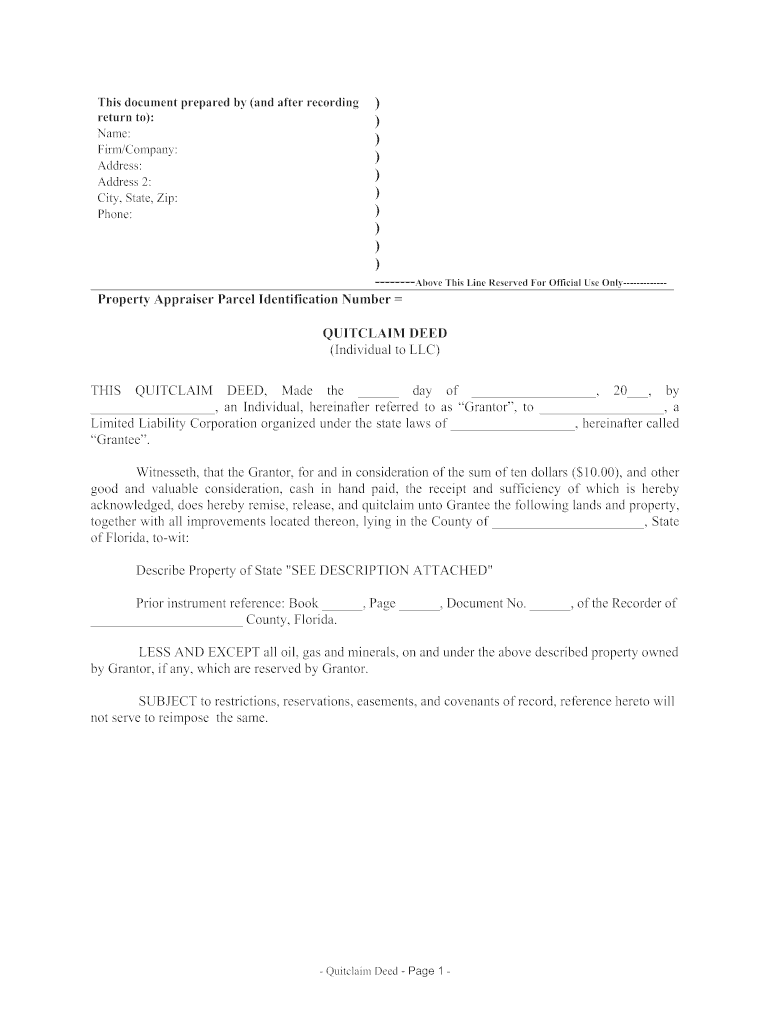

Quit Claim Deed to Llc Form

What is the quitclaim deed from LLC to individual?

A quitclaim deed from an LLC to an individual is a legal document that transfers ownership of property from a limited liability company (LLC) to a private person. This type of deed does not guarantee that the property is free of liens or other claims, but it allows the LLC to relinquish any interest it may have in the property. It is often used in situations where the parties know each other, such as family transfers or intra-company transactions.

Steps to complete the quitclaim deed from LLC to individual

Completing a quitclaim deed from an LLC to an individual involves several important steps:

- Identify the property: Clearly describe the property being transferred, including its address and legal description.

- Gather necessary information: Collect details about the LLC, including its name, address, and the name of the individual receiving the property.

- Draft the quitclaim deed: Use a template or legal service to create the deed, ensuring all required elements are included, such as the names of the parties, property description, and a statement of transfer.

- Sign the document: The authorized representative of the LLC must sign the deed in the presence of a notary public.

- Record the deed: Submit the signed quitclaim deed to the appropriate county recorder's office to make the transfer official.

Key elements of the quitclaim deed from LLC to individual

When drafting a quitclaim deed from an LLC to an individual, several key elements must be included to ensure its legality:

- Parties involved: Clearly state the names of the LLC and the individual.

- Property description: Provide a detailed legal description of the property being transferred.

- Consideration: Indicate any payment or consideration exchanged for the property, if applicable.

- Signature and notarization: The deed must be signed by an authorized representative of the LLC and notarized to validate the transfer.

Legal use of the quitclaim deed from LLC to individual

The quitclaim deed is legally recognized in the United States, allowing for the transfer of property rights without warranties. It is commonly used for various purposes, including:

- Transferring property between family members.

- Clearing up title issues by releasing claims.

- Facilitating property transfers in business transactions.

State-specific rules for the quitclaim deed from LLC to individual

Each state in the U.S. has specific laws governing the use of quitclaim deeds. It is essential to be aware of these regulations, which may include:

- Requirements for notarization and witnessing.

- Specific language that must be included in the deed.

- Filing fees and procedures for recording the deed.

Form submission methods for the quitclaim deed from LLC to individual

Once the quitclaim deed is completed, it must be submitted to the appropriate county office. Common submission methods include:

- Online submission: Some counties allow electronic filing through their websites.

- Mail: The deed can be mailed to the county recorder's office with the required fees.

- In-person: You may also deliver the deed in person to ensure immediate processing.

Quick guide on how to complete quit claim deed to llc

Effortlessly Prepare Quit Claim Deed To Llc on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without obstacles. Manage Quit Claim Deed To Llc on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to Alter and eSign Quit Claim Deed To Llc with Ease

- Find Quit Claim Deed To Llc and select Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature utilizing the Sign feature, which takes moments and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Quit Claim Deed To Llc to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the quit claim deed to llc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a quitclaim deed from LLC to individual?

A quitclaim deed from LLC to individual is a legal document that transfers ownership of a specific property from a Limited Liability Company (LLC) to an individual. This type of deed does not guarantee that the LLC holds a clear title, so it's essential to ensure that there are no encumbrances on the property. Understanding how this process works can help you effectively manage property ownership.

-

How can airSlate SignNow help with a quitclaim deed from LLC to individual?

airSlate SignNow simplifies the process of creating, sending, and eSigning a quitclaim deed from LLC to individual. Our platform offers templates and user-friendly tools that help you efficiently produce legally binding documents without needing extensive legal knowledge. This ensures a smooth transfer of ownership while saving time and resources.

-

What are the costs involved in generating a quitclaim deed from LLC to individual using airSlate SignNow?

Using airSlate SignNow to create a quitclaim deed from LLC to individual is cost-effective, with various pricing plans available to suit different needs. Whether you need a basic plan or advanced features, our pricing is designed to accommodate all business sizes. You'll save money compared to hiring legal professionals for document preparation.

-

Are there any legal requirements for a quitclaim deed from LLC to individual?

Yes, there are specific legal requirements that must be satisfied for a quitclaim deed from LLC to individual to be valid. The deed must be signNowd and filed with the appropriate local government office. Ensuring compliance with these requirements is critical to avoid potential legal issues down the line.

-

Can I customize a quitclaim deed from LLC to individual using airSlate SignNow?

Absolutely! airSlate SignNow provides customizable templates for a quitclaim deed from LLC to individual, allowing you to adjust the document to fit your unique situation. Customization ensures that all relevant details are accurately captured, making your document tailored and precise.

-

What features does airSlate SignNow offer for signing a quitclaim deed from LLC to individual?

airSlate SignNow includes a range of features for signing a quitclaim deed from LLC to individual, such as eSignature capability, document tracking, and collaboration tools. These features enhance the efficiency of the signing process, ensuring that all parties can engage seamlessly and securely. You can also automate reminders to keep everyone on track.

-

How does airSlate SignNow ensure the security of a quitclaim deed from LLC to individual?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols and secure cloud storage to protect your quitclaim deed from LLC to individual throughout the entire process. You can rest assured that your sensitive information remains confidential and safeguarded against unauthorized access.

Get more for Quit Claim Deed To Llc

- Form52adoc

- Form52bdoc

- Annual report guardian new york state unified court form

- Guardianship process and the rights of the ou law form

- Who can use these forms oklahoma

- 30 3 120 proposed plan for care and treatment of ward form

- Plan for the management of the property of the ward form

- Guardianship of a childminorwelcome to oklahoma form

Find out other Quit Claim Deed To Llc

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself