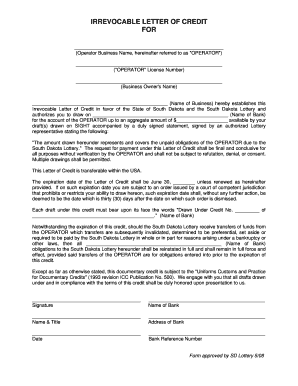

Irrevocable Letter of Credit Form

What is the irrevocable letter of credit?

An irrevocable letter of credit is a financial document issued by a bank that guarantees payment to a seller on behalf of a buyer, provided that the seller meets specific terms and conditions outlined in the letter. Unlike a revocable letter of credit, once issued, it cannot be altered or cancelled without the consent of all parties involved. This type of letter offers security to both buyers and sellers in international trade transactions.

Key elements of the irrevocable letter of credit

The irrevocable letter of credit includes several critical components that define its terms:

- Beneficiary: The individual or entity entitled to receive payment.

- Applicant: The buyer who requests the letter from the bank.

- Issuing bank: The bank that issues the letter of credit on behalf of the applicant.

- Amount: The total sum guaranteed by the letter of credit.

- Expiration date: The date by which the seller must present the required documents to receive payment.

- Terms and conditions: Specific requirements that must be met for the payment to be executed.

Steps to complete the irrevocable letter of credit

Completing an irrevocable letter of credit involves several steps to ensure that all parties are protected and that the transaction proceeds smoothly:

- Initiate the request: The buyer contacts their bank to request the issuance of an irrevocable letter of credit.

- Provide necessary documentation: The buyer submits all required documents, including details of the transaction and the seller's information.

- Review terms: The bank reviews the terms and conditions to ensure compliance with legal and financial standards.

- Issue the letter: Once approved, the bank issues the irrevocable letter of credit to the seller's bank.

- Document presentation: The seller presents the required documents to their bank for payment.

- Payment execution: The issuing bank verifies the documents and releases payment to the seller.

How to use the irrevocable letter of credit

Using an irrevocable letter of credit effectively requires understanding its purpose and the process involved:

- For buyers: This letter provides assurance to sellers that payment will be made once the terms are fulfilled, thereby encouraging them to proceed with the transaction.

- For sellers: It acts as a guarantee of payment, allowing them to ship goods or provide services with confidence.

- For banks: The bank acts as an intermediary, ensuring that the terms of the letter are met before releasing funds.

Legal use of the irrevocable letter of credit

The irrevocable letter of credit is governed by international trade laws and regulations, making it a legally binding document. It is essential for all parties to understand their rights and obligations under the letter. Compliance with the Uniform Commercial Code (UCC) and the International Chamber of Commerce (ICC) rules is crucial to ensure that the letter is enforceable in a court of law.

Examples of using the irrevocable letter of credit

Real-world scenarios illustrate the application of an irrevocable letter of credit:

- International trade: A U.S. importer uses an irrevocable letter of credit to purchase machinery from a manufacturer in Germany, ensuring payment upon delivery and compliance with specified terms.

- Real estate transactions: A buyer may use an irrevocable letter of credit to secure financing for a property purchase, assuring the seller of payment upon closing.

Quick guide on how to complete irrevocable letter of credit 136575

Complete Irrevocable Letter Of Credit effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Irrevocable Letter Of Credit on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Irrevocable Letter Of Credit seamlessly

- Obtain Irrevocable Letter Of Credit and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method to distribute your form, whether by email, SMS, invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Irrevocable Letter Of Credit and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irrevocable letter of credit 136575

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an irrevocable letter of credit example?

An irrevocable letter of credit example refers to a financial document that guarantees a buyer's payment to a seller, which cannot be canceled without mutual consent. This document is vital in international trade, as it assures the seller that they will receive their payment on time and under specified conditions.

-

How does airSlate SignNow support the use of irrevocable letters of credit?

airSlate SignNow streamlines the process of creating and signing irrevocable letters of credit by providing a user-friendly eSignature platform. With our solution, businesses can easily draft, send, and manage these signNow documents digitally, ensuring compliance and security while saving time.

-

What are the pricing options for using airSlate SignNow for irrevocable letters of credit?

airSlate SignNow offers a range of pricing plans that cater to different business needs, ensuring you can find a suitable option for managing irrevocable letters of credit. Each plan provides access to essential features, enabling seamless eSigning and document management at competitive rates.

-

Can I customize the irrevocable letter of credit example template in airSlate SignNow?

Yes, you can customize the irrevocable letter of credit example template in airSlate SignNow. Our platform allows you to modify documents by adding specific terms, conditions, and branding elements that align with your business requirements, ensuring personalized and professional outputs.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers robust features for document management, including the ability to store, track, and manage your irrevocable letters of credit in a secure cloud environment. With automated reminders, in-depth analytics, and an intuitive interface, you can efficiently oversee all your important transactions.

-

Is it easy to integrate airSlate SignNow with existing tools for managing letters of credit?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications and productivity tools. This flexibility allows you to incorporate your existing systems into our platform, making it easier to manage irrevocable letters of credit alongside your other business workflows.

-

What are the benefits of using an electronic irrevocable letter of credit?

Using an electronic irrevocable letter of credit simplifies and accelerates the transaction process, reducing paperwork and minimizing errors. Moreover, it enhances security, providing a transparent trail of documentation that facilitates efficient audits and compliance checks, thus benefiting all parties involved.

Get more for Irrevocable Letter Of Credit

- Iowa disclaimer 497304899 form

- Notice to owner of dwelling individual iowa form

- Quitclaim deed by two individuals to corporation iowa form

- Warranty deed from two individuals to corporation iowa form

- Ia corporation llc form

- Demand to record satisfaction individual iowa form

- Quitclaim deed from individual to corporation iowa form

- Warranty deed from individual to corporation iowa form

Find out other Irrevocable Letter Of Credit

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online