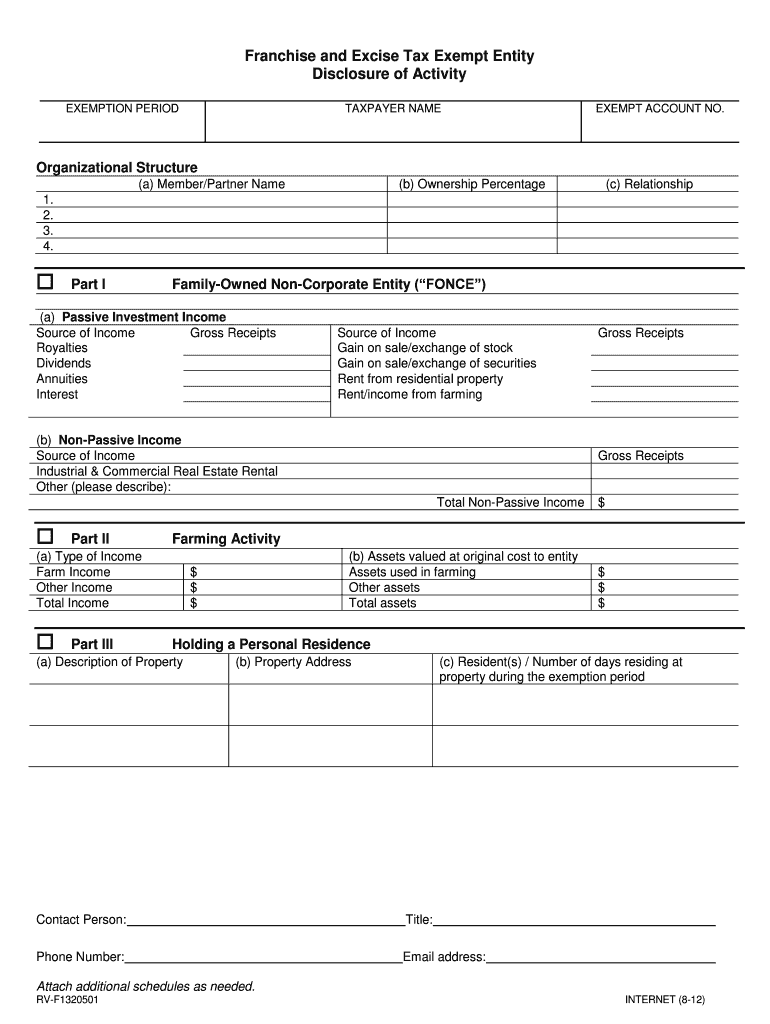

Franchise and Excise Tax Exempt Entity Disclosure of Activity Form 2012

What is the Franchise and Excise Tax Exempt Entity Disclosure of Activity Form

The Franchise and Excise Tax Exempt Entity Disclosure of Activity Form is a specific document used by exempt entities to report their activities related to franchise and excise taxes. This form is essential for organizations that qualify for tax exemptions under state laws. It ensures compliance with state regulations while providing transparency regarding the entity's operations. The form typically includes sections for detailing the nature of the entity's activities, financial information, and any relevant tax exemption claims.

Steps to Complete the Franchise and Excise Tax Exempt Entity Disclosure of Activity Form

Completing the Franchise and Excise Tax Exempt Entity Disclosure of Activity Form involves several important steps:

- Gather necessary information, including the entity's legal name, address, and tax identification number.

- Detail the nature of the activities conducted by the entity, ensuring all relevant information is included.

- Provide financial data as required, including income and expenses related to the exempt activities.

- Review the form for accuracy and completeness before submission.

- Sign the form electronically or by hand as required by your state regulations.

How to Use the Franchise and Excise Tax Exempt Entity Disclosure of Activity Form

Using the Franchise and Excise Tax Exempt Entity Disclosure of Activity Form requires careful attention to detail. Begin by filling out the form with accurate information regarding the entity’s activities. Be sure to follow the instructions provided for each section, as they guide you in reporting the necessary details. After completing the form, verify that all information is correct and that the form is signed appropriately. This ensures that the submission is valid and meets state requirements.

Legal Use of the Franchise and Excise Tax Exempt Entity Disclosure of Activity Form

The legal use of the Franchise and Excise Tax Exempt Entity Disclosure of Activity Form is crucial for maintaining compliance with state tax laws. Exempt entities must submit this form to demonstrate their eligibility for tax exemptions and to report their activities accurately. Failure to use the form correctly can lead to penalties, including loss of tax-exempt status or fines. It is important to adhere to all legal guidelines when completing and submitting this form.

Filing Deadlines / Important Dates

Filing deadlines for the Franchise and Excise Tax Exempt Entity Disclosure of Activity Form can vary by state. Typically, the form must be submitted annually, often aligned with the entity's fiscal year-end. It is essential to check specific state regulations for exact deadlines to avoid late submissions, which could result in penalties or loss of tax-exempt status. Keeping track of these important dates ensures compliance and smooth operation for the exempt entity.

Required Documents

When completing the Franchise and Excise Tax Exempt Entity Disclosure of Activity Form, certain documents may be required for submission. Commonly needed documents include:

- Proof of tax-exempt status, such as IRS determination letters.

- Financial statements that detail income and expenditures.

- Any additional documentation that supports the entity's claims of exemption.

Having these documents ready can facilitate a smoother filing process and ensure all necessary information is provided.

Quick guide on how to complete franchise and excise tax exempt entity disclosure of activity 2012 form

Your assistance manual for preparing your Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form

If you're seeking information on how to create and submit your Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form, here are some concise guidelines on how to facilitate tax processing.

To start, simply register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, draft, and complete your tax forms with ease. With its editor, you can alternate between text, check boxes, and eSignatures, returning to edit information as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form in just a few minutes:

- Create your account and begin working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; explore versions and schedules.

- Click Get form to open your Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form in our editor.

- Fill in the required fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save modifications, print your copy, submit it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting in written form can lead to return errors and delay refunds. Of course, before electronically filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct franchise and excise tax exempt entity disclosure of activity 2012 form

FAQs

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the franchise and excise tax exempt entity disclosure of activity 2012 form

How to make an eSignature for your Franchise And Excise Tax Exempt Entity Disclosure Of Activity 2012 Form in the online mode

How to create an electronic signature for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity 2012 Form in Google Chrome

How to generate an electronic signature for putting it on the Franchise And Excise Tax Exempt Entity Disclosure Of Activity 2012 Form in Gmail

How to create an electronic signature for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity 2012 Form straight from your mobile device

How to make an eSignature for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity 2012 Form on iOS

How to create an eSignature for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity 2012 Form on Android devices

People also ask

-

What is the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form?

The Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form is a crucial document required by certain entities to report their activities related to franchise and excise taxes. This form must be completed accurately to ensure compliance with state tax regulations, allowing tax-exempt entities to maintain their privileges.

-

How can airSlate SignNow help with the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form?

airSlate SignNow simplifies the process of filling out and signing the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form. Our platform provides easy-to-use templates and tools that streamline document management, ensuring that your forms are completed correctly and filed on time.

-

Is there a cost associated with using airSlate SignNow for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our cost-effective solution ensures that you can manage and eSign your Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form without breaking the bank, allowing you to focus on your business.

-

What features does airSlate SignNow offer for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form?

airSlate SignNow offers essential features such as customizable templates, secure eSigning, document tracking, and cloud storage for your Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form. These features enhance efficiency and ensure that your documents are organized and accessible at all times.

-

Are there any integrations available with airSlate SignNow for the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form?

Absolutely! airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Salesforce, and Microsoft Teams. This allows you to manage your Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form alongside other essential tools, streamlining your workflow.

-

How secure is the airSlate SignNow platform for handling the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your data and documents, including the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form, ensuring that your sensitive information remains confidential.

-

Can multiple users collaborate on the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form in real-time. This collaborative feature helps teams work more efficiently and keeps everyone informed, leading to faster completion and submission of necessary documentation.

Get more for Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form

- Histopathology requisition form

- Lgbt position paper final pages vineyard usa vineyardusa form

- Youth football and cheerleading sponsorship form

- Utility cost and usage history form 311 pdf

- Calnet application form

- Form it 2106 estimated income tax payment voucher for fiduciaries tax year

- Sale of land agreement template form

- Sale of land in installments agreement template form

Find out other Franchise And Excise Tax Exempt Entity Disclosure Of Activity Form

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement