Tip Affidavit Form

What is the Tip Affidavit

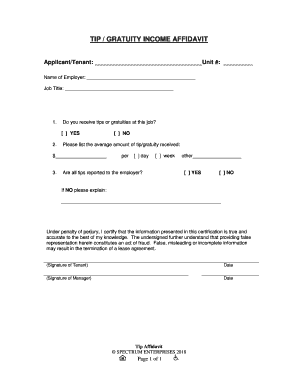

The tip affidavit is a legal document used primarily by employees in the service industry to report their tips accurately for tax purposes. This form serves as an official declaration of the tips received, ensuring compliance with Internal Revenue Service (IRS) guidelines. By submitting a tip affidavit, employees can provide a clear record of their earnings, which is crucial for both tax reporting and employer record-keeping.

How to use the Tip Affidavit

To utilize the tip affidavit effectively, employees should first gather all relevant information regarding their tip earnings over a specific period. This includes cash tips, tips received through credit cards, and any other forms of gratuities. Once the information is compiled, the employee should fill out the affidavit accurately, ensuring that all amounts are reported truthfully. After completing the form, it should be submitted to the employer or relevant tax authorities as required.

Steps to complete the Tip Affidavit

Completing the tip affidavit involves several key steps:

- Gather all documentation related to tip earnings, including daily log sheets or receipts.

- Fill in personal information such as name, address, and Social Security number.

- Report the total amount of tips received during the specified period.

- Sign and date the affidavit to validate the information provided.

- Submit the completed affidavit to your employer or the appropriate tax authority.

Legal use of the Tip Affidavit

The legal use of the tip affidavit is essential for ensuring compliance with tax laws. By accurately reporting tips, employees fulfill their obligations under the law, thereby avoiding potential penalties or audits. The affidavit acts as a protective measure, demonstrating that the employee has made a good faith effort to report all earnings. Employers also benefit from receiving accurate records, which helps in calculating payroll taxes and ensuring proper tax withholding.

IRS Guidelines

The IRS has specific guidelines regarding the reporting of tips, which are crucial for employees to understand. According to IRS regulations, any employee who receives tips must report them to their employer if the total amount exceeds twenty dollars in a month. The tip affidavit serves as a formal method of reporting these earnings, and adherence to IRS guidelines is vital for maintaining compliance and avoiding tax-related issues.

Required Documents

When preparing to complete a tip affidavit, several documents may be required to ensure accuracy:

- Daily tip logs or records of tips received.

- Pay stubs or other income documentation.

- Previous tax returns, if applicable.

- Any correspondence from the IRS regarding tip reporting.

Penalties for Non-Compliance

Failure to accurately report tips can lead to significant penalties from the IRS. Employees may face fines, interest on unpaid taxes, and potential audits if discrepancies arise. Additionally, employers may also be held liable for not ensuring that their employees report tips correctly. Therefore, completing and submitting the tip affidavit is a critical step in maintaining compliance with tax regulations.

Quick guide on how to complete tip affidavit

Prepare Tip Affidavit effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can acquire the necessary form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents promptly without any delays. Handle Tip Affidavit on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric workflows today.

The easiest way to edit and electronically sign Tip Affidavit with ease

- Obtain Tip Affidavit and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Verify all the information and then click the Done button to save your changes.

- Select your preferred method of sending your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Tip Affidavit and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tip affidavit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tip affidavit and how does it work?

A tip affidavit is a legal document used to affirm the accuracy of specific information provided about tips received, often in a business setting. With airSlate SignNow, you can easily create, send, and eSign tip affidavits, ensuring that all necessary details are accurately documented and securely stored.

-

How can airSlate SignNow streamline the creation of tip affidavits?

airSlate SignNow provides intuitive templates and editing tools that make the process of creating tip affidavits quick and efficient. You can customize your affidavits to include relevant fields, ensuring that all required information is easily captured in a professional format.

-

Is there a cost associated with using airSlate SignNow for tip affidavits?

airSlate SignNow offers affordable pricing plans that cater to various business needs. You can assess the different subscription levels to find an option that fits your budget and provides access to features for managing tip affidavits and other documents.

-

What features does airSlate SignNow offer for managing tip affidavits?

airSlate SignNow includes features such as eSignature capabilities, document sharing, and cloud storage that enhance the management of tip affidavits. These tools not only make the signing process easier but also ensure that all documents are securely accessible from anywhere.

-

Can I integrate airSlate SignNow with other tools for handling tip affidavits?

Yes, airSlate SignNow offers integrations with various popular business applications that enhance its functionality. This enables you to incorporate tip affidavit management into your existing workflows seamlessly, helping maintain efficiency across your operations.

-

How secure is my data when using airSlate SignNow for tip affidavits?

Security is a top priority for airSlate SignNow, which employs robust encryption and compliance measures to protect your data. When you create and store tip affidavits, you can be confident that your sensitive information is secure from unauthorized access.

-

Can airSlate SignNow help me track the status of my tip affidavits?

Absolutely! airSlate SignNow provides real-time tracking features that allow you to monitor the status of your tip affidavits throughout the signing process. You'll receive notifications as soon as documents are viewed and signed, helping you stay informed.

Get more for Tip Affidavit

- Quitclaim deed by two individuals to husband and wife idaho form

- Warranty deed from two individuals to husband and wife idaho form

- Order dismissing claim without prejudice lack of service idaho form

- Idaho summons form

- Idaho intestate succession form

- Quitclaim deed by two individuals to llc idaho form

- Warranty deed from two individuals to llc idaho form

- Quitclaim deed by two individuals to corporation idaho form

Find out other Tip Affidavit

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself