Mortgage Underwriting Checklist Template Form

What is the mortgage underwriting checklist template

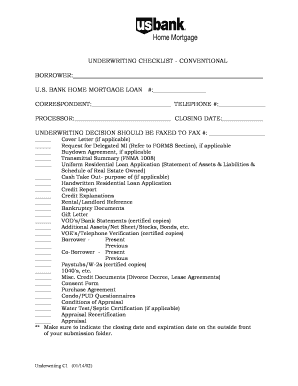

The mortgage underwriting checklist template is a structured document designed to guide mortgage underwriters through the essential steps of evaluating a loan application. This template typically includes a comprehensive list of criteria that must be met to assess the borrower's financial stability, creditworthiness, and overall eligibility for a mortgage. By standardizing the underwriting process, this checklist helps ensure that all necessary information is collected and reviewed, promoting consistency and efficiency in loan processing.

How to use the mortgage underwriting checklist template

Using the mortgage underwriting checklist template involves several key steps. First, gather all relevant documents from the borrower, including income statements, credit reports, and asset documentation. Next, systematically review each item on the checklist to ensure all necessary information is complete and accurate. It is essential to verify the borrower’s financial details against the checklist items, such as debt-to-income ratios and employment history. Finally, once all criteria are satisfied, the underwriter can make an informed decision regarding the loan application.

Key elements of the mortgage underwriting checklist template

The key elements of a mortgage underwriting checklist template typically include:

- Borrower Information: Personal details, employment status, and income verification.

- Credit Analysis: Credit score, credit history, and any outstanding debts.

- Property Details: Appraisal value, property type, and location.

- Financial Ratios: Debt-to-income ratio and loan-to-value ratio calculations.

- Documentation Requirements: List of required documents for verification.

Steps to complete the mortgage underwriting checklist template

Completing the mortgage underwriting checklist template involves a systematic approach:

- Collect all necessary documentation from the borrower.

- Review each item on the checklist for completeness.

- Verify the accuracy of financial details provided.

- Assess the borrower’s creditworthiness against established guidelines.

- Document any discrepancies or additional information needed.

- Make a final determination based on the checklist outcomes.

Legal use of the mortgage underwriting checklist template

The legal use of the mortgage underwriting checklist template is crucial for ensuring compliance with federal and state regulations. The checklist must adhere to guidelines set forth by agencies such as the Consumer Financial Protection Bureau (CFPB) and the Federal Housing Administration (FHA). Proper completion of the checklist not only facilitates a transparent underwriting process but also protects both the lender and borrower by ensuring that all legal requirements are met, thus minimizing the risk of disputes or legal challenges.

Required documents

When utilizing the mortgage underwriting checklist template, certain documents are typically required to support the underwriting process. These may include:

- Two years of tax returns

- Recent pay stubs or proof of income

- Bank statements for the last two months

- Credit report

- Property appraisal report

Quick guide on how to complete mortgage underwriting checklist template

Prepare Mortgage Underwriting Checklist Template effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and seamlessly. Manage Mortgage Underwriting Checklist Template on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Mortgage Underwriting Checklist Template without hassle

- Locate Mortgage Underwriting Checklist Template and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow.

- Generate your signature with the Sign function, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign Mortgage Underwriting Checklist Template and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage underwriting checklist template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mortgage underwriting checklist template?

A mortgage underwriting checklist template is a standardized document that outlines the necessary information and documentation required for processing a mortgage application. This template helps ensure that all key elements are considered during the underwriting process, improving efficiency and accuracy.

-

How can I use the mortgage underwriting checklist template with airSlate SignNow?

You can easily integrate the mortgage underwriting checklist template with airSlate SignNow to streamline your document management process. Simply upload the template, customize it to fit your needs, and utilize our eSigning features for a seamless experience.

-

What are the benefits of using a mortgage underwriting checklist template?

Using a mortgage underwriting checklist template allows for greater organization and ensures no critical documents are overlooked during the underwriting process. Furthermore, it helps improve communication between lenders and borrowers, fostering a smoother transaction.

-

Is the mortgage underwriting checklist template customizable?

Yes, airSlate SignNow allows you to fully customize your mortgage underwriting checklist template. You can add or remove fields, modify formatting, and tailor the content according to your specific underwriting requirements.

-

What integrations does airSlate SignNow offer for the mortgage underwriting checklist template?

airSlate SignNow integrates seamlessly with various platforms, allowing you to enhance the functionality of your mortgage underwriting checklist template. You can connect with popular tools such as CRM systems, cloud storage services, and accounting software to create a comprehensive workflow.

-

How secure is the mortgage underwriting checklist template in airSlate SignNow?

The mortgage underwriting checklist template in airSlate SignNow is protected by top-notch security measures. We utilize encryption protocols and access controls to ensure that your sensitive information remains secure while handling important documents.

-

What is the pricing for using the mortgage underwriting checklist template?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for users who need access to a mortgage underwriting checklist template. Contact our sales team for detailed pricing information and to find a plan that suits your business.

Get more for Mortgage Underwriting Checklist Template

- Legal last will and testament form for a single person with minor children illinois

- Illinois legal adult form

- Legal last will and testament form for single person with adult children illinois

- Legal last will and testament for married person with minor children from prior marriage illinois form

- Legal last will and testament for civil union partner with minor children from prior marriage illinois form

- Legal last will and testament form for married person with adult children from prior marriage illinois

- Legal last will and testament form for divorced person not remarried with adult children illinois

- Legal last will and testament form for civil union partner with adult children from prior marriage illinois

Find out other Mortgage Underwriting Checklist Template

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template