Loss Run Request TMK Risk Form

What is the Loss Run Request TMK Risk

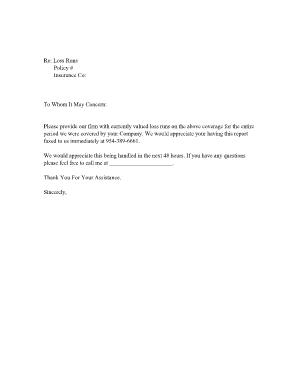

The loss run request letter is a formal document used by businesses to request a history of insurance claims from their insurance provider. This document is crucial for companies seeking to understand their risk profile and for obtaining quotes from new insurers. The loss run report typically includes details of any claims made, including dates, amounts, and the nature of the claims. Understanding this information helps businesses assess their insurance needs and negotiate better terms with potential insurers.

How to Obtain the Loss Run Request TMK Risk

To obtain the loss run request letter, a business should follow a straightforward process. First, identify the current insurance provider and gather any necessary account information, such as policy numbers and company details. Next, draft a formal request that includes the specific time period for which loss runs are needed. It is advisable to send this request via email or certified mail to ensure it is received. Many insurance companies also provide an online portal where businesses can submit their requests directly.

Steps to Complete the Loss Run Request TMK Risk

Completing the loss run request letter involves several key steps:

- Gather necessary information, including policy numbers and the period for which you need loss runs.

- Draft a clear and concise letter that specifies your request and includes your contact information.

- Send the request to your insurance provider, ensuring you keep a copy for your records.

- Follow up with the insurer if you do not receive a response within a reasonable timeframe.

Legal Use of the Loss Run Request TMK Risk

The loss run request letter is legally recognized as a formal means of obtaining information from an insurance provider. It is important to ensure that the request complies with relevant state laws and insurance regulations. This includes understanding any privacy laws that may affect the release of claims information. A well-drafted loss run request letter can help protect a business's interests and ensure that it receives the necessary documentation for insurance purposes.

Key Elements of the Loss Run Request TMK Risk

When drafting a loss run request letter, certain key elements should be included to ensure clarity and effectiveness:

- Sender Information: Include your name, title, and company details.

- Recipient Information: Address the letter to the appropriate contact at the insurance company.

- Request Details: Clearly state the request for loss run reports and specify the time period.

- Contact Information: Provide your phone number and email address for follow-up.

- Signature: Sign the letter to authenticate the request.

Form Submission Methods

The loss run request letter can be submitted through various methods, depending on the preferences of the insurance provider. Common submission methods include:

- Email: Many insurers accept requests via email, which allows for quick processing.

- Certified Mail: Sending the request by certified mail provides proof of delivery.

- Online Portals: Some insurance companies offer online platforms for submitting requests directly.

Quick guide on how to complete loss run request tmk risk

Effortlessly prepare Loss Run Request TMK Risk on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the correct form and safely store it online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your documents quickly without delays. Manage Loss Run Request TMK Risk on any platform with airSlate SignNow's Android or iOS apps and enhance any document-related process today.

The easiest way to alter and electronically sign Loss Run Request TMK Risk effortlessly

- Obtain Loss Run Request TMK Risk and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and electronically sign Loss Run Request TMK Risk and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loss run request tmk risk

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loss run request letter?

A loss run request letter is a formal document used to ask your insurance provider for a record of your past claims. This letter typically includes important details like policy numbers and the period for which the claims history is being requested. Understanding how to craft an effective loss run request letter can help streamline your insurance processes.

-

How can airSlate SignNow help with my loss run request letter?

airSlate SignNow simplifies the process of creating and sending a loss run request letter. With customizable templates and eSignature capabilities, you can quickly generate a professional-looking letter and get it signed by necessary parties. This efficiency ensures timely handling of your insurance requests.

-

Is there a cost associated with using airSlate SignNow for loss run request letters?

Yes, airSlate SignNow offers flexible pricing plans. Depending on your business needs, you can choose a plan that fits your budget and provides access to features tailored for crafting loss run request letters. This cost-effective solution allows you to manage your documents efficiently without breaking the bank.

-

Can I track the status of my loss run request letter with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your loss run request letter once it has been sent. You’ll receive notifications when it’s viewed and signed, ensuring that you’re always informed about your document's progress.

-

Are there any templates available for loss run request letters?

Yes, airSlate SignNow offers a variety of templates specifically designed for loss run request letters. These templates provide a convenient starting point and can be customized to fit your specific needs, saving you time when drafting your letters.

-

What industries can benefit from using a loss run request letter?

Many industries that require insurance, such as real estate, construction, and healthcare, can benefit from using a loss run request letter. By utilizing airSlate SignNow to streamline this process, businesses can enhance their operational efficiency and ensure they have the necessary data for better risk management.

-

Can I integrate airSlate SignNow with my existing tools for handling loss run request letters?

Yes, airSlate SignNow offers seamless integrations with popular tools and applications. This means you can easily connect it to your existing systems to manage loss run request letters alongside other document processes, enhancing productivity and collaboration.

Get more for Loss Run Request TMK Risk

- Sample interview questions for investigators form

- Model temporary agency client agreement form

- Determining contractor status form

- Ex 1025 employment agreement and change in control form

- Direct deposit form oregongov

- From time to time idioms by the free dictionary form

- Flexible work arrangement acknowledgement form

- A labor relations guide for supervisors administering form

Find out other Loss Run Request TMK Risk

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation