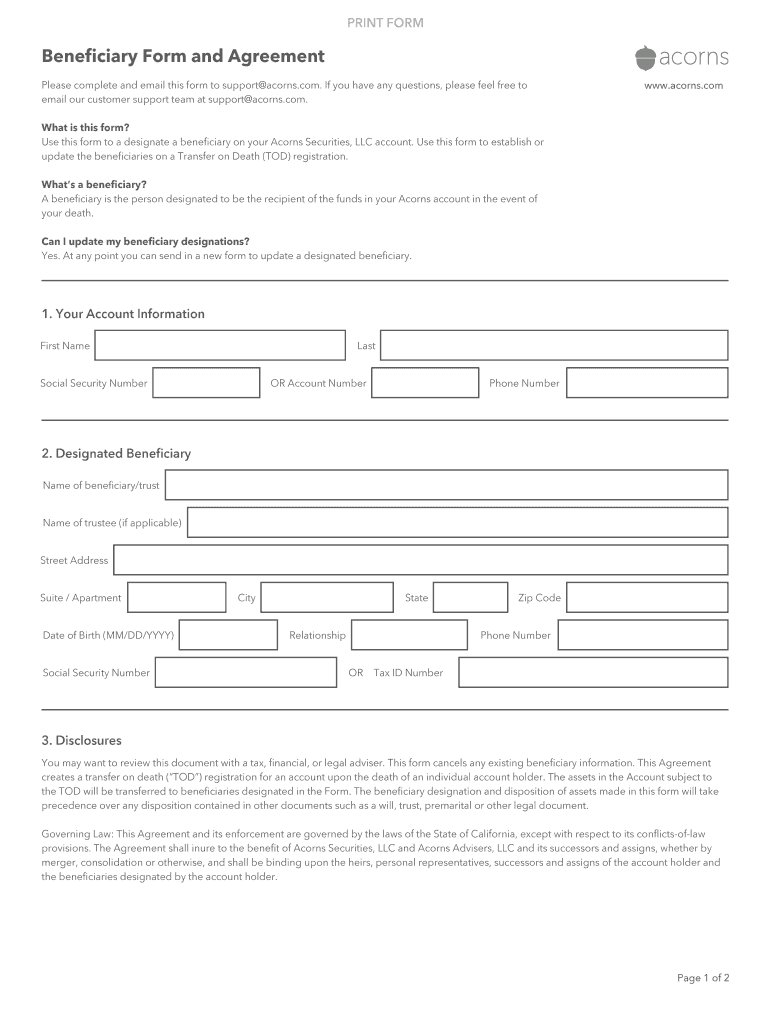

Acorns Beneficiary Form

What is the Acorns Beneficiary

The Acorns beneficiary is an individual or entity designated to receive the assets in your Acorns account upon your passing. This designation is crucial for estate planning, ensuring that your investments are transferred according to your wishes. By specifying a beneficiary, you can avoid the lengthy probate process, allowing for a smoother transition of your assets. The beneficiary can be a family member, friend, or even a charity, depending on your preferences.

How to Use the Acorns Beneficiary

Using the Acorns beneficiary feature is straightforward. Once you log into your Acorns account, navigate to the settings or account management section. Here, you will find an option to add or update your beneficiary information. You will need to provide the beneficiary's full name, relationship to you, and contact information. It is essential to keep this information current, especially after significant life events such as marriage, divorce, or the birth of a child.

Steps to Complete the Acorns Beneficiary

To complete the beneficiary designation in your Acorns account, follow these steps:

- Log into your Acorns account.

- Go to the settings or account management section.

- Select the option to add or edit your beneficiary.

- Enter the required information, including the beneficiary's name, relationship, and contact details.

- Review your entries for accuracy.

- Save the changes to ensure your beneficiary designation is updated.

Legal Use of the Acorns Beneficiary

Designating a beneficiary in your Acorns account is legally binding, provided you follow the necessary procedures. This designation is recognized under U.S. law, allowing for the direct transfer of assets without going through probate. To ensure legal validity, it is important to comply with any specific state laws regarding beneficiary designations. Additionally, maintaining accurate and up-to-date beneficiary information can help prevent disputes among potential heirs.

Key Elements of the Acorns Beneficiary

When designating a beneficiary for your Acorns account, consider the following key elements:

- Full Name: Ensure the beneficiary's name is spelled correctly.

- Relationship: Specify your relationship to the beneficiary, as this can impact tax implications.

- Contact Information: Provide accurate contact details to facilitate communication.

- Contingent Beneficiaries: Consider naming alternate beneficiaries in case your primary beneficiary is unable to inherit.

Examples of Using the Acorns Beneficiary

Here are a few scenarios illustrating the importance of the Acorns beneficiary designation:

- A parent designates their child as the beneficiary to ensure that their investment assets are passed on directly without probate complications.

- A single individual names a close friend as a beneficiary, reflecting their wishes to support that friend after their passing.

- A couple decides to name each other as primary beneficiaries, with their children as contingent beneficiaries, ensuring that their assets are distributed according to their family structure.

Quick guide on how to complete acorns beneficiary

Effortlessly prepare Acorns Beneficiary on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Acorns Beneficiary on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric task today.

The easiest method to alter and eSign Acorns Beneficiary with ease

- Find Acorns Beneficiary and click Get Form to commence.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Acorns Beneficiary to guarantee effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the acorns beneficiary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an acorns beneficiary?

An acorns beneficiary is a designated person who will receive the funds from your Acorns investment account in the event of your passing. Understanding how to name an acorns beneficiary can help ensure that your investments are passed on according to your wishes.

-

How can I add or change my acorns beneficiary?

To add or change your acorns beneficiary, log in to your Acorns account and navigate to the settings menu. Look for the section labeled 'Beneficiaries' where you can manage your beneficiary information, ensuring your assets are designated correctly.

-

Is it necessary to have an acorns beneficiary?

While it's not legally required to name an acorns beneficiary, doing so can prevent complications during the distribution of your assets. Having a clear beneficiary reduces the likelihood of disputes and ensures your investments go to the right person.

-

What happens to my Acorns account if I don’t designate an acorns beneficiary?

If you do not designate an acorns beneficiary, your account will be treated as part of your estate upon your death. This could lead to potential delays and additional legal complications regarding the distribution of your investments.

-

Can I specify multiple beneficiaries for my Acorns account?

Yes, Acorns allows you to specify multiple beneficiaries for your account. You can designate percentages for each person to ensure that your investments are distributed according to your preferences.

-

Does naming an acorns beneficiary incur any fees?

Naming an acorns beneficiary does not incur any fees. This service is typically part of your account management and is designed to provide you with peace of mind regarding the future distribution of your investments.

-

How does naming an acorns beneficiary benefit my family?

Naming an acorns beneficiary ensures that your loved ones receive your investment assets without unnecessary delays or complications. This proactive step simplifies the inheritance process during a difficult time for your family.

Get more for Acorns Beneficiary

- Motion to bar use of certain aggravating circumstances form

- Motion to produce negatives form

- The people of the state of illinois appeal from the form

- Release and waiver of liability for using salvage yard form

- Sample written warning letters including employee policies form

- Request a default judgment by court homesaclaworg form

- Board of directors resolution changing officers salaries form

- License agreement allowing search on property for antique bottles form

Find out other Acorns Beneficiary

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online