Gensen Choshu Hyo English Form

What is the Gensen Choshu Hyo in English?

The Gensen Choshu Hyo is a Japanese tax document that translates to "Withholding Tax Statement" in English. This form is issued by employers to employees and is essential for reporting income and taxes withheld from salaries. It serves as a summary of an employee's earnings and tax deductions for the year, providing critical information for tax filing purposes.

How to Use the Gensen Choshu Hyo in English

To utilize the Gensen Choshu Hyo effectively, employees should first ensure they receive this document from their employer at the end of the tax year. It is important to review the details for accuracy, including total income and tax withheld. This information is then used when completing tax returns, as it provides a clear record of earnings and taxes paid. Understanding how to interpret the figures on the form can aid in ensuring compliance with tax obligations.

Steps to Complete the Gensen Choshu Hyo in English

Completing the Gensen Choshu Hyo involves several key steps:

- Gather necessary information, including personal identification and income details.

- Fill out the form with accurate income figures and tax deductions.

- Double-check the entries for any errors or omissions.

- Submit the completed form to the relevant tax authority, along with any required supporting documents.

Legal Use of the Gensen Choshu Hyo in English

The Gensen Choshu Hyo is legally recognized in Japan as a valid document for tax reporting. It must be issued correctly by employers to ensure that employees can accurately report their income. The form must adhere to local tax laws and regulations, making it crucial for both employers and employees to understand their obligations regarding this document.

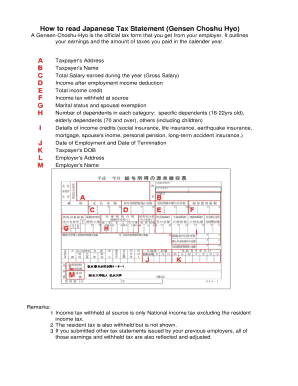

Key Elements of the Gensen Choshu Hyo in English

Key elements of the Gensen Choshu Hyo include:

- Employee's name and identification number.

- Total income earned during the fiscal year.

- Amount of tax withheld by the employer.

- Employer's name and identification number.

- Fiscal year for which the statement is issued.

IRS Guidelines

While the Gensen Choshu Hyo is specific to Japan, understanding similar IRS guidelines in the U.S. can provide context for its use. The IRS requires accurate reporting of income and taxes withheld, similar to the requirements of the Gensen Choshu Hyo. Familiarity with IRS forms, such as the W-2, can help individuals understand their obligations when filing taxes in the U.S.

Filing Deadlines / Important Dates

Filing deadlines for the Gensen Choshu Hyo typically align with the Japanese tax calendar. Employees should be aware of the deadline for submitting their tax returns, which is usually in mid-March. Keeping track of these dates is essential to avoid penalties and ensure compliance with tax regulations.

Quick guide on how to complete gensen choshu hyo english

Effortlessly prepare Gensen Choshu Hyo English on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Gensen Choshu Hyo English on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and electronically sign Gensen Choshu Hyo English without stress

- Find Gensen Choshu Hyo English and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Gensen Choshu Hyo English and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gensen choshu hyo english

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'gensen in english' and how is it relevant to airSlate SignNow?

'Gensen in english' refers to the detailed breakdown of earnings that can include various deductions. airSlate SignNow helps businesses manage these documents effectively by allowing users to securely eSign and send them, ensuring compliance and clarity in financial transactions.

-

How does airSlate SignNow improve the handling of financial documents like 'gensen in english'?

With airSlate SignNow, users can streamline the process of handling 'gensen in english' documents by utilizing eSignature features. This saves time and reduces the need for paper documents, making it easier to manage payroll and financial records electronically.

-

What pricing plans does airSlate SignNow offer for handling documents related to 'gensen in english'?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting from a free trial and scaling to premium plans. This allows users to choose a plan that best suits their volume of 'gensen in english' document management and eSigning needs.

-

Can airSlate SignNow integrate with other financial software for managing 'gensen in english'?

Yes, airSlate SignNow provides easy integrations with popular accounting and financial management software. This allows users to import, export, and manage 'gensen in english' data seamlessly across platforms, enhancing overall productivity.

-

What features does airSlate SignNow offer that are useful for 'gensen in english'?

airSlate SignNow includes features such as customizable templates, document analytics, and secure cloud storage. These features are particularly beneficial for managing 'gensen in english' documents efficiently and ensuring that all necessary information is easily accessible.

-

Is airSlate SignNow secure for sending 'gensen in english' related documents?

Absolutely! airSlate SignNow employs top-notch security measures, including encryption and multifactor authentication, to protect sensitive documents like 'gensen in english'. Users can confidently send and store their critical financial information without compromising security.

-

How user-friendly is airSlate SignNow for accessing 'gensen in english' documents?

airSlate SignNow is designed with ease of use in mind, making it simple for anyone to access and manage 'gensen in english' documents. The intuitive interface allows users to navigate quickly, ensuring that eSigning and document management tasks can be completed efficiently.

Get more for Gensen Choshu Hyo English

- Tonsillectomy referral form patient name southend nhs

- Reportlet co uk03517244worthing homes limitedworthing homes limited in north street bn11 1er form

- Greeley police department greeley co address and phone form

- Ao 367 solicitationofferacceptance u s district court for the cod uscourts form

- Ccdf temple form

- Cover sheet for protection order no contact order form

- Referral for services southside obgyn form

- Release of medical records authorization allergy and asthma form

Find out other Gensen Choshu Hyo English

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney