Form 593 V

What is the Form 593 V

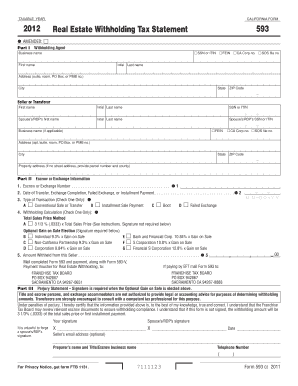

The Form 593 V is a California tax form used primarily for reporting the sale of real property in the state. This form is essential for both buyers and sellers, as it helps to ensure compliance with California tax laws. The form serves as a declaration of the withholding amount, which is a percentage of the sale price that must be withheld for state taxes. Understanding the purpose and requirements of the Form 593 V is crucial for anyone involved in real estate transactions in California.

How to use the Form 593 V

Using the Form 593 V involves several key steps to ensure proper completion and submission. First, determine if the form is required for your transaction. If applicable, gather the necessary information, including details about the property, the buyer, and the seller. Next, accurately fill out the form, ensuring that all required fields are completed. Once the form is filled out, it must be submitted to the California Franchise Tax Board along with any applicable payments. Proper use of the Form 593 V helps avoid penalties and ensures compliance with state tax regulations.

Steps to complete the Form 593 V

Completing the Form 593 V involves a series of straightforward steps:

- Gather relevant information about the property, including the sale price and property address.

- Identify the buyer and seller, including their contact information and tax identification numbers.

- Fill in the withholding amount, which is typically a percentage of the sale price.

- Review the form for accuracy, ensuring all required fields are completed.

- Submit the completed form to the California Franchise Tax Board, either online or by mail.

Following these steps carefully will help ensure that the Form 593 V is completed correctly and submitted on time.

Legal use of the Form 593 V

The legal use of the Form 593 V is governed by California tax laws, which require that withholding occurs on the sale of real property. This form must be used to report the withholding amount to the California Franchise Tax Board. Failure to comply with these legal requirements can result in penalties and interest on unpaid taxes. It is important for both buyers and sellers to understand their responsibilities regarding this form to avoid any legal complications.

Filing Deadlines / Important Dates

Timely filing of the Form 593 V is crucial for compliance with California tax regulations. The form must be submitted at the time of the property sale or within a specific timeframe set by the California Franchise Tax Board. Typically, the withholding amount must be paid at the time of filing the form. It is essential to be aware of any changes in deadlines or requirements, especially during tax season, to avoid penalties.

Required Documents

To complete the Form 593 V, certain documents are required. These include:

- Details of the property being sold, including the sale price and address.

- Identification numbers for both the buyer and seller, such as Social Security numbers or Employer Identification Numbers.

- Any previous tax documents related to the property that may impact withholding requirements.

Having these documents ready will streamline the process of completing and submitting the Form 593 V.

Quick guide on how to complete form 593 v

Complete Form 593 V effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Form 593 V on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 593 V with ease

- Obtain Form 593 V and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your edits.

- Select your preferred method to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 593 V and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 593 v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 593v in relation to airSlate SignNow?

The term '593v' refers to the unique identifier for a specific feature set in the airSlate SignNow platform. This feature includes tools designed to streamline document management and eSignature processes for businesses. Understanding how to leverage 593v can improve your operational efficiency signNowly.

-

How does airSlate SignNow pricing work with 593v features?

airSlate SignNow offers flexible pricing plans that include access to the essential '593v' features. Depending on your business needs, you can choose between different tiers that allow for a varying number of users and document transactions. This ensures that you find a cost-effective solution tailored to your needs.

-

What are the key benefits of using airSlate SignNow 593v?

The '593v' features of airSlate SignNow provide several benefits including enhanced security for your documents, real-time tracking of signed agreements, and customization options for eSignatures. These benefits empower businesses to operate more efficiently and maintain compliance with industry regulations.

-

Can I integrate 593v features with other applications?

Yes, airSlate SignNow allows the integration of '593v' features with various applications such as Salesforce, Google Drive, and more. This capability enhances your workflow by allowing seamless data transfer between platforms. Utilizing integrations with '593v' can further optimize your document management processes.

-

Is airSlate SignNow user-friendly for those unfamiliar with 593v functionalities?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, regardless of your familiarity with '593v' functionalities. The interface is intuitive, and there are numerous resources available including tutorials and customer support to help you navigate all the tools effectively.

-

What types of documents can I send using 593v features?

With airSlate SignNow's '593v' features, you can send a wide variety of documents, including contracts, forms, and agreements. This versatility is essential for businesses that require different document types for various purposes. The platform supports all standard document formats making it convenient to use.

-

How secure is airSlate SignNow while using 593v features?

Security is a top priority at airSlate SignNow, especially with the '593v' features. The platform employs advanced encryption protocols to protect your documents and sensitive information. This commitment to security means you can send and store documents with peace of mind.

Get more for Form 593 V

- A motion has been made to dismiss the petition by form

- Dispositional form

- Waiver of stayed delinquency form

- Reforming juvenile justice a developmental approach

- In re the termination of parental rights to diana p form

- Madison school district sued after denying anonymous form

- Conditions and sanctions form

- To the juvenile form

Find out other Form 593 V

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure