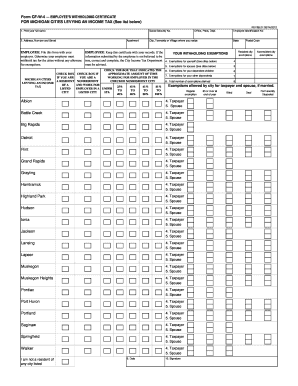

City of Grand Rapids Income Tax Withholding Form

What is the City of Grand Rapids Income Tax Withholding?

The City of Grand Rapids income tax withholding refers to the portion of an employee's wages that is withheld by their employer to cover the individual's tax obligations to the city. This withholding is essential for ensuring that residents contribute to local services and infrastructure. Employers are required to deduct a specific percentage from each paycheck and remit it to the city's treasury. Understanding this process is crucial for both employees and employers to ensure compliance with local tax laws.

Steps to Complete the City of Grand Rapids Income Tax Withholding

Completing the City of Grand Rapids income tax withholding form involves several key steps:

- Gather necessary information, including your Social Security number, address, and employment details.

- Obtain the city of Grand Rapids W-4 form, which can typically be downloaded from the city’s official website or requested from your employer.

- Fill out the form accurately, ensuring that all required fields are completed. This includes your filing status and any additional allowances you wish to claim.

- Review the completed form for accuracy to avoid any potential issues with your withholding.

- Submit the form to your employer, who will then process it and adjust your paycheck accordingly.

Legal Use of the City of Grand Rapids Income Tax Withholding

The legal framework governing the City of Grand Rapids income tax withholding is defined by local tax regulations. Employers must comply with these regulations to ensure that the withholding process is valid and enforceable. This includes adhering to deadlines for submitting withheld taxes and maintaining accurate records of employee withholdings. Failure to comply can result in penalties for both the employer and the employee.

Form Submission Methods

The city of Grand Rapids W-4 form can be submitted through various methods, depending on your employer’s policies. Common submission methods include:

- Online: Many employers offer electronic submission options through payroll systems.

- Mail: You can send a physical copy of the completed form to your employer's payroll department.

- In-Person: Some employees may prefer to deliver the form directly to their HR or payroll office.

Key Elements of the City of Grand Rapids Income Tax Withholding

Understanding the key elements of the City of Grand Rapids income tax withholding is essential for accurate tax reporting. Important components include:

- Filing Status: Determines the tax rate applied to your income.

- Allowances: The number of allowances claimed affects the amount withheld.

- Exemptions: Certain individuals may qualify for exemptions, which can reduce withholding amounts.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for compliance with tax regulations. For the City of Grand Rapids income tax withholding, key dates include:

- Quarterly Payment Deadlines: Employers must remit withheld taxes to the city on a quarterly basis.

- Annual Reconciliation: Employers must complete an annual reconciliation of withheld taxes by the designated deadline.

Quick guide on how to complete city of grand rapids income tax withholding

Complete City Of Grand Rapids Income Tax Withholding seamlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage City Of Grand Rapids Income Tax Withholding on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign City Of Grand Rapids Income Tax Withholding effortlessly

- Locate City Of Grand Rapids Income Tax Withholding and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to preserve your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any chosen device. Edit and eSign City Of Grand Rapids Income Tax Withholding and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of grand rapids income tax withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the grand rapids w4 form and why is it important?

The grand rapids w4 form is a crucial document used by employees in Grand Rapids to designate their tax withholding preferences. Accurately filling out this form ensures that the right amount of federal income tax is withheld from your paycheck, which helps in avoiding tax liabilities during tax season.

-

How can airSlate SignNow help with grand rapids w4 forms?

airSlate SignNow offers an efficient platform for businesses to send and eSign grand rapids w4 forms quickly and securely. With easy document tracking and a user-friendly interface, you can ensure that all employees complete their W4 forms correctly and on time.

-

What are the pricing options for using airSlate SignNow for grand rapids w4?

airSlate SignNow provides competitive pricing plans tailored to meet the needs of businesses managing grand rapids w4 forms. Depending on the features you require, plans typically start at a reasonable monthly rate, ensuring a cost-effective solution for all your document signing needs.

-

Are there any integrations available with airSlate SignNow for managing grand rapids w4?

Yes, airSlate SignNow integrates with various popular business applications, making it easier to manage grand rapids w4 forms. You can connect it with payroll systems, HR software, and cloud storage, streamlining your workflow and ensuring seamless data transfer.

-

What features does airSlate SignNow offer for grand rapids w4 management?

airSlate SignNow provides features such as customizable templates, automatic reminders, and secure cloud storage specifically for managing grand rapids w4 forms. These functionalities enhance collaboration and ensure compliance with state and federal regulations.

-

Is airSlate SignNow suitable for small businesses handling grand rapids w4?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses in Grand Rapids. Its affordability and ease of use make it an ideal solution for managing grand rapids w4 forms without overwhelming administrative burdens.

-

How secure is airSlate SignNow when signing grand rapids w4 forms?

Security is a top priority at airSlate SignNow. When signing grand rapids w4 forms, your documents are encrypted and stored securely, meeting industry standards for data protection. This ensures that sensitive employee information remains confidential and protected.

Get more for City Of Grand Rapids Income Tax Withholding

- Tenants maintenance repair request form connecticut

- Guaranty attachment to lease for guarantor or cosigner connecticut form

- Amendment to lease or rental agreement connecticut form

- Warning notice due to complaint from neighbors connecticut form

- Lease subordination agreement connecticut form

- Apartment rules and regulations connecticut form

- Agreed cancellation of lease connecticut form

- Amendment of residential lease connecticut form

Find out other City Of Grand Rapids Income Tax Withholding

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement