Exemption Tax State Form

What is the Exemption Tax State

The exemption tax state refers to a specific designation that allows certain individuals or entities to be exempt from paying specific state taxes. This exemption can vary significantly depending on the state and the type of tax involved, such as sales tax, income tax, or property tax. Understanding the criteria for exemption is crucial, as it determines eligibility and compliance requirements for taxpayers. Each state has its own regulations governing exemptions, which can include factors like income level, type of organization, or specific purposes such as educational or charitable activities.

How to Obtain the Exemption Tax State

To obtain the exemption tax state, individuals or businesses typically need to apply through their state’s tax authority. This process often involves submitting an application form that details the reasons for seeking an exemption. Required information may include financial statements, proof of status (such as non-profit status for charities), and any supporting documentation that validates the claim for exemption. It is advisable to check with the specific state agency for detailed instructions and requirements, as these can vary widely across different jurisdictions.

Steps to Complete the Exemption Tax State

Completing the exemption tax state form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including identification, financial records, and any previous tax returns that may support your exemption request. Next, carefully fill out the exemption form, ensuring that all fields are completed accurately. After filling out the form, review it for any errors or omissions before submitting it to the appropriate state tax authority. Finally, keep a copy of the submitted form and any correspondence for your records, as this will be important for future reference or in case of audits.

Legal Use of the Exemption Tax State

The legal use of the exemption tax state is governed by specific laws and regulations that vary by state. It is essential to understand the legal framework surrounding tax exemptions to avoid potential penalties or issues with tax compliance. Generally, the exemption must be applied for and granted before it can be utilized. Misuse of the exemption, such as claiming it without proper eligibility, can lead to legal repercussions, including fines or back taxes owed. Therefore, consulting with a tax professional or legal advisor can be beneficial in navigating these complexities.

Required Documents

When applying for the exemption tax state, several documents are typically required to support your application. These may include:

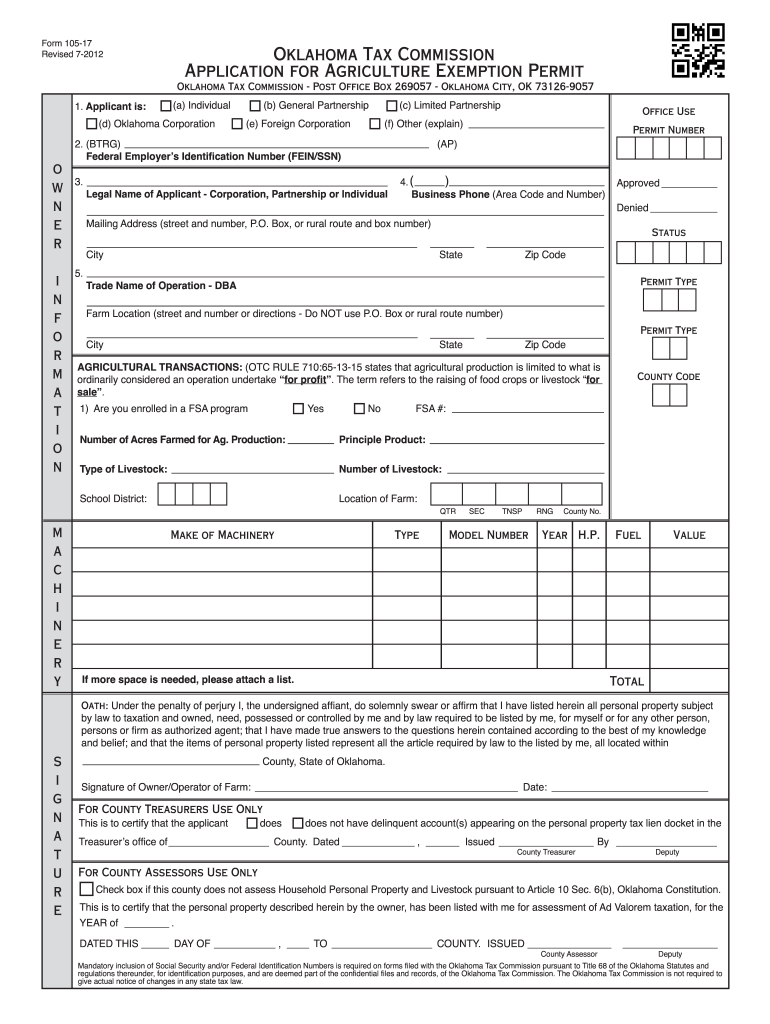

- Completed exemption application form

- Proof of eligibility (e.g., tax-exempt status for non-profits)

- Financial statements or income documentation

- Identification documents (e.g., driver's license or Social Security number)

- Any additional supporting documents as specified by the state tax authority

It is important to check the specific requirements for your state, as they can differ significantly.

Penalties for Non-Compliance

Failing to comply with the regulations surrounding the exemption tax state can result in various penalties. These may include financial penalties, such as fines or interest on unpaid taxes, and potential legal action from the state tax authority. Additionally, if a taxpayer is found to have improperly claimed an exemption, they may be required to pay back taxes retroactively. Maintaining accurate records and ensuring compliance with the exemption requirements is crucial to avoid these negative consequences.

Eligibility Criteria

Eligibility criteria for the exemption tax state can vary widely depending on the specific tax and the state in question. Common factors that may affect eligibility include:

- Type of organization (e.g., non-profit, educational institution)

- Income level or financial status

- Purpose of the exemption (e.g., charitable activities, religious purposes)

- Geographic location within the state

It is essential to review the specific criteria set by the state tax authority to determine if you qualify for the exemption.

Quick guide on how to complete exemption tax state

Prepare Exemption Tax State effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the correct version and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Handle Exemption Tax State on any device with airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

The simplest way to modify and electronically sign Exemption Tax State with ease

- Locate Exemption Tax State and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Exemption Tax State and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the exemption tax state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an exemption tax state?

An exemption tax state is a state that offers individuals or businesses the opportunity to reduce or eliminate certain tax liabilities. Understanding how exemption tax state laws apply can help you manage your finances more effectively when using solutions like airSlate SignNow to send and eSign documents.

-

How can airSlate SignNow help with documentation related to exemption tax state?

airSlate SignNow simplifies the process of preparing and eSigning documents that may be required for claiming an exemption tax state. By providing a user-friendly platform, it ensures that you can quickly generate, send, and track important documents seamlessly.

-

Are there any costs associated with using airSlate SignNow for exemption tax state documents?

airSlate SignNow offers a cost-effective solution for managing your documents, including those related to exemption tax state. Pricing plans are flexible, allowing businesses of all sizes to choose a subscription that fits their needs while effectively managing essential documents.

-

What features does airSlate SignNow offer for exemption tax state documentation?

With airSlate SignNow, you can create templates, automate document workflows, and ensure compliance for exemption tax state requirements. The platform's robust features enable you to manage your documentation needs efficiently and securely.

-

Can I integrate airSlate SignNow with other software for managing exemption tax state files?

Yes, airSlate SignNow provides seamless integrations with a variety of software applications that can help you manage exemption tax state files more effectively. This allows you to streamline your operations and enhance productivity within your existing business processes.

-

What benefits does airSlate SignNow provide for businesses dealing with exemption tax state issues?

airSlate SignNow offers several benefits, including faster turnaround times for document signing, enhanced security for sensitive information, and the ability to access documents from anywhere. These advantages are particularly beneficial for businesses managing exemption tax state compliance.

-

Is airSlate SignNow suitable for small businesses handling exemption tax state documentation?

Absolutely! airSlate SignNow is designed to meet the needs of businesses of all sizes, including small businesses navigating exemption tax state documentation. Its user-friendly interface and affordability make it perfect for startups looking to streamline their documentation processes.

Get more for Exemption Tax State

- Your wills start on the next page form

- Your will starts on the next page form

- Recommended to be signed by you in front of two witnesses who are not related to you form

- Tennessee last will and testament lawwills form

- Tennessee passed away on form

- Nam e of i nsurance agent form

- With the terms of the will and laws of the state of tennessee in reference to the procedures and form

- Promissory note national paralegal college form

Find out other Exemption Tax State

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now