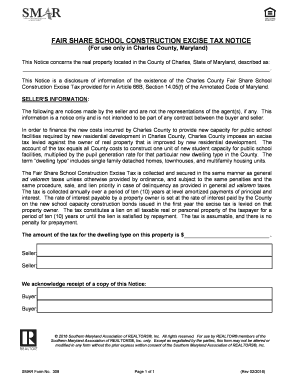

Charles County School Excise Tax Form

What is the Charles County School Excise Tax

The Charles County School Excise Tax is a fee imposed on new residential developments within Charles County, Maryland. This tax is designed to generate revenue for funding public school construction and improvements. The tax is calculated based on the number of residential units being built and is intended to ensure that new developments contribute to the educational infrastructure that supports the growing population. Understanding this tax is essential for developers, builders, and homeowners to navigate the financial responsibilities associated with new construction projects.

Steps to complete the Charles County School Excise Tax

Completing the Charles County School Excise Tax involves several key steps:

- Determine the number of residential units being constructed.

- Calculate the total excise tax based on the current rate set by the county.

- Fill out the necessary forms provided by the Charles County government.

- Submit the completed forms along with payment to the appropriate county office.

- Keep a copy of the submitted forms and payment receipt for your records.

Following these steps ensures compliance with local regulations and contributes to the funding of essential educational facilities.

Legal use of the Charles County School Excise Tax

The legal framework governing the Charles County School Excise Tax is established by local laws and regulations. This tax must be applied consistently to all qualifying residential developments, ensuring fairness and transparency. Developers are required to adhere to the guidelines set forth by the Charles County government, which include timely payment and accurate reporting of residential units. Non-compliance with these regulations can result in penalties and delays in project approvals.

Required Documents

To successfully complete the Charles County School Excise Tax process, several documents are typically required:

- Completed excise tax application form.

- Detailed project plans outlining the number of residential units.

- Proof of payment for the excise tax.

- Any additional documentation as specified by the county regulations.

Having these documents ready can streamline the application process and help avoid potential delays.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Charles County School Excise Tax. These deadlines can vary based on project timelines and local regulations. Typically, developers must submit their excise tax forms and payments before the commencement of construction. Staying informed about these dates helps ensure compliance and prevents any financial penalties.

Who Issues the Form

The Charles County government is responsible for issuing the forms related to the School Excise Tax. The relevant department typically handles applications, payments, and compliance checks. Developers should contact the local government office for the most current forms and guidelines, ensuring that they are using the correct documentation for their projects.

Quick guide on how to complete charles county school excise tax

Complete Charles County School Excise Tax effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Charles County School Excise Tax on any device using the airSlate SignNow applications for Android or iOS and enhance any document-oriented process today.

How to alter and eSign Charles County School Excise Tax with ease

- Obtain Charles County School Excise Tax and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and eSign Charles County School Excise Tax to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the charles county school excise tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Charles County school excise tax?

The Charles County school excise tax is a fee imposed on new development to fund educational infrastructure. This tax ensures that the local schools can accommodate the growing number of students due to new residential areas. Understanding the specifics of this tax can help developers budget more effectively.

-

How is the Charles County school excise tax calculated?

The Charles County school excise tax is generally calculated based on the number of new residential units being constructed and their estimated impact on local schools. Each unit incurs a specific fee that contributes to funding educational facilities. It's important to consult local regulations for precise calculation methods.

-

Are there any exemptions for the Charles County school excise tax?

Certain projects may qualify for exemptions or reductions of the Charles County school excise tax, such as affordable housing initiatives. Developers should check with local authorities to see if their project meets the criteria for any available exemptions. Doing so can result in signNow cost savings during the development process.

-

How does the Charles County school excise tax benefit local schools?

The revenue generated from the Charles County school excise tax is allocated directly to improving local educational facilities. This support helps fund new classrooms, infrastructure upgrades, and resources for students. Ultimately, the tax plays a crucial role in enhancing the quality of education in the area.

-

What documents are needed to assess the Charles County school excise tax?

To assess the Charles County school excise tax, developers typically need to provide site plans, building permits, and other development-related documents. These records help local authorities determine the applicable tax based on the project's details. Ensuring all documentation is accurate is key to a smooth assessment process.

-

Is the Charles County school excise tax refundable?

In most cases, the Charles County school excise tax is non-refundable once it has been paid. However, there may be specific circumstances, such as project cancellations, where refunds could be considered. Developers should discuss potential refund options with local officials.

-

How does the Charles County school excise tax affect homebuyers?

The Charles County school excise tax can indirectly impact homebuyers, as developers may pass the cost onto them through higher home prices. Understanding this tax can help buyers negotiate better deals or make informed decisions about new developments. Knowledge of the excise tax is advantageous for any prospective homebuyer.

Get more for Charles County School Excise Tax

- 14 72a 14 71 form

- Gs 15a 304 page 115a 304 warrant for arrest a form

- In the county named above you unlawfully and willfully did threaten to physically injure the person and form

- Felonious financial form

- State of north carolina indictment form

- Criminal summons misdemeanor assault north justia form

- Full text of ampquotcases on constitutional law with notesampquot form

- First degree statutory rape form

Find out other Charles County School Excise Tax

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation