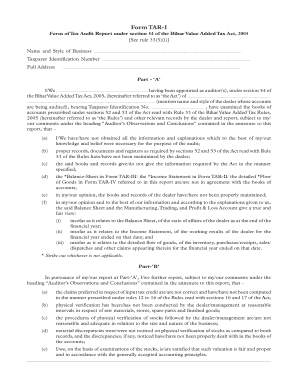

Biharcommercialtax Gov Inihar Form

What is the Biharcommercialtax Gov Inihar

The Biharcommercialtax Gov Inihar is an official online platform that provides information and services related to commercial tax in Bihar. This platform is essential for businesses operating in the state, as it facilitates the filing and management of commercial tax obligations. Users can access various resources, including tax rates, forms, and guidelines necessary for compliance with state tax regulations.

Steps to complete the Biharcommercialtax Gov Inihar

Completing the Biharcommercialtax Gov Inihar involves several key steps to ensure accurate and timely filing. First, users should gather all necessary documentation, such as sales records and previous tax returns. Next, log into the Biharcommercialtax Gov Inihar website and navigate to the appropriate section for commercial tax. Fill out the required forms with accurate information, ensuring all fields are completed. Finally, review the submission for accuracy before submitting it electronically. This process helps maintain compliance with state tax laws.

Legal use of the Biharcommercialtax Gov Inihar

The legal use of the Biharcommercialtax Gov Inihar is governed by state regulations that outline the requirements for electronic filing and documentation. To ensure that submissions are legally binding, users must comply with the guidelines set forth by the state tax authority. This includes using a secure electronic signature, which verifies the identity of the signer and ensures the integrity of the submitted documents. Compliance with these legal frameworks helps protect both the taxpayer and the state from potential disputes.

Required Documents

When filing through the Biharcommercialtax Gov Inihar, certain documents are essential to ensure a smooth process. These typically include:

- Sales invoices and receipts

- Previous tax returns

- Business registration documents

- Financial statements

Having these documents ready will facilitate the completion of forms and help in maintaining accurate records for tax purposes.

Form Submission Methods (Online / Mail / In-Person)

Submissions for the Bihar commercial tax can be made through various methods. The primary method is online submission via the Biharcommercialtax Gov Inihar platform, which offers a streamlined process. Alternatively, businesses may choose to submit forms by mail or in-person at designated tax offices. Each method has its own set of guidelines and timelines, so it is important to select the one that best suits the business's needs.

Penalties for Non-Compliance

Failure to comply with the requirements set forth by the Biharcommercialtax Gov Inihar can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to stay informed about their tax obligations and ensure timely submissions to avoid these consequences. Understanding the penalties associated with non-compliance can help motivate timely and accurate tax filings.

Quick guide on how to complete biharcommercialtax gov inihar

Complete Biharcommercialtax Gov Inihar effortlessly on any device

Digital document management has gained traction among enterprises and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Biharcommercialtax Gov Inihar across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Biharcommercialtax Gov Inihar with ease

- Obtain Biharcommercialtax Gov Inihar and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then hit the Done button to save your changes.

- Select your preferred method to submit your form: via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Biharcommercialtax Gov Inihar and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the biharcommercialtax gov inihar

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is bihar commercial tax and why is it important for businesses?

Bihar commercial tax refers to the tax levied on the sale of goods and services within the state of Bihar. It is crucial for businesses to comply with this tax to avoid penalties and legal issues. Understanding the bihar commercial tax helps businesses manage their finances effectively and maintain good standing with the state.

-

How can airSlate SignNow assist with managing bihar commercial tax documents?

AirSlate SignNow offers a streamlined process for sending and eSigning documents related to bihar commercial tax. Our easy-to-use platform enables businesses to prepare, sign, and store tax-related documents securely, ensuring compliance with the state's regulations while saving time and resources.

-

What features does airSlate SignNow offer for handling bihar commercial tax paperwork?

AirSlate SignNow provides features like customizable templates, automated reminders, and secure cloud storage, specifically designed to handle bihar commercial tax paperwork efficiently. These tools simplify the documentation process, ensuring that tax submissions are timely and compliant with state requirements.

-

Is airSlate SignNow cost-effective for small businesses managing bihar commercial tax?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their bihar commercial tax documents. With affordable pricing plans and no hidden fees, businesses can streamline their tax processes without straining their budgets.

-

Can airSlate SignNow integrate with other software for bihar commercial tax management?

Absolutely, airSlate SignNow integrates seamlessly with various accounting and financial software to manage bihar commercial tax more efficiently. By integrating these systems, businesses can automate their tax calculations and submissions, reducing manual errors and saving time.

-

What are the benefits of using airSlate SignNow for bihar commercial tax compliance?

Using airSlate SignNow for bihar commercial tax compliance provides numerous benefits, including enhanced document security, reduced turnaround times, and improved accuracy. Our platform ensures that all tax-related documents are securely signed and stored, helping businesses stay compliant easily.

-

How does airSlate SignNow ensure the security of bihar commercial tax documents?

AirSlate SignNow prioritizes security with advanced encryption and secure cloud storage for all bihar commercial tax documents. Our platform adheres to strict data protection standards to ensure that sensitive information remains confidential and protected from unauthorized access.

Get more for Biharcommercialtax Gov Inihar

- 5 county complex court suite 170 prince william va 22192 form

- Www texasattorneygeneral govesmanutencion ninosmanutencin de niosoffice of the attorney general form

- Child support servicessolicitud de servicios de ch form

- Dma 5202asp ia pdf apndice a coberta de salud de empleos form

- Printable io waiver shared living documentation sheets form

- Disability report adult form

- Idapa 16 03 19 101 form

- Application part b form

Find out other Biharcommercialtax Gov Inihar

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast