Form 17 Nebraska 1998

What is the Form 17 Nebraska

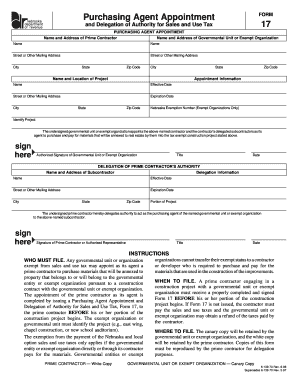

The Form 17 Nebraska is a state tax form used by individuals and businesses in Nebraska to report specific financial information to the Nebraska Department of Revenue. This form is primarily associated with income tax filings, allowing taxpayers to declare their income, deductions, and credits for the tax year. Understanding the purpose of this form is essential for ensuring compliance with state tax regulations and accurately reporting financial information.

How to use the Form 17 Nebraska

To effectively use the Form 17 Nebraska, taxpayers must first gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. The form requires detailed information about income sources, deductions, and credits. It is crucial to fill out the form accurately, as errors can lead to delays in processing or potential penalties. Once completed, the form can be submitted either electronically or via mail, depending on the taxpayer's preference.

Steps to complete the Form 17 Nebraska

Completing the Form 17 Nebraska involves several key steps:

- Gather all necessary financial documents, including income statements and deduction records.

- Carefully read the instructions accompanying the form to understand the requirements.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the completed form either electronically through the Nebraska Department of Revenue website or by mailing it to the appropriate address.

Legal use of the Form 17 Nebraska

The Form 17 Nebraska is legally binding when filled out correctly and submitted according to state regulations. It is essential for taxpayers to comply with all relevant laws and guidelines to avoid potential legal issues. The form must be signed and dated by the taxpayer to validate the information provided. Additionally, maintaining copies of submitted forms and supporting documents is advisable for record-keeping and future reference.

Filing Deadlines / Important Dates

Filing deadlines for the Form 17 Nebraska typically align with federal tax deadlines. Generally, individual taxpayers must submit their forms by April 15 of the following tax year. If this date falls on a weekend or holiday, the deadline may be extended. It is important for taxpayers to stay informed about any changes to deadlines or additional extensions that may be granted by the Nebraska Department of Revenue.

Required Documents

When completing the Form 17 Nebraska, taxpayers must have several documents on hand to ensure accurate reporting. Required documents include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as receipts for charitable contributions or medical expenses

- Any relevant tax credit information

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Form 17 Nebraska. The form can be filed online through the Nebraska Department of Revenue's website, which often provides a faster processing time. Alternatively, taxpayers may choose to mail the completed form to the designated address provided in the instructions. In-person submissions are generally not available, making online and mail options the primary methods for filing.

Quick guide on how to complete form 17 nebraska 38397984

Accomplish Form 17 Nebraska seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents quickly and without complications. Manage Form 17 Nebraska on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

The easiest way to modify and electronically sign Form 17 Nebraska effortlessly

- Find Form 17 Nebraska and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important areas of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to store your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, dull form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 17 Nebraska and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 17 nebraska 38397984

Create this form in 5 minutes!

How to create an eSignature for the form 17 nebraska 38397984

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 17 Nebraska, and why is it important?

The form 17 Nebraska is an essential document used for various legal and administrative purposes in the state. It serves as a declaration of intent or decision related to property or business transactions, making it important for transparency and legal compliance.

-

How does airSlate SignNow assist with completing the form 17 Nebraska?

airSlate SignNow simplifies the process of completing the form 17 Nebraska by providing an intuitive interface for document preparation and e-signatures. Users can easily fill out the form online, ensuring quick processing and secure submission.

-

What are the pricing options for using airSlate SignNow with form 17 Nebraska?

airSlate SignNow offers flexible pricing plans that cater to different business needs, ensuring you can efficiently manage your form 17 Nebraska submissions. Pricing is competitive, and you can choose from monthly or annual plans based on your usage requirements.

-

Can I integrate airSlate SignNow with other software for managing the form 17 Nebraska?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your ability to manage the form 17 Nebraska alongside your existing workflows. This compatibility allows for seamless document management across platforms, improving efficiency.

-

What features does airSlate SignNow provide for electronic signatures on the form 17 Nebraska?

airSlate SignNow includes advanced features such as multiple signature options, customizable templates, and secure document storage, all crucial for electronically signing the form 17 Nebraska. These features enhance the signing experience and ensure compliance with legal standards.

-

Are there any benefits of using airSlate SignNow for form 17 Nebraska compared to traditional methods?

Using airSlate SignNow for the form 17 Nebraska provides numerous benefits, including reduced paper waste, faster turnaround times, and enhanced security. This digital approach streamlines the signing process, making it more efficient than traditional methods.

-

Is it safe to submit form 17 Nebraska electronically through airSlate SignNow?

Yes, submitting the form 17 Nebraska through airSlate SignNow is secure, as the platform uses robust encryption and compliance measures to protect your data. Trust in the platform’s security features ensures your sensitive information remains confidential.

Get more for Form 17 Nebraska

- And two individuals as joint tenants with rights form

- Guarantee of actions of warranty against all former proprietors of the property herein conveyed together

- Deliver and warrant with full guarantee of actions of warranty against all former proprietors of the

- And husband and wife whose address is form

- Whose address is hereinafter referred form

- To as vendor does hereby quitclaim give grant sell convey and deliver unto form

- Whose address is hereinafter referred to as vendors do hereby quitclaim form

- Whose address is hereinafter referred to as vendors do hereby grant form

Find out other Form 17 Nebraska

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF