Self Employed Income Worksheet Form

What is the Self Employed Income Worksheet

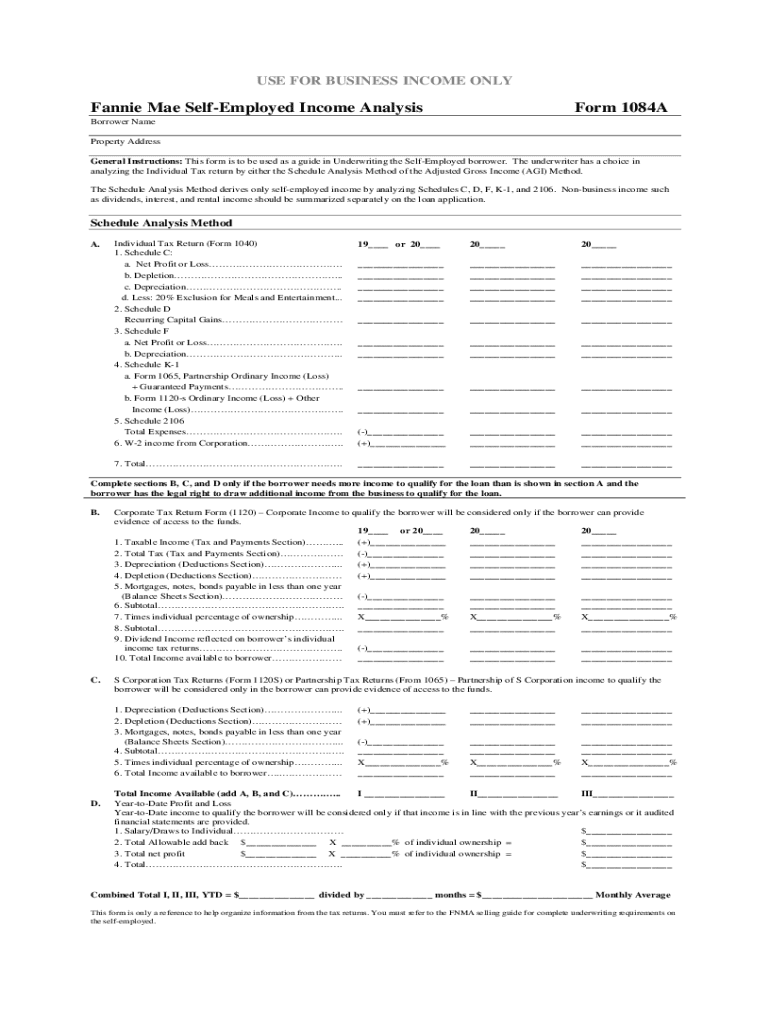

The Self Employed Income Worksheet is a crucial document used by individuals who operate their own businesses to calculate their income and expenses. This worksheet helps in determining net earnings, which is essential for tax reporting and financial planning. It typically includes sections for reporting gross income, deductible expenses, and any applicable credits. By accurately completing this form, self-employed individuals can ensure they are compliant with IRS regulations and can effectively manage their tax obligations.

How to use the Self Employed Income Worksheet

Using the Self Employed Income Worksheet involves several key steps. First, gather all relevant financial documents, including income statements, receipts for expenses, and any other supporting materials. Next, begin filling out the worksheet by entering your total gross income from all sources. Then, list your business expenses in the designated sections, ensuring to include only those that are necessary and ordinary for your business operations. Finally, calculate your net income by subtracting total expenses from gross income. This completed worksheet can then be used for tax filings or financial assessments.

Steps to complete the Self Employed Income Worksheet

Completing the Self Employed Income Worksheet can be broken down into manageable steps:

- Gather all necessary financial documents, including income statements and expense receipts.

- Enter your total gross income from all business activities in the appropriate section.

- List all deductible business expenses, categorizing them as needed.

- Calculate your total expenses and subtract this amount from your gross income to determine net income.

- Review the worksheet for accuracy before using it for tax purposes.

Key elements of the Self Employed Income Worksheet

The Self Employed Income Worksheet consists of several key elements that are essential for accurate reporting. These include:

- Gross Income: Total earnings before any deductions.

- Business Expenses: Costs incurred in the course of running the business, such as supplies, utilities, and wages.

- Net Income: The amount remaining after subtracting total expenses from gross income.

- Tax Deductions: Specific deductions that may apply based on business type and expenses.

Legal use of the Self Employed Income Worksheet

The Self Employed Income Worksheet is legally recognized by the IRS as a valid method for reporting income and expenses for self-employed individuals. It is important to ensure that all information entered is accurate and reflects true business activities. Misrepresentation or errors can lead to penalties or audits. Therefore, maintaining thorough records and using the worksheet correctly is vital for compliance with tax regulations.

Filing Deadlines / Important Dates

Self-employed individuals must be aware of specific filing deadlines related to the Self Employed Income Worksheet. Typically, the deadline for submitting tax returns is April fifteenth of each year. However, if you are unable to meet this deadline, you may request an extension, which usually allows for an additional six months. It is crucial to stay informed about these dates to avoid late fees and penalties.

Quick guide on how to complete self employed income analysis worksheet form

The simplest method to obtain and endorse Self Employed Income Worksheet

At the level of your entire organization, ineffective workflows around paper approval can take up a signNow amount of work hours. Endorsing documents such as Self Employed Income Worksheet is a customary aspect of operations in any enterprise, which is why the effectiveness of every contract’s lifecycle signNowly impacts the organization’s overall productivity. With airSlate SignNow, endorsing your Self Employed Income Worksheet can be as straightforward and rapid as possible. This platform provides you with the most recent version of nearly any document. Even better, you can endorse it immediately without needing to install external applications on your device or printing anything as hard copies.

Steps to obtain and endorse your Self Employed Income Worksheet

- Browse our repository by category or utilize the search bar to find the document you require.

- Check the document preview by clicking Learn more to confirm it’s the correct one.

- Press Get form to begin editing right away.

- Fill out your document and input any required information using the toolbar.

- Once finished, click the Sign tool to endorse your Self Employed Income Worksheet.

- Choose the signature method that suits you best: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to complete editing and move to document-sharing options as necessary.

With airSlate SignNow, you have everything you need to manage your documents efficiently. You can find, complete, edit, and even send your Self Employed Income Worksheet in one window with no trouble. Optimize your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What is the right way to fill out Two-Earners Worksheet tax form?

Wages, in this context, are what you expect to appear in box 1 of your W-2.The IRS recommends that the additional withholding be applied to the higher-paid spouse and that the lesser-paid spouse should simply claim zero withholding allowances, as this is usually more accurate (due to the way that withholding is actually calculated by payroll programs, you may wind up with less withheld than you want if you split it).

-

What form can I fill out as a self-employed individual to make my CPA’s job easier?

A QuickBooks Trial Balance and Detailed General Ledger - printed and in Excel format. Work with your CPA to create an appropriate chart of accounts for your business. And use a good bookkeeper to keep your books. If your books look good, the CPA will ask some question to gain comfort and then accept your numbers with little further investigation.Please do not bring a boxful of crumpled receipts. You will pay more for your CPA to uncrumple them and categorize them. If you are a really small business, a legal pad sheet categorizing your receipts. If your receipts are a mess, or your books a mess, your CPA needs to ask a lot more questions and spend a lot more time gaining comfort with your books. Bad books from a shady client means a lot of grief for the CPA and a lot more fees.

-

For the new 2018 W-4 form, do I also print out the separate A-H worksheet and fill that out for my employer?

No, an employee is not required to give the separate worksheet to the employer. Keep it for your own records.

-

What form should I fill out if I am a UK self-employed resident invoicing the EU company?

You question is unclear. Do you mean another company in the EU, or administration of the EU like the Parliament or the Commission.

-

How do you qualify for a mortgage if you are self-employed (I.e. have founded a startup)?

According to typically underwriting guidelines, you are considered to be self-employed if you own 25% or more of the company. If you own less than 25%, you may be able to qualify just using your salaried income. That being said, assuming you do own more than 25% of your company, you would be subject to additional underwriting criteria specific to self-employed borrowers:Business has been in operations for at least 2 years2 years of W2s and personal tax returns2 years of business tax returnThe underwriter will want to review your business tax returns to make sure that your business is no generating signNow cash flow losses. If you're like most start-ups, your business probably would show cash flow losses. The underwriter would likely deduct an average of cash flow losses from a 2 year average of your W2 income to determine your qualifying income regardless of the fact that you would not be personally responsible for those losses. In effect your qualifying income could be dramatically lower than your actual salary thus creating the difficulty with traditional loan qualification.Although a traditional mortgage might be an issue there are some additional possibilities that you might want to explore: Stated income loanBack before the housing crisis you probably would have been able to qualify with a stated income program but today those programs are hard to come by. There are a few lenders that offer stated income loans today but you would still need to be able to provide the business has been in operation for 2 years and would likely need a 20%-25% down payment. Asset-backed mortgageIf you have substantial assets in the form of liquid investments, you might be able to qualify for an asset-backed mortgage. Basically, your investment account would become additional collateral for the loan. Private mortgageYou might explore a private mortgage. A great place to start would be to ask your current investors in your company. They may be motivated to help you out or have resources that can help in our situation. Given they know your business prospects, they may be willing to structure a mortgage to help you out until your able to qualify for a traditional refinance loan.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

Create this form in 5 minutes!

How to create an eSignature for the self employed income analysis worksheet form

How to create an electronic signature for your Self Employed Income Analysis Worksheet Form online

How to create an electronic signature for the Self Employed Income Analysis Worksheet Form in Google Chrome

How to make an electronic signature for signing the Self Employed Income Analysis Worksheet Form in Gmail

How to create an eSignature for the Self Employed Income Analysis Worksheet Form right from your mobile device

How to create an eSignature for the Self Employed Income Analysis Worksheet Form on iOS

How to create an electronic signature for the Self Employed Income Analysis Worksheet Form on Android OS

People also ask

-

What is a Self Employed Income Worksheet and how can it help me?

A Self Employed Income Worksheet is a tool designed to help freelancers and independent contractors calculate their income and expenses for tax purposes. By using this worksheet, you can clearly outline your earnings and deductions, ensuring accurate tax filings and maximizing your eligible deductions. This organization can ultimately lead to better financial management for your self-employed business.

-

How do I create a Self Employed Income Worksheet using airSlate SignNow?

Creating a Self Employed Income Worksheet with airSlate SignNow is simple and efficient. You can use our customizable templates to input your income sources and expenses, making it easy to generate a comprehensive worksheet. Plus, our intuitive platform allows you to eSign and share your worksheet seamlessly with your accountant or financial advisor.

-

Can I integrate airSlate SignNow with my accounting software for my Self Employed Income Worksheet?

Yes, airSlate SignNow offers integrations with popular accounting software, making it convenient to manage your Self Employed Income Worksheet. This integration allows for seamless data transfer between your accounting tools and your worksheets, ensuring you have access to accurate financial information in real-time. This feature enhances your productivity and keeps your records organized.

-

Is there a cost associated with using airSlate SignNow for my Self Employed Income Worksheet?

airSlate SignNow provides a cost-effective solution for creating your Self Employed Income Worksheet. We offer various pricing plans to fit different business needs, including a free trial to get started. You can choose the plan that best suits your volume of document management and eSigning needs.

-

What features does airSlate SignNow offer for managing my Self Employed Income Worksheet?

With airSlate SignNow, you can enjoy features like document templates, eSigning capabilities, and collaboration tools specifically designed for your Self Employed Income Worksheet. These tools streamline the process of creating, signing, and sharing your financial documents, making it easier to handle your self-employed income management efficiently.

-

How secure is my Self Employed Income Worksheet data on airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols to protect your Self Employed Income Worksheet and all documents shared on our platform. You can rest assured that your sensitive financial information remains confidential and secure.

-

Can I access my Self Employed Income Worksheet from multiple devices?

Absolutely! airSlate SignNow is a cloud-based platform, allowing you to access your Self Employed Income Worksheet from any device with internet connectivity. Whether you're at home, in the office, or on the go, you can manage and sign your worksheets anytime and anywhere.

Get more for Self Employed Income Worksheet

Find out other Self Employed Income Worksheet

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast