to Use the FHA Rider

Using the FHA Rider involves incorporating it into the purchase agreement for a property financed with an FHA loan. It is essential to ensure that all parties involved in the transaction understand the implications of the rider. The FHA Rider typically includes provisions regarding the resale of the property, ensuring that the buyer is aware of the restrictions imposed by the FHA flipping rule. This helps to prevent any potential legal issues or misunderstandings during the sale process.

Key Elements of the FHA Rider

The FHA Rider contains several key elements that are crucial for compliance with FHA regulations. These include:

- Flipping Rule Compliance: Details regarding the 91 and 180-day flipping rule, which restricts the resale of properties within a specific timeframe.

- Disclosure Requirements: Information that must be provided to the buyer about the property's history and any previous sales.

- Amendatory Clauses: Provisions that allow for adjustments to the agreement based on FHA requirements.

Steps to Complete the FHA Rider

Completing the FHA Rider involves several steps to ensure that all necessary information is accurately captured. These steps include:

- Gathering Property Information: Collect all relevant details about the property, including its history and any prior sales.

- Reviewing FHA Guidelines: Familiarize yourself with the FHA regulations, particularly the flipping rule.

- Filling Out the Rider: Complete the FHA Rider with the necessary information, ensuring that all parties understand the terms.

- Signing the Document: Have all parties sign the rider to make it legally binding.

Legal Use of the FHA Rider

The FHA Rider is legally binding when properly executed and integrated into the purchase agreement. It is important to ensure that the rider complies with all applicable laws and FHA regulations. This includes adhering to the 91 and 180-day flipping rule, which prohibits the resale of properties within these timeframes unless certain conditions are met. Failure to comply with these regulations can result in penalties for both buyers and sellers.

Examples of Using the FHA Rider

Examples of using the FHA Rider can help illustrate its practical application in real estate transactions. For instance, if a buyer purchases a home with an FHA loan and intends to sell it shortly after, the FHA Rider would outline the restrictions based on the flipping rule. Another example could involve a property that has undergone significant renovations, where the rider would clarify the conditions under which the property can be resold within the specified timeframe.

Quick guide on how to complete fha rider 45794292

Complete Fha Rider effortlessly on any device

Online document management has gained signNow traction among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents rapidly without delays. Manage Fha Rider on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-driven process today.

The simplest way to modify and eSign Fha Rider without hassle

- Find Fha Rider and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tiresome form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Fha Rider and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fha rider 45794292

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FHA flipping rule 91 180 days?

The FHA flipping rule 91 180 days is a regulation that prevents the resale of a home within 91 to 180 days of its previous sale to discourage property flipping for quick profits. This rule helps maintain stability in the housing market. Understanding this rule is crucial if you're considering a quick property investment or sale.

-

How does the FHA flipping rule 91 180 days affect real estate transactions?

The FHA flipping rule 91 180 days impacts how quickly a buyer can resell a property with FHA financing. If a property is sold within this timeframe, it may not qualify for FHA loans, reducing the pool of potential buyers. Knowing this can help you plan your buying and selling strategies more effectively.

-

What features can airSlate SignNow provide to help with FHA-related transactions?

airSlate SignNow offers features such as eSignature, document creation, and secure sharing that streamline the transaction process for FHA-related deals. This can be particularly helpful when navigating the FHA flipping rule 91 180 days. Our platform ensures that you can easily manage documents while complying with FHA requirements.

-

What are the benefits of using airSlate SignNow for FHA transactions?

Using airSlate SignNow for FHA transactions simplifies the signing process, reduces paperwork, and enhances compliance with regulations like the FHA flipping rule 91 180 days. You'll benefit from faster transaction times and reduced processing costs. This helps keep your business running smoothly while you focus on optimizing your property investments.

-

Is there a cost associated with using airSlate SignNow for handling FHA documents?

Yes, airSlate SignNow provides various pricing plans to accommodate different business needs, whether you're handling FHA documents or other contracts. The cost is designed to be cost-effective compared to traditional methods, making it a practical choice for managing compliance with regulations like the FHA flipping rule 91 180 days.

-

Can airSlate SignNow integrate with other tools for real estate professionals?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and real estate tools to provide a streamlined workflow for professionals dealing with properties. This integration can help ensure compliance with the FHA flipping rule 91 180 days as it keeps all documents organized and easily accessible throughout the transaction process.

-

How does airSlate SignNow ensure compliance with FHA rules?

airSlate SignNow helps ensure compliance with FHA rules, including the FHA flipping rule 91 180 days, by providing templates and tools for accurate documentation. Our platform offers features that help track transaction timelines, ensuring you meet the FHA's requirements. This support makes it easier to navigate the complexities of FHA real estate transactions.

Get more for Fha Rider

- Of the lease and the law and constitutes unlawful self help repossession form

- Form wc 102 request for documents to parties georgia

- Reduction or denial of services to families with children form

- Motionobjection to motion form

- Notice of representation of any party other than a claimant or employee by an attorney form

- Attorney leave of absence state board of workers form

- Deposit all of which is recoverable by me form

- Repair and maintain window and doors in good repair and working condition form

Find out other Fha Rider

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online