Form No 1 Partner Ship Act 1932

What is the Form No 1 Partnership Act 1932

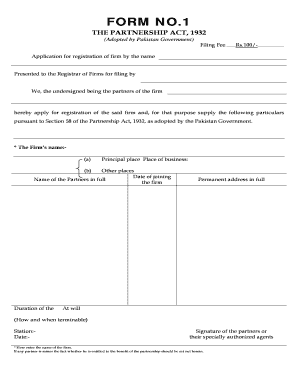

The Form No 1 Partnership Act 1932 is a legal document used for the registration of partnerships in accordance with the Partnership Act of 1932. This form is essential for formalizing the partnership agreement between two or more individuals who wish to operate a business together. It outlines the rights, responsibilities, and obligations of each partner, ensuring that all parties are aware of their roles within the partnership.

How to use the Form No 1 Partnership Act 1932

To effectively use the Form No 1 Partnership Act 1932, individuals must first gather all necessary information about the partnership, including the names and addresses of all partners, the nature of the business, and the duration of the partnership. Once this information is collected, partners can fill out the form accurately, ensuring that all details are correct to avoid any legal complications. After completing the form, it must be submitted to the appropriate state authority for registration.

Steps to complete the Form No 1 Partnership Act 1932

Completing the Form No 1 Partnership Act 1932 involves several key steps:

- Gather necessary information about the partnership.

- Fill out the form with accurate details, including partner names and business information.

- Review the completed form for any errors or omissions.

- Sign the form where required by all partners.

- Submit the form to the relevant state authority for registration.

Legal use of the Form No 1 Partnership Act 1932

The legal use of the Form No 1 Partnership Act 1932 is crucial for establishing a valid partnership. Once registered, the partnership gains legal recognition, allowing it to operate as a business entity. This form serves as a binding agreement that can be referred to in case of disputes among partners or in legal proceedings. It is important to ensure compliance with local laws and regulations when using this form.

Key elements of the Form No 1 Partnership Act 1932

Key elements of the Form No 1 Partnership Act 1932 include:

- Names and addresses of all partners.

- The name of the partnership.

- The nature of the business.

- The duration of the partnership.

- Capital contribution of each partner.

- Profit and loss sharing ratios.

Required Documents

When completing the Form No 1 Partnership Act 1932, certain documents may be required to support the application. These typically include:

- Identification documents for each partner.

- Proof of address for each partner.

- Any prior partnership agreements, if applicable.

- Business licenses or permits, if needed.

Quick guide on how to complete form no 1 partner ship act 1932

Effortlessly Prepare Form No 1 Partner Ship Act 1932 on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the proper format and securely store it on the web. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents rapidly without any delays. Handle Form No 1 Partner Ship Act 1932 on any platform with airSlate SignNow’s mobile applications for Android or iOS and enhance any document-focused procedure today.

How to Edit and eSign Form No 1 Partner Ship Act 1932 with Ease

- Locate Form No 1 Partner Ship Act 1932 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to share your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Form No 1 Partner Ship Act 1932 and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 1 partner ship act 1932

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the form no 1 partnership act 1932?

The form no 1 under the Partnership Act 1932 is used to register a partnership firm in India. This form includes essential details about the partnership agreement, the partners, and the business operations. Understanding its significance is crucial for legal compliance and ensuring your business operates smoothly.

-

How can airSlate SignNow assist with completing the form no 1 partnership act 1932?

airSlate SignNow provides an intuitive platform for businesses to fill out and eSign important documents like the form no 1 partnership act 1932. Our platform streamlines the process, making it easier to collaborate with partners and ensure all required details are captured accurately. You can save time and reduce errors with our user-friendly interface.

-

What features does airSlate SignNow offer for document management related to the form no 1 partnership act 1932?

Our platform includes features such as document templates, automated workflows, team collaboration tools, and eSignature capabilities, all designed to simplify the management of documents like the form no 1 partnership act 1932. With secure cloud storage, users can access important documents anytime, ensuring seamless business operations.

-

Is there a cost associated with using airSlate SignNow for processing the form no 1 partnership act 1932?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, making the platform a cost-effective solution for processing documents like the form no 1 partnership act 1932. Our flexible pricing structure ensures you are only paying for the features you need, allowing businesses of all sizes to benefit from our services.

-

What are the benefits of using airSlate SignNow for the form no 1 partnership act 1932?

Using airSlate SignNow to manage the form no 1 partnership act 1932 allows for increased efficiency through easy eSigning and document management. Our platform enhances security, provides legal compliance, and eliminates the need for physical document handling. These benefits collectively ensure that your partnership registration process is smooth and reliable.

-

Can airSlate SignNow integrate with other tools to manage the form no 1 partnership act 1932?

Absolutely! airSlate SignNow offers integrations with various business tools and systems, allowing for streamlined management of documents like the form no 1 partnership act 1932. Whether you use CRM systems or cloud storage solutions, our platform can seamlessly connect with them to enhance your workflow.

-

What types of businesses can benefit from using airSlate SignNow for the form no 1 partnership act 1932?

Any business planning to register a partnership in India can benefit from using airSlate SignNow for the form no 1 partnership act 1932. This includes startups, small and medium-sized enterprises, and even larger corporations seeking efficient document management solutions. Our platform caters to diverse industries and business needs.

Get more for Form No 1 Partner Ship Act 1932

- Satisfactory progress appeal form oftc edu oftc

- Spanish internship student deliver this form to the placement site supervisor then return completed original to their faculty

- Calculadora igs interamericana form

- Missed punch exception form

- Financial aid office p o box 14007 salem or 9730 form

- Request for official transcript pensacola state form

- Course waiver form lim college limcollege

- Asset management equipment disposal form

Find out other Form No 1 Partner Ship Act 1932

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document