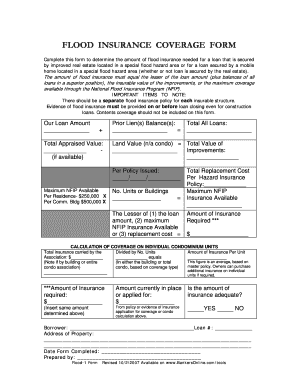

Flood Insurance Calculation Worksheet Form

What is the flood insurance calculation worksheet

The flood insurance calculation worksheet is a tool designed to help property owners estimate the cost of flood insurance premiums based on various factors. This worksheet typically includes sections for inputting details about the property, such as its location, elevation, and flood zone designation. By using this worksheet, individuals can gain a clearer understanding of their potential insurance costs and the coverage they may need to protect their homes and belongings from flood damage.

How to use the flood insurance calculation worksheet

Using the flood insurance calculation worksheet involves several steps to ensure accurate estimates. First, gather relevant information about your property, including its address, flood zone, and any previous flood claims. Next, fill in the worksheet by entering data into the designated fields. The worksheet may require you to input your property's elevation and the type of coverage you are considering. Once all information is entered, the worksheet will provide an estimate of your flood insurance premium, allowing you to make informed decisions about your coverage needs.

Steps to complete the flood insurance calculation worksheet

Completing the flood insurance calculation worksheet can be straightforward if you follow these steps:

- Gather property information, including location and flood zone designation.

- Determine the property's elevation above sea level.

- Input the gathered data into the worksheet as prompted.

- Review the information for accuracy before finalizing your entries.

- Calculate the estimated premium based on the provided data.

Key elements of the flood insurance calculation worksheet

The flood insurance calculation worksheet includes several key elements that are crucial for an accurate assessment. These elements typically encompass:

- Property Location: The geographic area where the property is situated.

- Flood Zone: The specific flood zone designation assigned to the property by FEMA.

- Elevation: The height of the property above the base flood elevation.

- Coverage Options: Different types of coverage available, such as building and contents coverage.

- Deductibles: The amount the policyholder agrees to pay out of pocket before insurance coverage kicks in.

Legal use of the flood insurance calculation worksheet

The flood insurance calculation worksheet serves not only as a budgeting tool but also as a legally recognized document when completed accurately. For the estimates to be valid, it is essential to ensure that all information is truthful and complies with local regulations. Misrepresentation of data can lead to issues with insurance claims or policy enforcement. Therefore, using the worksheet in accordance with legal guidelines is crucial for ensuring that the flood insurance estimates are reliable and actionable.

Examples of using the flood insurance calculation worksheet

Utilizing the flood insurance calculation worksheet can vary based on individual circumstances. For example, a homeowner in a high-risk flood zone may use the worksheet to assess the cost of comprehensive coverage, while a property owner in a lower-risk area might focus on minimal coverage options. Additionally, examples may include scenarios where homeowners factor in recent renovations that could affect their property's elevation or flood risk, ultimately influencing their insurance premiums. These practical applications help users tailor their flood insurance needs effectively.

Quick guide on how to complete flood insurance calculation worksheet

Effortlessly prepare Flood Insurance Calculation Worksheet on any device

Managing documents online has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Flood Insurance Calculation Worksheet on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Flood Insurance Calculation Worksheet with ease

- Obtain Flood Insurance Calculation Worksheet and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Flood Insurance Calculation Worksheet and ensure superior communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the flood insurance calculation worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a flood insurance calculator and how does it work?

A flood insurance calculator is a tool that helps homeowners estimate the cost of flood insurance based on their property details and location. By inputting essential information such as home value and flood zone, users can quickly get an estimate tailored to their circumstances. This simplifies the process of understanding potential insurance costs and assists in budgeting accordingly.

-

How can I use the flood insurance calculator on airSlate SignNow?

To use the flood insurance calculator on airSlate SignNow, simply navigate to the designated section on our landing page. Enter the required property details, and the calculator will provide an estimate for your flood insurance needs. This intuitive interface makes it easy to determine your potential costs without any hassle.

-

Is there a fee to use the flood insurance calculator?

No, the flood insurance calculator on airSlate SignNow is completely free to use. We believe in empowering homeowners with the tools they need to make informed decisions regarding flood insurance. Try it out without any commitment or charges involved.

-

What factors affect the flood insurance estimates generated by the calculator?

The estimates produced by the flood insurance calculator take into account various factors such as the property's location, construction type, and the value of the home. Additional elements like previous flood damage history and proximity to water bodies may also be considered. This comprehensive approach ensures that you receive a more accurate estimate.

-

Can I integrate the flood insurance calculator with other tools?

Yes, the flood insurance calculator can be easily integrated with other applications through airSlate SignNow's features. This allows users to streamline their workflow by linking insurance estimates directly to document management or eSigning functionalities. Integration simplifies the overall user experience.

-

What are the benefits of using the flood insurance calculator?

Using the flood insurance calculator helps you gain clarity on the costs associated with flood insurance, allowing for better financial planning. It eliminates guesswork, enabling you to make informed decisions about coverage. Ultimately, it could save you time and money by finding the right coverage for your needs.

-

Will the flood insurance calculator provide accurate estimates for all locations?

The flood insurance calculator aims to provide accurate estimates for most locations, but the final costs may vary based on local regulations and insurer policies. It's a handy starting point that helps establish a baseline for your flood insurance needs. Always consult with an insurance professional for the most precise information tailored to your area.

Get more for Flood Insurance Calculation Worksheet

- Purchase and sale agreement tennessee bar form

- County of state of tennessee and described as form

- County clerks e li university of tennessee form

- Are liable to be fined not more than 5000 or imprisoned not more form

- Tennessee being of sound and disposing mind and memory do hereby make publish and declare this to form

- I do hereby make oath that i am a licensed attorney andor the custodian of form

- Before me of the state and county mentioned personally appeared form

- Before me of the state and county aforementioned personally form

Find out other Flood Insurance Calculation Worksheet

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe