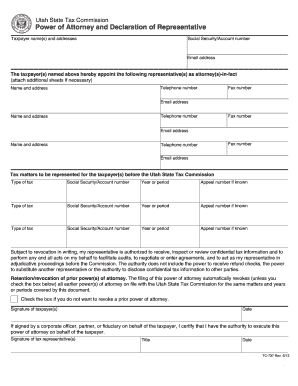

Tc 737 Form

What is the TC 941E?

The TC 941E is a specific tax form utilized by businesses in the United States to report various tax-related information. This form is essential for ensuring compliance with federal tax regulations and is often required for specific tax filings. Understanding its purpose and the information it collects is crucial for accurate reporting and avoiding potential penalties.

How to Use the TC 941E

Using the TC 941E involves several key steps. First, gather all necessary financial documentation, including income statements and expense records. Next, complete the form by accurately entering the required information, ensuring that all figures are correct to prevent discrepancies. After filling out the form, review it thoroughly for any errors before submission. Finally, submit the completed TC 941E according to the specified guidelines, either online or by mail.

Steps to Complete the TC 941E

Completing the TC 941E requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents.

- Fill in your business information, including name and tax identification number.

- Report your income and any deductions accurately.

- Double-check all entries for accuracy.

- Sign and date the form as required.

Ensuring that each step is followed diligently will help in the successful completion of the TC 941E.

Legal Use of the TC 941E

The TC 941E is legally binding when completed and submitted according to IRS regulations. It is important to ensure that the information provided is truthful and accurate, as false reporting can lead to significant penalties. The form must comply with all applicable federal tax laws, and businesses should retain copies for their records to support their filings in case of audits.

Filing Deadlines / Important Dates

Filing deadlines for the TC 941E are critical to avoid penalties. Typically, the form must be submitted quarterly, with specific due dates depending on the tax year. Businesses should mark their calendars for these important dates to ensure timely submissions. Missing a deadline can result in fines and interest on unpaid taxes, so staying informed is essential.

Who Issues the Form

The TC 941E is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and resources for businesses to ensure proper completion and submission of the form, supporting compliance with federal tax laws.

Quick guide on how to complete tc 737

Complete Tc 737 effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents quickly and without delays. Manage Tc 737 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign Tc 737 with ease

- Locate Tc 737 and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Tc 737 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 737

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tc 941e and how does it relate to airSlate SignNow?

The tc 941e is a specific tax form that businesses may need to manage and eSign. airSlate SignNow simplifies the process of handling forms like the tc 941e by providing an intuitive platform for sending, signing, and storing documents securely.

-

How much does airSlate SignNow cost for managing tc 941e forms?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to manage documents such as the tc 941e. With cost-effective solutions, users can choose a plan that best fits their needs, ensuring access to features that enhance document management.

-

Can I integrate airSlate SignNow with my existing software to handle tc 941e?

Yes, airSlate SignNow offers seamless integrations with various software platforms to manage tc 941e and other documents efficiently. Users can connect their existing systems to streamline workflows and enhance productivity.

-

What features does airSlate SignNow offer for managing documents like tc 941e?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure eSigning capabilities tailored for tc 941e management. These features ensure that users can efficiently create, send, and track their documents with ease.

-

What are the benefits of using airSlate SignNow for tc 941e?

Using airSlate SignNow for tc 941e offers numerous benefits, including increased efficiency in document handling and enhanced security measures for sensitive information. The platform's user-friendly interface also provides a smooth experience for signing and managing forms.

-

Is airSlate SignNow secure for handling sensitive documents like tc 941e?

Absolutely! airSlate SignNow employs advanced security measures to ensure that documents, including the tc 941e, are handled safely. This includes encryption, secure cloud storage, and compliance with industry regulations to protect sensitive information.

-

How can I get started with airSlate SignNow for tc 941e forms?

Getting started with airSlate SignNow for managing tc 941e forms is simple. You can sign up for a free trial, explore the features, and start creating your documents immediately to see how the platform can meet your needs.

Get more for Tc 737

- Instruction to jury regarding damages for wrongful foreclosure form

- Trust bequest form

- Letter to foreclosure attorney general demand to stop foreclosure and reasons form

- Rent increase form

- Inspection notification form

- Personal guarantee format

- Letter to client request for admissions to answer form

- Utah notice of lease for recording form

Find out other Tc 737

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free