W9 Form Ri 2008-2026

What is the W-9 Form RI

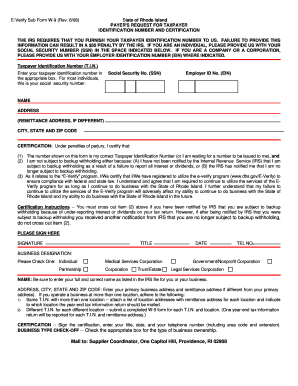

The W-9 Form, officially known as the Request for Taxpayer Identification Number and Certification, is a crucial document used in the United States. Specifically, the W-9 Form RI refers to the version used in Rhode Island. It is primarily utilized by individuals and businesses to provide their taxpayer identification number to entities that are required to report income paid to them. This form is essential for freelancers, contractors, and other self-employed individuals who receive payments that may be subject to IRS reporting.

How to use the W-9 Form RI

Using the W-9 Form RI is straightforward. First, download the form from the IRS website or obtain it from the entity requesting it. Complete the form by providing your name, business name (if applicable), address, and taxpayer identification number, which may be your Social Security Number or Employer Identification Number. Once filled out, submit the form to the requester, not to the IRS. This ensures that the entity has the necessary information to report payments accurately.

Steps to complete the W-9 Form RI

Completing the W-9 Form RI involves several key steps:

- Download the W-9 Form from a reliable source.

- Fill in your name and business name, if applicable.

- Provide your address, ensuring it matches IRS records.

- Enter your taxpayer identification number.

- Sign and date the form to certify the information is correct.

After completing these steps, ensure you send the form to the requester promptly to avoid any delays in payment processing.

Legal use of the W-9 Form RI

The W-9 Form RI serves a legal purpose by ensuring that the information provided is accurate and up to date. It is important for compliance with IRS regulations, as it helps businesses report payments made to individuals and entities. By submitting a W-9 Form, you certify that the taxpayer identification number you provided is correct and that you are not subject to backup withholding. This legal assurance is vital for both the payer and the payee in maintaining proper tax records.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the W-9 Form RI. According to these guidelines, the form must be filled out completely and accurately to avoid penalties. It is important to keep the form updated, especially if there are changes to your name or taxpayer identification number. The IRS also advises that the W-9 Form should only be provided to entities that require it for tax reporting purposes, thus protecting your personal information from unnecessary exposure.

Penalties for Non-Compliance

Failure to provide a completed W-9 Form RI when requested can lead to significant penalties. If a business does not receive your W-9, they may be required to withhold a percentage of your payments for tax purposes. Additionally, inaccuracies on the form can result in penalties from the IRS, including fines and increased scrutiny of your tax filings. Therefore, it is essential to complete and submit the W-9 Form accurately and on time to avoid these potential issues.

Quick guide on how to complete w9 form ri 1442568

Effortlessly prepare W9 Form Ri on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents since you can access the appropriate form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Manage W9 Form Ri on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign W9 Form Ri with ease

- Obtain W9 Form Ri and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign W9 Form Ri to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w9 form ri 1442568

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the primary w9 form purpose?

The primary w9 form purpose is to provide the IRS with accurate taxpayer information, allowing businesses to report income paid to independent contractors. It ensures proper tax reporting and compliance for both the payee and the payer. By using a W-9 form, companies can collect the necessary details to issue 1099 forms at the end of the tax year.

-

How does airSlate SignNow facilitate the completion of W-9 forms?

airSlate SignNow streamlines the process of completing W-9 forms by offering an intuitive interface for eSigning and document management. Users can fill out and send W-9 forms electronically, eliminating the need for paper forms and ink signatures. This simplifies the process, saves time, and helps maintain accuracy in information submission.

-

Are there any costs associated with using airSlate SignNow for W-9 forms?

Yes, while airSlate SignNow offers a range of pricing plans, individuals and businesses can access features related to W-9 forms at competitive rates. The plans are designed to cater to different business sizes and needs, ensuring that users can find an economically viable option. Investing in this service can help streamline processes and reduce administrative burdens.

-

What security measures does airSlate SignNow have for handling W-9 forms?

Security is a top priority at airSlate SignNow, especially when handling sensitive information like that found on W-9 forms. The platform uses encryption to protect data during transmission and storage, ensuring that your information remains confidential. Additionally, features like password protection and audit trails further enhance document security.

-

Can airSlate SignNow integrate with other tools for managing W-9 forms?

Absolutely! airSlate SignNow offers various integrations with popular business tools and software, allowing for seamless management of W-9 forms alongside your existing workflows. This capability makes it easy to incorporate eSignature processes into your operations without disrupting your current systems. Streamlining your documentation will enhance efficiency across your business.

-

What are the benefits of using airSlate SignNow for managing W-9 forms?

Using airSlate SignNow for managing W-9 forms offers numerous benefits, including time savings, enhanced accuracy, and improved compliance. The platform simplifies the entire document workflow from creation to signature, reducing the potential for errors associated with manual entry. By automating this process, businesses can focus more on their core operations.

-

Can I access my submitted W-9 forms through airSlate SignNow?

Yes, airSlate SignNow provides users with easy access to all submitted W-9 forms. You can view, manage, and save your completed documents securely, ensuring that you can retrieve them whenever necessary for tax reporting or audits. This feature enhances organizational efficiency and helps maintain compliance with tax regulations.

Get more for W9 Form Ri

- Yearly expenses form

- Guidelines for writing effective goals form

- Hand check request form

- Request for amendment notice of denial letter form

- Authorization for access use and disclosure form

- Querying the database queries and views form

- Guide 1 training package assessment materials kit form

- Date from form

Find out other W9 Form Ri

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now