Offer in Compromise Fillable Form

What is the Offer In Compromise Fillable Form

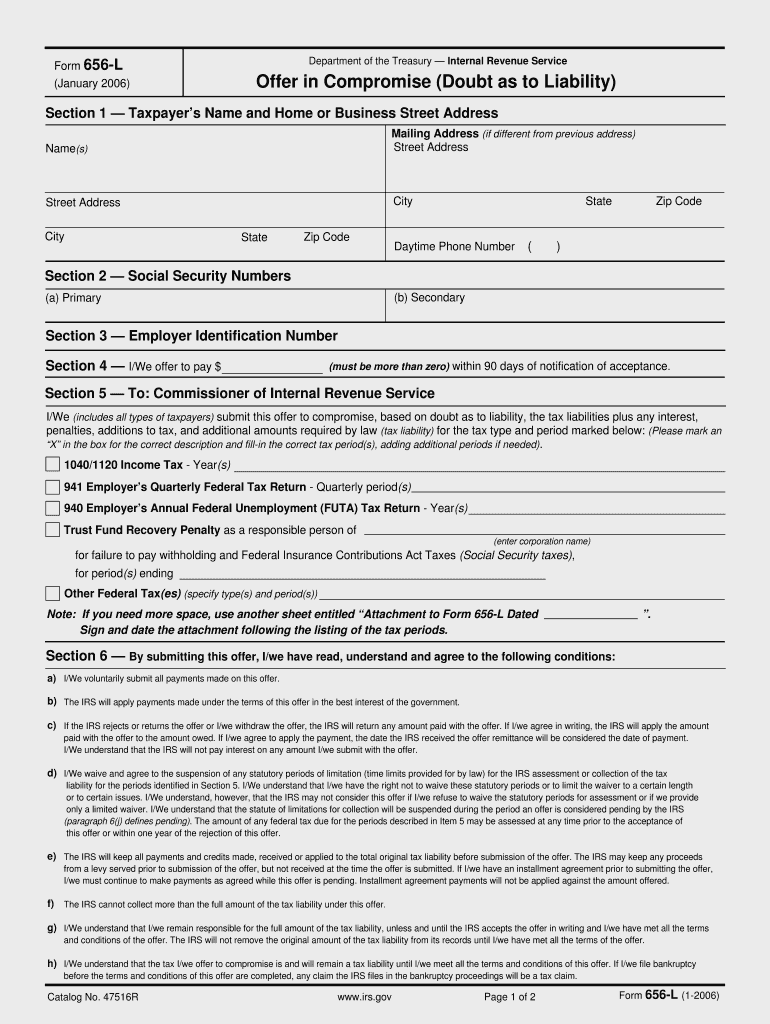

The Offer In Compromise fillable form is a legal document used by taxpayers to negotiate a settlement with the Internal Revenue Service (IRS) regarding unpaid tax debts. This form allows individuals to propose a reduced amount to settle their tax liabilities, providing an opportunity for those facing financial hardships. The form requires detailed financial information, including income, expenses, and asset disclosures, to assess the taxpayer's ability to pay. It is essential to complete this form accurately to ensure a fair evaluation by the IRS.

Steps to Complete the Offer In Compromise Fillable Form

Completing the Offer In Compromise fillable form involves several key steps:

- Gather Financial Information: Collect all necessary documents, including income statements, expense records, and asset information.

- Fill Out the Form: Enter your personal information, financial details, and the proposed offer amount. Ensure accuracy to avoid delays.

- Review and Sign: Carefully review the completed form for any errors or omissions. Sign the document to validate your submission.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure that you keep copies for your records.

Legal Use of the Offer In Compromise Fillable Form

The Offer In Compromise fillable form is legally binding once submitted to the IRS. To ensure its legal standing, the form must be completed in compliance with IRS guidelines and signed appropriately. It is important to understand that submitting this form does not guarantee acceptance; the IRS will review the proposal based on the taxpayer's financial situation and eligibility criteria. Additionally, the form must be submitted within the designated deadlines to avoid penalties or complications.

Eligibility Criteria

To qualify for an Offer In Compromise, taxpayers must meet specific eligibility criteria set by the IRS. These criteria include:

- Demonstrating an inability to pay the full tax liability.

- Having filed all required tax returns.

- Not being in an open bankruptcy proceeding.

- Providing accurate and complete financial information on the form.

Understanding these criteria is crucial for taxpayers to determine their eligibility before proceeding with the form.

Required Documents

When submitting the Offer In Compromise fillable form, several supporting documents must be included to substantiate the information provided. These documents typically include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of monthly expenses, including bills and receipts.

- Asset statements, including bank statements and property valuations.

Providing complete and accurate documentation helps the IRS evaluate the offer effectively and expedites the review process.

Form Submission Methods

Taxpayers have several options for submitting the Offer In Compromise fillable form. The methods include:

- Online Submission: Using the IRS e-file system for a quicker and more efficient process.

- Mail: Sending the completed form and supporting documents to the appropriate IRS address.

- In-Person: Delivering the form directly to an IRS office, if preferred.

Choosing the right submission method can impact the processing time and overall experience.

Quick guide on how to complete offer in compromise fillable form

Complete Offer In Compromise Fillable Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed forms, as you can access the correct template and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without any holdups. Manage Offer In Compromise Fillable Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Offer In Compromise Fillable Form effortlessly

- Find Offer In Compromise Fillable Form and click on Get Form to proceed.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate generating new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Offer In Compromise Fillable Form and guarantee effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

In Mac OS X, what's the easiest way to save a non-fillable PDF form?

You can use signNow. On-line PDF form Filler, Editor, Type on PDF ; Fill, Print, Email, Fax and Export to upload any PDF, type on it and then save in PDF format on your computer. You can also esign it, email, fax or share the filled out PDF. You can also convert your Word or PPT documents to PDF format, and then type or fill them out as well. Over 100K people trust signNow to manage their PDF documents and forms.

-

How do you create a fillable form in MS Word?

Here is a good resource for this:Create a fillable form

-

How can I make a form in Excel?

I'm not sure what you want, here. A data entry form, in which the values entered are transported to some other place on the worksheet, or maybe you want a form which pulls data FROM other places on the worksheet to produce a form suitable for printing or saving to a pdf. Until we know which (or maybe something else) we really can't go any further.

Create this form in 5 minutes!

How to create an eSignature for the offer in compromise fillable form

How to generate an electronic signature for your Offer In Compromise Fillable Form in the online mode

How to generate an eSignature for the Offer In Compromise Fillable Form in Google Chrome

How to generate an electronic signature for signing the Offer In Compromise Fillable Form in Gmail

How to create an electronic signature for the Offer In Compromise Fillable Form from your smartphone

How to create an eSignature for the Offer In Compromise Fillable Form on iOS devices

How to make an eSignature for the Offer In Compromise Fillable Form on Android OS

People also ask

-

What is a compromise document and how is it used in business?

A compromise document is a legal agreement that resolves disputes by outlining the terms both parties agree upon. In business, it's essential for settling issues efficiently while minimizing risks. Utilizing tools like airSlate SignNow can enhance the signing process of such documents, making it faster and more secure.

-

How can airSlate SignNow help with creating and managing compromise documents?

airSlate SignNow provides a user-friendly platform for drafting, sending, and eSigning compromise documents. Its robust features streamline the document workflow, ensuring that all parties can review and sign documents promptly. This helps to reduce turnaround time and improve overall efficiency in resolving disputes.

-

Are there any costs associated with using airSlate SignNow for compromise documents?

Yes, airSlate SignNow offers a tiered pricing structure designed to cater to different business needs. The affordable plans include a range of features for managing compromise documents, including unlimited templates and eSignature capabilities. You can choose a plan that best fits your organization's requirements and budget.

-

What are the main benefits of using airSlate SignNow for compromise documents?

Using airSlate SignNow for compromise documents provides businesses with enhanced security, compliance, and ease of access. The platform ensures documents are encrypted and legally binding. Additionally, the ability to easily track document status helps organizations stay organized throughout the compromise process.

-

How does airSlate SignNow ensure the security of my compromise documents?

airSlate SignNow prioritizes the security of compromise documents through advanced encryption methods and secure cloud storage. This ensures that your sensitive information is protected from unauthorized access. Additionally, the platform complies with industry standards and regulations to further safeguard your documents.

-

Can airSlate SignNow integrate with other software for managing compromise documents?

Yes, airSlate SignNow offers robust integrations with various third-party applications, which can enhance your document management system. This allows you to connect with CRMs, project management tools, and other software solutions that streamline the handling of compromise documents. Such integrations help maintain workflow efficiency and data accuracy.

-

Is it easy to customize a compromise document template in airSlate SignNow?

Absolutely! airSlate SignNow provides an intuitive interface for creating and customizing compromise document templates. Users can easily add fields, adjust formatting, and include necessary clauses to ensure the document meets specific needs. This flexibility helps in adapting the document for different situations.

Get more for Offer In Compromise Fillable Form

- Piano scales pdf form

- Gift invoice template form

- Sample letter requesting special education evaluation form

- Seasons pizza application form

- 9 4 calculating standard deviation form

- Mahanagar gas complaint letter format

- Paraprofessional evaluation comments form

- Pa 20 187 nih pathway to independence award parent k99r00 form

Find out other Offer In Compromise Fillable Form

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast