Marriott Tax Exempt Form

What is the Marriott Tax Exempt Form

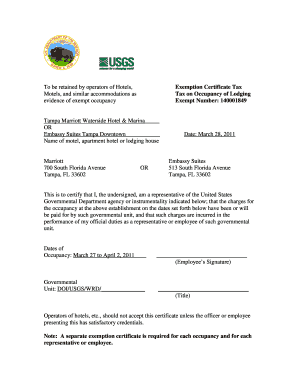

The Marriott Tax Exempt Form is a specific document that allows eligible organizations to claim tax exemption on lodging expenses at Marriott properties. This form is primarily used by government entities, non-profit organizations, and certain educational institutions that qualify under federal or state tax exemption laws. By submitting this form, these organizations can avoid paying sales tax on their accommodations, thus reducing overall travel costs.

How to use the Marriott Tax Exempt Form

Using the Marriott Tax Exempt Form involves a few straightforward steps. First, ensure that your organization qualifies for tax exemption under applicable laws. Next, complete the form with accurate information, including your organization’s name, address, and tax identification number. Once the form is filled out, present it at the time of check-in or when making a reservation to ensure that the tax exemption is applied to your stay.

Steps to complete the Marriott Tax Exempt Form

Completing the Marriott Tax Exempt Form requires careful attention to detail. Follow these steps:

- Gather necessary information, including your organization’s tax ID and contact details.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form to the hotel at the time of check-in or with your reservation.

Legal use of the Marriott Tax Exempt Form

The legal use of the Marriott Tax Exempt Form is governed by state and federal tax laws. To ensure compliance, organizations must verify their eligibility for tax exemption status. Misuse of the form can lead to penalties, including back taxes owed and potential legal repercussions. It is crucial to understand the specific tax exemption criteria applicable in your state to avoid any legal issues.

Eligibility Criteria

To qualify for the Marriott Tax Exempt Form, organizations generally need to meet specific criteria. Eligible entities typically include:

- Government agencies at the federal, state, or local level.

- Non-profit organizations recognized under section 501(c)(3) of the Internal Revenue Code.

- Educational institutions that are tax-exempt.

Each state may have additional requirements, so it is advisable to consult local tax regulations to confirm eligibility.

Form Submission Methods

The Marriott Tax Exempt Form can be submitted in various ways, depending on the hotel’s policies. Common submission methods include:

- Presenting the completed form in person at the hotel during check-in.

- Submitting the form electronically through the hotel’s reservation system, if available.

- Mailing the form to the hotel prior to arrival for pre-approval.

Always confirm with the specific Marriott location regarding their preferred submission method to ensure a smooth process.

Quick guide on how to complete marriott tax exempt form

Effortlessly Prepare Marriott Tax Exempt Form on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed forms, enabling you to find the correct template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Marriott Tax Exempt Form across any platform with airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

Edit and eSign Marriott Tax Exempt Form with Ease

- Find Marriott Tax Exempt Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Marriott Tax Exempt Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the marriott tax exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the marriott tax exempt form and how can I use it?

The marriott tax exempt form is a document used by eligible organizations to exempt certain transactions from sales tax when staying at Marriott properties. To use it, simply fill out the form and submit it to the hotel during check-in. This process can help your organization save on accommodation costs.

-

How does airSlate SignNow facilitate the signing of the marriott tax exempt form?

airSlate SignNow allows you to electronically sign the marriott tax exempt form quickly and securely. Our platform ensures that your documents are legally binding and can be easily shared with Marriott hotels without the hassle of printing or faxing. This streamlines the process for both you and the hotel.

-

Can I customize the marriott tax exempt form using airSlate SignNow?

Yes, airSlate SignNow offers customization options for the marriott tax exempt form. You can add your organization's logo, adjust the fields, and tailor the document to fit your needs. This flexibility ensures that your form reflects your brand and meets all requirements.

-

What are the cost implications of using airSlate SignNow for the marriott tax exempt form?

Using airSlate SignNow is a cost-effective solution for managing the marriott tax exempt form. Our pricing plans are designed to suit various business needs, ensuring that you can manage all your signing needs without exceeding your budget. Additionally, saving on tax can offset your investment in our services.

-

What features does airSlate SignNow offer for managing the marriott tax exempt form?

airSlate SignNow provides features like templates, reminders, and status tracking that can enhance your experience with the marriott tax exempt form. You can easily create, send, and track the completion of your forms, ensuring you never miss a deadline. These features help streamline your workflow.

-

Is it easy to integrate the marriott tax exempt form with other software using airSlate SignNow?

Absolutely! airSlate SignNow can seamlessly integrate with a variety of software solutions, making it easy to incorporate the marriott tax exempt form into your existing processes. Whether you use CRM systems or accounting software, our integrations simplify management and improve efficiency.

-

What benefits does my organization gain from using the marriott tax exempt form with airSlate SignNow?

Using the marriott tax exempt form with airSlate SignNow provides your organization with time savings, improved accuracy, and legal compliance. Electronic signatures reduce the turnaround time for document processing, while organized records ensure you maintain compliance for reporting purposes.

Get more for Marriott Tax Exempt Form

- Minnesota deed search form

- Minnesota legal last will and testament form for single person with adult children

- Minnesota last will testament form

- Mn widow form

- Missouri legal last will and testament form for single person with no children

- Missouri legal last will and testament form for divorced person not remarried with no children

- Missouri legal last will and testament form for divorced person not remarried with minor children

- Missouri legal last will and testament form for married person with adult children

Find out other Marriott Tax Exempt Form

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe