Nys Form Ct 4 for Year Fill in Form

What is the Nys Form Ct 4 For Year Fill In Form

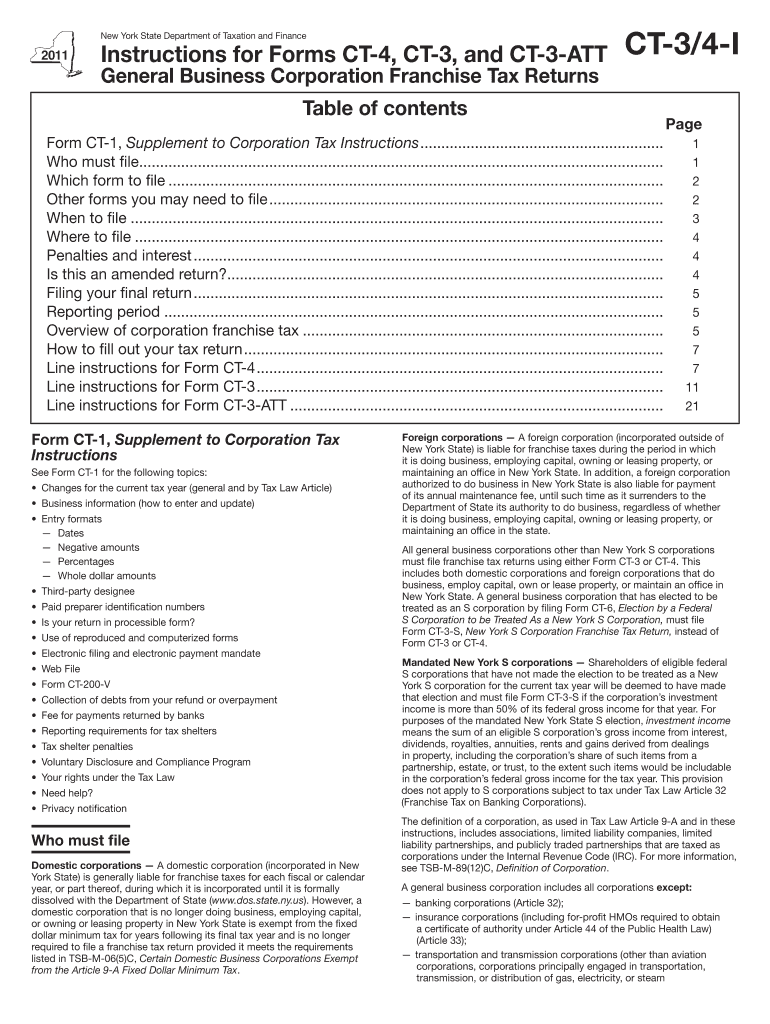

The Nys Form Ct 4 for year fill in form is a crucial document used in New York State for tax purposes. This form is typically utilized by businesses to report certain financial information to the state. It provides a structured way for entities to disclose their income, deductions, and other relevant financial data. Understanding the purpose of this form is essential for compliance with state tax regulations.

How to use the Nys Form Ct 4 For Year Fill In Form

Using the Nys Form Ct 4 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form by entering the required information in the designated fields. It is important to double-check all entries for accuracy. Once completed, the form can be submitted electronically or via traditional mail, depending on the preferences of the filing entity.

Steps to complete the Nys Form Ct 4 For Year Fill In Form

Completing the Nys Form Ct 4 requires careful attention to detail. Here are the steps to follow:

- Begin by downloading the form from an official source.

- Fill in your business name, address, and identification number at the top of the form.

- Enter your total income and any deductions in the appropriate sections.

- Review the calculations to ensure accuracy.

- Sign and date the form before submission.

Legal use of the Nys Form Ct 4 For Year Fill In Form

The Nys Form Ct 4 is legally binding when completed and submitted according to state regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or legal issues. Compliance with the relevant tax laws is critical for maintaining good standing with the state authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Nys Form Ct 4 can vary based on the type of business entity and the specific tax year. Typically, businesses must submit this form by the end of the tax year or within a designated period following the end of the fiscal year. It is important to stay informed about these deadlines to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Nys Form Ct 4 can be submitted through various methods. Businesses have the option to file online using approved electronic filing systems, which can streamline the process. Alternatively, the form may be printed and mailed to the appropriate state office. Some businesses may also choose to submit the form in person, depending on their preferences and the requirements of the state.

Quick guide on how to complete nys form ct 4 for year fill in form

Complete Nys Form Ct 4 For Year Fill In Form effortlessly on any device

Digital document management has become increasingly prevalent among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Nys Form Ct 4 For Year Fill In Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Nys Form Ct 4 For Year Fill In Form with ease

- Find Nys Form Ct 4 For Year Fill In Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Nys Form Ct 4 For Year Fill In Form and ensure outstanding communication at every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys form ct 4 for year fill in form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nys Form Ct 4 For Year Fill In Form?

The Nys Form Ct 4 For Year Fill In Form is a document used for corporate tax purposes in New York State. It facilitates the reporting of income and taxes owed by corporations. Understanding this form is crucial for ensuring compliance and accurate tax filing.

-

How can airSlate SignNow help with Nys Form Ct 4 For Year Fill In Form?

airSlate SignNow provides a user-friendly platform that allows you to fill in, sign, and send the Nys Form Ct 4 For Year Fill In Form electronically. The solution streamlines the process, ensuring your documents are always securely stored and easily accessible. This efficiency helps businesses save time during tax season.

-

Is there a cost associated with using airSlate SignNow for the Nys Form Ct 4 For Year Fill In Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. The cost-effective solution includes features specifically designed to simplify paperwork, including the Nys Form Ct 4 For Year Fill In Form. Check the pricing page for the most current options and benefits.

-

What features are available for handling the Nys Form Ct 4 For Year Fill In Form?

With airSlate SignNow, you can easily fill in, eSign, and manage the Nys Form Ct 4 For Year Fill In Form. Key features include document templates, real-time collaboration, and automated reminders for critical deadlines. These tools enhance the experience of managing corporate tax documents.

-

Can I integrate airSlate SignNow with other software for the Nys Form Ct 4 For Year Fill In Form?

Absolutely! airSlate SignNow offers integrations with popular software like Google Workspace, Microsoft Office, and CRM systems. This ensures a seamless flow of information when handling the Nys Form Ct 4 For Year Fill In Form and enhances overall productivity.

-

What are the benefits of using airSlate SignNow for tax documents like the Nys Form Ct 4 For Year Fill In Form?

Using airSlate SignNow for documents like the Nys Form Ct 4 For Year Fill In Form offers several advantages, including increased efficiency, enhanced security, and improved accessibility. The platform reduces the risk of errors and streamlines communication among stakeholders involved in the signing process.

-

How secure is my information when using airSlate SignNow for the Nys Form Ct 4 For Year Fill In Form?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and secure data storage protocols to ensure your information, including the Nys Form Ct 4 For Year Fill In Form, is kept confidential and protected from unauthorized access.

Get more for Nys Form Ct 4 For Year Fill In Form

Find out other Nys Form Ct 4 For Year Fill In Form

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form