Self Employed Income Worksheet Form

What is the Self Employed Income Worksheet

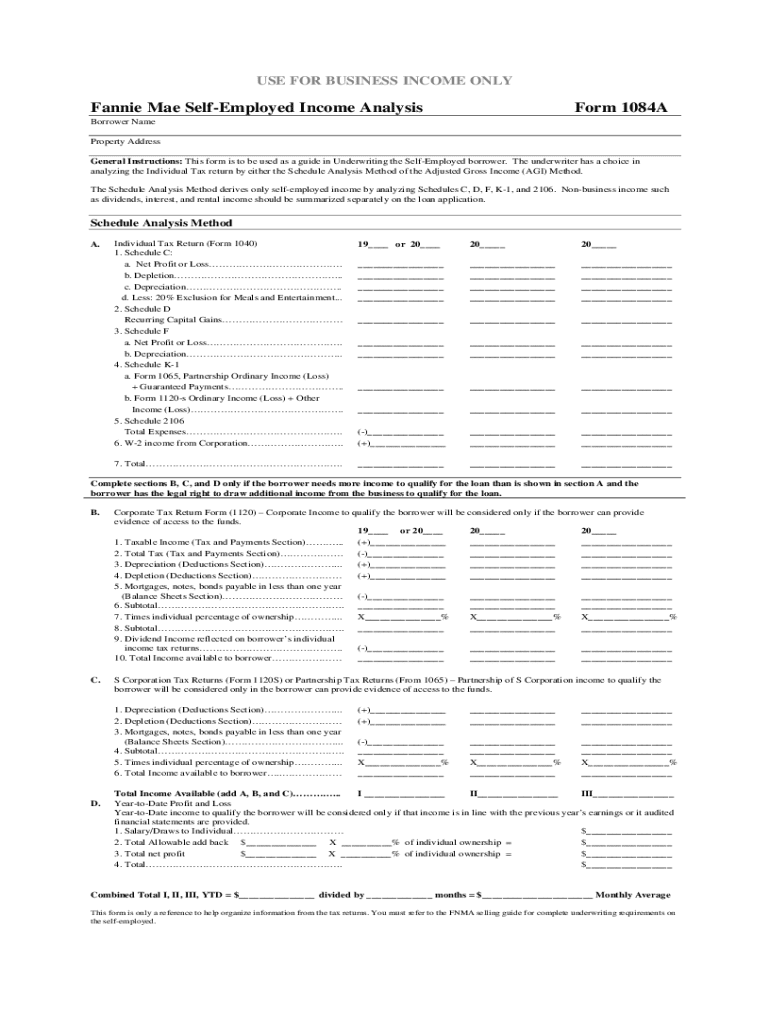

The Self Employed Income Worksheet is a crucial document used by individuals who operate their own businesses to calculate their income and expenses. This worksheet helps in determining net earnings, which is essential for tax reporting and financial planning. It typically includes sections for reporting gross income, deductible expenses, and any applicable credits. By accurately completing this form, self-employed individuals can ensure they are compliant with IRS regulations and can effectively manage their tax obligations.

How to use the Self Employed Income Worksheet

Using the Self Employed Income Worksheet involves several key steps. First, gather all relevant financial documents, including income statements, receipts for expenses, and any other supporting materials. Next, begin filling out the worksheet by entering your total gross income from all sources. Then, list your business expenses in the designated sections, ensuring to include only those that are necessary and ordinary for your business operations. Finally, calculate your net income by subtracting total expenses from gross income. This completed worksheet can then be used for tax filings or financial assessments.

Steps to complete the Self Employed Income Worksheet

Completing the Self Employed Income Worksheet can be broken down into manageable steps:

- Gather all necessary financial documents, including income statements and expense receipts.

- Enter your total gross income from all business activities in the appropriate section.

- List all deductible business expenses, categorizing them as needed.

- Calculate your total expenses and subtract this amount from your gross income to determine net income.

- Review the worksheet for accuracy before using it for tax purposes.

Key elements of the Self Employed Income Worksheet

The Self Employed Income Worksheet consists of several key elements that are essential for accurate reporting. These include:

- Gross Income: Total earnings before any deductions.

- Business Expenses: Costs incurred in the course of running the business, such as supplies, utilities, and wages.

- Net Income: The amount remaining after subtracting total expenses from gross income.

- Tax Deductions: Specific deductions that may apply based on business type and expenses.

Legal use of the Self Employed Income Worksheet

The Self Employed Income Worksheet is legally recognized by the IRS as a valid method for reporting income and expenses for self-employed individuals. It is important to ensure that all information entered is accurate and reflects true business activities. Misrepresentation or errors can lead to penalties or audits. Therefore, maintaining thorough records and using the worksheet correctly is vital for compliance with tax regulations.

Filing Deadlines / Important Dates

Self-employed individuals must be aware of specific filing deadlines related to the Self Employed Income Worksheet. Typically, the deadline for submitting tax returns is April fifteenth of each year. However, if you are unable to meet this deadline, you may request an extension, which usually allows for an additional six months. It is crucial to stay informed about these dates to avoid late fees and penalties.

Quick guide on how to complete self employed income analysis worksheet form

The simplest method to obtain and endorse Self Employed Income Worksheet

At the level of your entire organization, ineffective workflows around paper approval can take up a signNow amount of work hours. Endorsing documents such as Self Employed Income Worksheet is a customary aspect of operations in any enterprise, which is why the effectiveness of every contract’s lifecycle signNowly impacts the organization’s overall productivity. With airSlate SignNow, endorsing your Self Employed Income Worksheet can be as straightforward and rapid as possible. This platform provides you with the most recent version of nearly any document. Even better, you can endorse it immediately without needing to install external applications on your device or printing anything as hard copies.

Steps to obtain and endorse your Self Employed Income Worksheet

- Browse our repository by category or utilize the search bar to find the document you require.

- Check the document preview by clicking Learn more to confirm it’s the correct one.

- Press Get form to begin editing right away.

- Fill out your document and input any required information using the toolbar.

- Once finished, click the Sign tool to endorse your Self Employed Income Worksheet.

- Choose the signature method that suits you best: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to complete editing and move to document-sharing options as necessary.

With airSlate SignNow, you have everything you need to manage your documents efficiently. You can find, complete, edit, and even send your Self Employed Income Worksheet in one window with no trouble. Optimize your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What is the right way to fill out Two-Earners Worksheet tax form?

Wages, in this context, are what you expect to appear in box 1 of your W-2.The IRS recommends that the additional withholding be applied to the higher-paid spouse and that the lesser-paid spouse should simply claim zero withholding allowances, as this is usually more accurate (due to the way that withholding is actually calculated by payroll programs, you may wind up with less withheld than you want if you split it).

-

What form can I fill out as a self-employed individual to make my CPA’s job easier?

A QuickBooks Trial Balance and Detailed General Ledger - printed and in Excel format. Work with your CPA to create an appropriate chart of accounts for your business. And use a good bookkeeper to keep your books. If your books look good, the CPA will ask some question to gain comfort and then accept your numbers with little further investigation.Please do not bring a boxful of crumpled receipts. You will pay more for your CPA to uncrumple them and categorize them. If you are a really small business, a legal pad sheet categorizing your receipts. If your receipts are a mess, or your books a mess, your CPA needs to ask a lot more questions and spend a lot more time gaining comfort with your books. Bad books from a shady client means a lot of grief for the CPA and a lot more fees.

-

For the new 2018 W-4 form, do I also print out the separate A-H worksheet and fill that out for my employer?

No, an employee is not required to give the separate worksheet to the employer. Keep it for your own records.

-

What form should I fill out if I am a UK self-employed resident invoicing the EU company?

You question is unclear. Do you mean another company in the EU, or administration of the EU like the Parliament or the Commission.

-

How do you qualify for a mortgage if you are self-employed (I.e. have founded a startup)?

According to typically underwriting guidelines, you are considered to be self-employed if you own 25% or more of the company. If you own less than 25%, you may be able to qualify just using your salaried income. That being said, assuming you do own more than 25% of your company, you would be subject to additional underwriting criteria specific to self-employed borrowers:Business has been in operations for at least 2 years2 years of W2s and personal tax returns2 years of business tax returnThe underwriter will want to review your business tax returns to make sure that your business is no generating signNow cash flow losses. If you're like most start-ups, your business probably would show cash flow losses. The underwriter would likely deduct an average of cash flow losses from a 2 year average of your W2 income to determine your qualifying income regardless of the fact that you would not be personally responsible for those losses. In effect your qualifying income could be dramatically lower than your actual salary thus creating the difficulty with traditional loan qualification.Although a traditional mortgage might be an issue there are some additional possibilities that you might want to explore: Stated income loanBack before the housing crisis you probably would have been able to qualify with a stated income program but today those programs are hard to come by. There are a few lenders that offer stated income loans today but you would still need to be able to provide the business has been in operation for 2 years and would likely need a 20%-25% down payment. Asset-backed mortgageIf you have substantial assets in the form of liquid investments, you might be able to qualify for an asset-backed mortgage. Basically, your investment account would become additional collateral for the loan. Private mortgageYou might explore a private mortgage. A great place to start would be to ask your current investors in your company. They may be motivated to help you out or have resources that can help in our situation. Given they know your business prospects, they may be willing to structure a mortgage to help you out until your able to qualify for a traditional refinance loan.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

Create this form in 5 minutes!

How to create an eSignature for the self employed income analysis worksheet form

How to create an electronic signature for your Self Employed Income Analysis Worksheet Form online

How to create an electronic signature for the Self Employed Income Analysis Worksheet Form in Google Chrome

How to make an electronic signature for signing the Self Employed Income Analysis Worksheet Form in Gmail

How to create an eSignature for the Self Employed Income Analysis Worksheet Form right from your mobile device

How to create an eSignature for the Self Employed Income Analysis Worksheet Form on iOS

How to create an electronic signature for the Self Employed Income Analysis Worksheet Form on Android OS

People also ask

-

What is the essent self employed worksheet?

The essent self employed worksheet is a comprehensive tool designed for self-employed individuals to easily track income, expenses, and maintain accurate records for tax purposes. This worksheet simplifies the process of managing your financials, ensuring you stay organized and prepared during tax season.

-

How can the essent self employed worksheet benefit my business?

Using the essent self employed worksheet can signNowly streamline your financial management. By keeping your income and expenses organized, you can save time, avoid potential tax issues, and ultimately improve your profitability. It also helps you stay on top of your financial goals.

-

Is the essent self employed worksheet easy to use?

Yes, the essent self employed worksheet is designed for ease of use. With a straightforward layout and clear instructions, even those with limited financial experience can navigate it efficiently. This allows self-employed individuals to focus more on their business rather than cumbersome paperwork.

-

What features come with the essent self employed worksheet?

The essent self employed worksheet includes various features such as income tracking, expense categorization, and automated calculations to help you manage your finances effortlessly. Additionally, it often comes with templates that can be customized to fit your specific business needs.

-

What pricing options are available for the essent self employed worksheet?

Pricing for the essent self employed worksheet can vary depending on the platform or tool you choose to use. Many options offer free versions with essential features, while more advanced versions may charge a nominal fee for added functionality and support.

-

Can I integrate the essent self employed worksheet with other tools?

Yes, the essent self employed worksheet can often be integrated with various accounting and bookkeeping software. This allows for seamless data transfer and helps maintain accurate financial records across different platforms, enhancing your overall workflow.

-

Does the essent self employed worksheet assist with tax preparation?

Absolutely! The essent self employed worksheet organizes your financial data in a way that makes tax preparation easier. By having all your income and expenses documented, you can quickly assess what deductions you qualify for and streamline the filing process.

Get more for Self Employed Income Worksheet

Find out other Self Employed Income Worksheet

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo