941 for Fillable Form

What is the fillable 941x form?

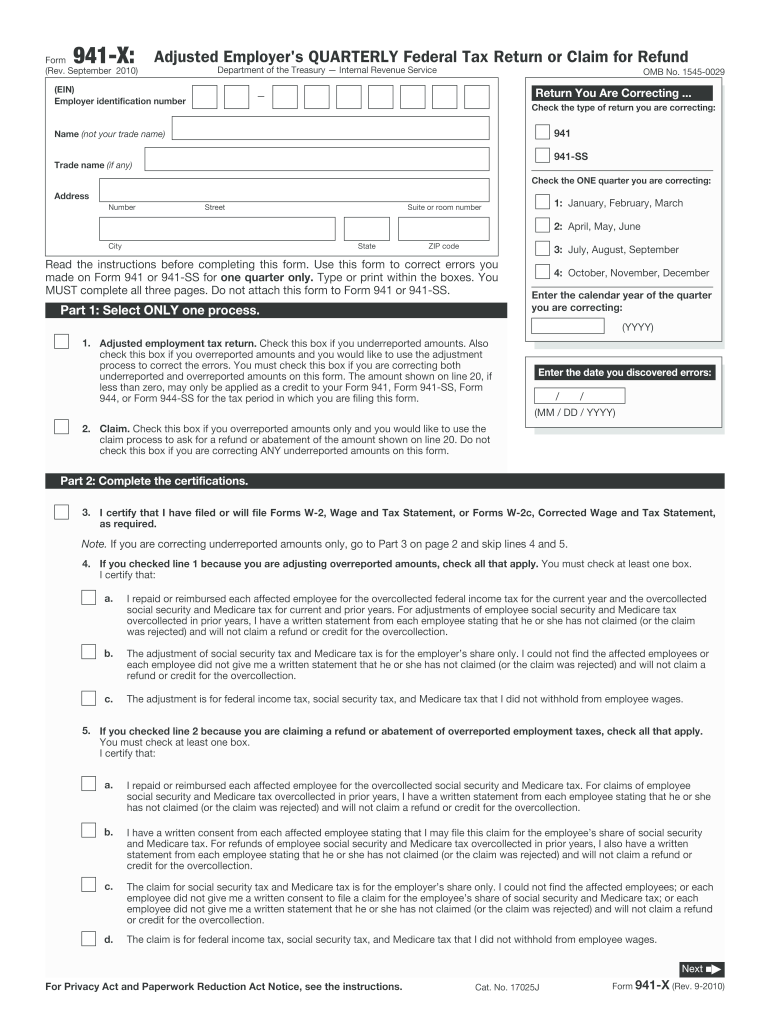

The fillable 941x form is an amended version of the IRS Form 941, which is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form allows employers to correct errors made on previously filed 941 forms. The 941x fillable form is essential for ensuring accurate reporting and compliance with federal tax regulations. It is particularly useful for businesses that need to adjust their tax liabilities due to overreporting or underreporting of wages or tax amounts.

Steps to complete the fillable 941x form

Completing the fillable 941x form involves several key steps:

- Gather necessary information, including your Employer Identification Number (EIN) and details from the original Form 941.

- Indicate the quarter for which you are amending the return.

- Fill in the corrected amounts in the appropriate fields, ensuring accuracy to avoid further amendments.

- Provide explanations for the changes made, detailing the reasons for adjustments.

- Review the completed form for any errors or omissions before submission.

Legal use of the fillable 941x form

The fillable 941x form is legally binding when completed correctly and submitted to the IRS. It must comply with the legal requirements set forth by the IRS, including accurate reporting of tax information and adherence to deadlines. Employers are responsible for ensuring that the information provided is truthful and complete. Failure to comply with these requirements may result in penalties or fines from the IRS.

Filing deadlines for the fillable 941x form

Filing deadlines for the 941x form align with the original Form 941 deadlines. Typically, employers must file Form 941 quarterly. If an amendment is necessary, the 941x form should be submitted as soon as the error is discovered. The IRS allows employers to file the 941x form within three years from the due date of the original Form 941 or within two years from the date the tax was paid, whichever is later.

Examples of using the fillable 941x form

Employers may need to use the fillable 941x form in various scenarios, such as:

- Correcting reported wages due to an employee's misclassification.

- Adjusting tax amounts after discovering an error in payroll calculations.

- Updating information after receiving a notice from the IRS regarding discrepancies.

Who issues the fillable 941x form?

The fillable 941x form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. Employers can obtain the form directly from the IRS website or through authorized tax software that supports electronic filing of amended returns.

Quick guide on how to complete 941 for 2010 fillable form

Effortlessly Prepare 941 For Fillable Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the right form and securely store it on the web. airSlate SignNow provides you with all the tools needed to quickly create, modify, and eSign your documents without delays. Manage 941 For Fillable Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based task today.

How to Modify and eSign 941 For Fillable Form with Ease

- Find 941 For Fillable Form and click on Get Form to begin.

- Utilize the provided tools to complete your form.

- Emphasize important parts of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal significance as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to submit your form, either via email, SMS, invitation link, or download it to your PC.

Eliminate worries about lost or misplaced files, frustrating form navigation, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign 941 For Fillable Form while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

What do you put on Schedule B when filling out Form 941?

Form 941 Schedule B can be filled out in 5 steps:1. Enter business info (Name and EIN)2. Choose tax year/quarter3. Select the quarter you’re filing for4. Enter your tax liability by semi-weekly & total liability for the quarter5. Attach to Form 941 & transmit to the IRS(these instructions work best when paired with TaxBandits e-filing)

-

How much would an accountant charge me for filling out a Quarterly Federal Tax Return (941) in Texas?

For full service payroll I charge $100 per month for up to 5 employees. That includes filing the federal and state quarterly returns and year end W2's.If you just need the 941 completed and you have all of your payroll records in order, then the fee would be $50 to prepare the form for you. Note that you also need to file a quarterly return with TWC if you have Texas employees.

-

How do I transfer data from Google Sheets cells to a PDF fillable form?

I refer you a amazing pdf editor, her name is Puspita, She work in fiverr, She is just amazing, Several time I am use her services. You can contact with her.puspitasaha : I will create fillable pdf form or edit pdf file for $5 on www.fiverr.com

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

Create this form in 5 minutes!

How to create an eSignature for the 941 for 2010 fillable form

How to generate an electronic signature for your 941 For 2010 Fillable Form online

How to create an electronic signature for the 941 For 2010 Fillable Form in Chrome

How to generate an eSignature for putting it on the 941 For 2010 Fillable Form in Gmail

How to make an electronic signature for the 941 For 2010 Fillable Form right from your smart phone

How to generate an electronic signature for the 941 For 2010 Fillable Form on iOS

How to create an electronic signature for the 941 For 2010 Fillable Form on Android

People also ask

-

What is a fillable 941x form, and why is it important?

A fillable 941x form is a modified version of the IRS Form 941 that allows businesses to correct previously filed quarterly federal tax returns. It is crucial for ensuring that your company's tax filings are accurate and compliant, preventing potential penalties and audits. Using a fillable format streamlines the process, making it easier to update and submit corrections.

-

How can airSlate SignNow help me with my fillable 941x form?

airSlate SignNow simplifies the process of creating and signing your fillable 941x form. With our easy-to-use platform, you can fill out the form electronically, ensuring accuracy and saving time. Plus, you can securely send it to recipients for eSignature, making compliance more efficient.

-

Is there a cost associated with using the fillable 941x form feature in airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to suit your business needs, including features for handling fillable 941x forms. Our cost-effective solution ensures that you get maximum value, combining document signing and management capabilities all in one platform. Explore our pricing options to find the perfect plan for your business.

-

Can I integrate airSlate SignNow with my existing software for fillable 941x forms?

Absolutely! airSlate SignNow offers integrations with popular software applications, allowing for seamless workflow automation with your fillable 941x form. Whether you're using accounting software or management tools, our platform makes it easy to incorporate eSigning and document handling effortlessly.

-

What file formats can I use to create a fillable 941x form?

You can create a fillable 941x form using various popular file formats, including PDF and Word documents. airSlate SignNow supports these formats, making it simple to upload existing forms and transform them into fillable documents. This flexibility helps you maintain consistency in your tax documentation.

-

Is my data secure when using airSlate SignNow for fillable 941x forms?

Yes, airSlate SignNow prioritizes data security, ensuring that your fillable 941x form is protected. Our platform uses advanced encryption methods and complies with industry standards to safeguard your information. You can confidently send and receive documents knowing that your data is secure.

-

Can multiple users collaborate on a fillable 941x form with airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on a fillable 941x form seamlessly. This feature enables your team to work together, making edits and providing eSignatures as needed. Collaboration is intuitive and efficient, helping your business stay organized during the tax correction process.

Get more for 941 For Fillable Form

Find out other 941 For Fillable Form

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed