407, State Convention Facility Development Tax State of Michigan Michigan Form

What is the 407, State Convention Facility Development Tax State Of Michigan Michigan

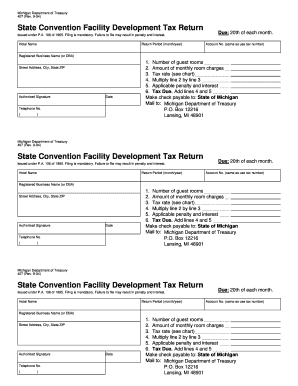

The 407, State Convention Facility Development Tax in Michigan is a specific tax designed to support the development and maintenance of convention facilities within the state. This tax is typically levied on certain businesses and activities related to the hospitality and tourism sectors. The funds generated from this tax are allocated to improve and enhance convention centers, making Michigan a more attractive destination for events and conferences.

Steps to complete the 407, State Convention Facility Development Tax State Of Michigan Michigan

Completing the 407 form involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents and information related to your business operations. Next, fill out the form accurately, providing details such as your business name, address, and tax identification number. Once completed, review the form carefully for any errors or omissions. Finally, submit the form by the designated deadline, either electronically or via mail, depending on your preference.

Legal use of the 407, State Convention Facility Development Tax State Of Michigan Michigan

The legal use of the 407 form is governed by state law, which outlines the requirements and regulations surrounding the tax. It is essential for businesses to comply with these laws to avoid penalties. The form serves as an official document that must be filled out correctly to ensure that the tax is calculated and paid appropriately. Failure to adhere to these regulations can result in legal repercussions, including fines or other penalties.

Eligibility Criteria for the 407, State Convention Facility Development Tax State Of Michigan Michigan

Eligibility for the 407 tax typically includes businesses that operate within the hospitality sector, such as hotels, restaurants, and event venues. To qualify, businesses must meet specific criteria set forth by the state, including having a physical presence in Michigan and engaging in activities that contribute to the convention and tourism industry. It is crucial for businesses to review these criteria to determine their eligibility before completing the form.

Form Submission Methods for the 407, State Convention Facility Development Tax State Of Michigan Michigan

The 407 form can be submitted through various methods to accommodate different preferences. Businesses have the option to file the form online, which often provides a quicker processing time and immediate confirmation of receipt. Alternatively, the form can be mailed to the appropriate state department or submitted in person at designated locations. Each submission method has its own guidelines and requirements, so it is important to follow the instructions carefully to ensure proper processing.

Filing Deadlines for the 407, State Convention Facility Development Tax State Of Michigan Michigan

Filing deadlines for the 407 form are critical for compliance. Typically, businesses must submit the form by a specific date each year, which is determined by the state. It is essential to be aware of these deadlines to avoid late fees or penalties. Keeping track of important dates and setting reminders can help ensure that the form is filed on time, allowing businesses to maintain good standing with state tax authorities.

Quick guide on how to complete 407 state convention facility development tax state of michigan michigan

Effortlessly Prepare 407, State Convention Facility Development Tax State Of Michigan Michigan on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to access the necessary forms and securely store them online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents quickly and efficiently. Manage 407, State Convention Facility Development Tax State Of Michigan Michigan on any device using the airSlate SignNow applications for Android or iOS and simplify any document-driven process today.

How to Edit and Electronically Sign 407, State Convention Facility Development Tax State Of Michigan Michigan with Ease

- Locate 407, State Convention Facility Development Tax State Of Michigan Michigan and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sharing the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign 407, State Convention Facility Development Tax State Of Michigan Michigan to ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 407 state convention facility development tax state of michigan michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 407, State Convention Facility Development Tax State Of Michigan Michigan?

The 407, State Convention Facility Development Tax State Of Michigan Michigan, is a tax levied to support the development of convention facilities across the state. This revenue helps fund improvements and expansions that attract larger events, boosting local economies. Understanding this tax is essential for businesses looking to leverage state resources for event planning.

-

How can airSlate SignNow help with documents related to the 407, State Convention Facility Development Tax State Of Michigan Michigan?

airSlate SignNow facilitates the electronic signing and management of documents related to the 407, State Convention Facility Development Tax State Of Michigan Michigan. Businesses can easily send relevant documents for eSignature, ensuring timely compliance and streamlined processes. This efficiency can signNowly enhance your dealings with taxation on facilities.

-

What are the pricing options for airSlate SignNow in relation to the 407, State Convention Facility Development Tax State Of Michigan Michigan?

airSlate SignNow offers various pricing plans to fit businesses of all sizes, making it an economical choice for managing documents tied to the 407, State Convention Facility Development Tax State Of Michigan Michigan. Each plan includes features tailored to meet diverse needs, allowing users to maximize their investment. You can find the plan that best suits your specific requirements on our pricing page.

-

What features does airSlate SignNow provide that are beneficial for dealing with tax documents?

airSlate SignNow offers several features beneficial for managing tax-related documents, including custom templates, secure cloud storage, and real-time tracking. These tools ensure your documents related to the 407, State Convention Facility Development Tax State Of Michigan Michigan are easily accessible and efficiently managed. Additionally, integrations with popular accounting software streamline the overall process.

-

Can airSlate SignNow integrate with other platforms to assist with the 407, State Convention Facility Development Tax State Of Michigan Michigan?

Yes, airSlate SignNow seamlessly integrates with various platforms that assist in managing events and finances, simplifying the handling of documents associated with the 407, State Convention Facility Development Tax State Of Michigan Michigan. This integration ensures that you can sync your workflows with existing applications, enhancing productivity. Check our integration section for full compatibility information.

-

What are the benefits of using airSlate SignNow for the 407, State Convention Facility Development Tax State Of Michigan Michigan?

Using airSlate SignNow for the 407, State Convention Facility Development Tax State Of Michigan Michigan streamlines the process of document management and signing, saving time and reducing errors. The platform is user-friendly and offers signNow cost savings over traditional methods. These benefits contribute to a more efficient tax-related workflow for your business.

-

Is airSlate SignNow secure for handling sensitive documents related to the 407, State Convention Facility Development Tax State Of Michigan Michigan?

Absolutely, airSlate SignNow prioritizes security, ensuring that all documents, including those related to the 407, State Convention Facility Development Tax State Of Michigan Michigan, are protected. The platform employs advanced encryption and compliance with robust security standards. You can trust that your sensitive information remains confidential and secure throughout the signing process.

Get more for 407, State Convention Facility Development Tax State Of Michigan Michigan

- Limitation on use of data subject to privacy policy form

- Sec filing investor relationshasbro inc form

- Age verification software license agreement form

- Kofax image products inc ipo investment prospectus s 1a form

- Software license agreement on a per database instance form

- Free republic form

- Instructions for form 4797 2018internal revenue service

- Like kind exchanges purpose of form internal revenue service

Find out other 407, State Convention Facility Development Tax State Of Michigan Michigan

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later