Ri W4 Form

What is the RI W-4?

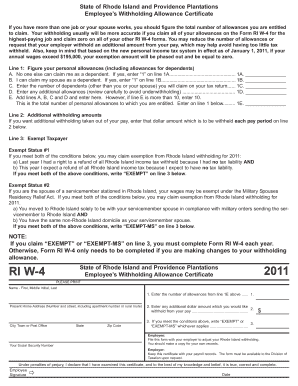

The RI W-4 is a state-specific withholding form used by employees in Rhode Island to determine the amount of state income tax to withhold from their paychecks. It is essential for ensuring that the correct amount of state tax is deducted based on an individual's filing status and any exemptions claimed. The form is similar to the federal W-4 but is tailored to meet Rhode Island's tax regulations.

How to use the RI W-4

To use the RI W-4 effectively, employees must complete the form with accurate personal information, including their name, address, and Social Security number. They should indicate their filing status and any exemptions they qualify for, such as being exempt from withholding. Once completed, the form should be submitted to the employer, who will use it to calculate the appropriate withholding amount from the employee's paycheck.

Steps to complete the RI W-4

Completing the RI W-4 involves several straightforward steps:

- Download the RI W-4 form from the Rhode Island Division of Taxation website.

- Fill in your personal details, including your name, address, and Social Security number.

- Select your filing status, such as single, married, or head of household.

- Claim any exemptions if applicable, indicating that you are exempt from withholding if you meet the criteria.

- Sign and date the form before submitting it to your employer.

Key elements of the RI W-4

The RI W-4 includes several key elements that employees must pay attention to:

- Personal Information: Name, address, and Social Security number are required.

- Filing Status: Employees must choose between single, married, or head of household.

- Exemptions: Employees can claim exemptions based on their tax situation.

- Signature: A signature is required to validate the form.

State-specific rules for the RI W-4

Rhode Island has specific rules regarding the use of the RI W-4. Employees must ensure they are aware of the current tax rates and any changes in tax laws that may affect their withholding amounts. Additionally, the state requires that the form be updated whenever there are significant changes in an employee's financial situation, such as marriage or a change in dependents.

Examples of using the RI W-4

Examples of using the RI W-4 include:

- A single employee with no dependents may complete the form by selecting single filing status and not claiming any exemptions.

- A married couple may choose to file jointly and claim exemptions based on their combined income and deductions.

- A student working part-time may claim exempt status if they had no tax liability in the previous year and expect none in the current year.

Quick guide on how to complete ri w4

Complete Ri W4 effortlessly on any device

Web-based document management has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Ri W4 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Ri W4 without breaking a sweat

- Find Ri W4 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document versions. airSlate SignNow meets all your document management requirements in just a few clicks from your choice of device. Edit and eSign Ri W4 and ensure excellent communication at any point throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri w4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to be exempt on the W4 form?

Being exempt on the W4 form means you are not subject to federal income tax withholding. To claim this status, you must meet certain criteria, including not having a tax liability in the previous year and expecting none in the current year. It's essential to understand where to put exempt on W4 to ensure your employer processes your withholding correctly.

-

How can I fill out the W4 form to indicate my exempt status?

To fill out the W4 form to indicate your exempt status, you should write 'Exempt' in the appropriate box on line 7. Remember to leave the other fields blank or unfilled, as this will signal to your employer that you are claiming exemption. Knowing where to put exempt on W4 is crucial for ensuring your tax situation is handled properly.

-

What are the consequences of incorrectly claiming exempt on W4?

Incorrectly claiming exempt on your W4 can lead to tax liabilities at the end of the year, as you may owe back taxes if too little is withheld. If you accidentally claim exempt but do not qualify, the IRS can impose penalties. Thus, it's important to accurately know where to put exempt on W4 to avoid mistakes.

-

Can I change my W4 exemptions during the year?

Yes, you can change your W4 exemptions at any time during the year by submitting a new W4 form to your employer. If your financial situation changes or if you no longer qualify for exempt status, it's advisable to update your W4. Make sure to indicate clearly where to put exempt on W4 if applicable.

-

Is there a cost associated with using airSlate SignNow for W4 submission?

airSlate SignNow offers cost-effective solutions for document signing, including W4 submissions. Prices vary based on the plan you choose, but they provide excellent value for businesses looking to streamline their document processing. Using airSlate SignNow can simplify where to put exempt on W4 with ease of digital signing.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers features such as templates, team collaboration, and automated workflows to manage documents efficiently. These tools make it easier to handle forms like the W4, ensuring all necessary fields are filled out, including where to put exempt on W4. It's designed for user-friendly and effective document handling.

-

Can airSlate SignNow integrate with other software for payroll processing?

Yes, airSlate SignNow seamlessly integrates with a variety of payroll and HR software, making it easier to manage your documents, including W4 forms. These integrations help ensure that all data is consistent and correctly processed, including where to put exempt on W4 in related applications. This can save time and reduce errors.

Get more for Ri W4

- Control number ut p062 pkg form

- Control number ut p064 pkg form

- Control number ut p066 pkg form

- Control number ut p067 pkg form

- Utah option to purchase forms and faqus legal forms

- Lease agreement with option for purchase utah form

- Take an annual financial check up townebank form

- Control number ut p077 pkg form

Find out other Ri W4

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now