Legal Last Will and Testament Form for Single Person with Adult Children Illinois

What is the Legal Last Will And Testament Form For Single Person With Adult Children Illinois

The Legal Last Will and Testament Form for a single person with adult children in Illinois is a legal document that outlines how an individual wishes to distribute their assets upon their death. This form is specifically designed for individuals who are single and have adult children, ensuring that their wishes regarding inheritance are clearly stated. The will typically includes provisions for the appointment of an executor, who will be responsible for managing the estate and ensuring that the terms of the will are carried out. It is important for this document to meet the legal requirements set forth by the state of Illinois to be considered valid and enforceable.

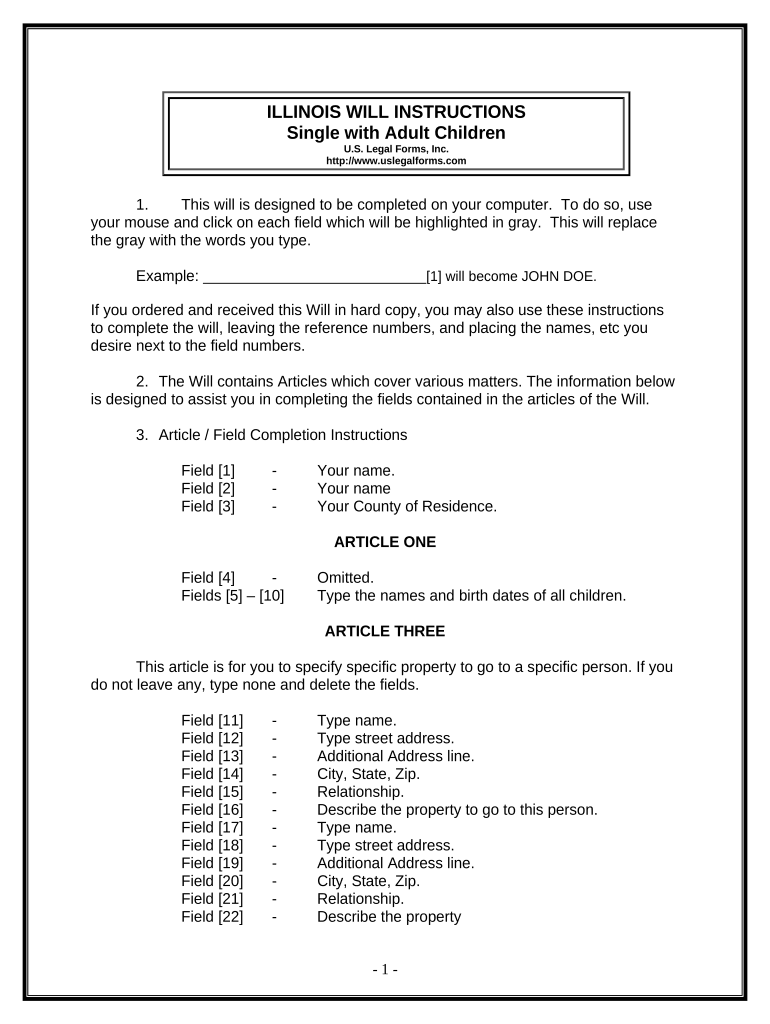

How to Use the Legal Last Will And Testament Form For Single Person With Adult Children Illinois

Using the Legal Last Will and Testament Form involves several key steps. First, individuals must gather information about their assets, debts, and any specific bequests they wish to make. Next, they should complete the form by providing necessary details such as their name, address, and the names of their adult children. It is crucial to clearly outline how assets will be divided among beneficiaries. After filling out the form, the individual must sign it in the presence of at least two witnesses, who must also sign the document. This process ensures that the will is legally binding in Illinois.

Key Elements of the Legal Last Will And Testament Form For Single Person With Adult Children Illinois

Key elements of the Legal Last Will and Testament Form include the testator's name and address, a declaration that the document is their last will, and the appointment of an executor. Additionally, the form should specify how assets are to be distributed among the adult children, including any specific gifts or bequests. It is also essential to include a clause that revokes any prior wills. A well-structured will may also contain provisions for guardianship of any dependents, although this may not apply to single individuals with adult children. Ensuring these elements are present helps to prevent disputes and confusion after the individual's passing.

Steps to Complete the Legal Last Will And Testament Form For Single Person With Adult Children Illinois

Completing the Legal Last Will and Testament Form involves a series of straightforward steps:

- Gather all relevant information about your assets and debts.

- Download or obtain the Legal Last Will and Testament Form for Illinois.

- Fill in your personal information, including your name and address.

- Clearly state your wishes regarding the distribution of your assets to your adult children.

- Designate an executor to manage your estate.

- Sign the document in front of at least two witnesses, who must also sign the will.

- Store the completed will in a safe place and inform your executor of its location.

State-Specific Rules for the Legal Last Will And Testament Form For Single Person With Adult Children Illinois

In Illinois, specific rules govern the creation and execution of a Last Will and Testament. The testator must be at least eighteen years old and of sound mind. The will must be in writing and signed by the testator. Witnesses must be present during the signing and should not be beneficiaries of the will to avoid potential conflicts of interest. Illinois does not require wills to be notarized, but a notarized will can simplify the probate process. Understanding these state-specific rules is essential for ensuring that the will is valid and enforceable.

Legal Use of the Legal Last Will And Testament Form For Single Person With Adult Children Illinois

The Legal Last Will and Testament Form serves a crucial legal purpose by clearly articulating an individual's wishes regarding asset distribution after death. It helps to avoid disputes among heirs and provides a clear directive for the executor. When properly executed, this form is recognized by courts in Illinois, allowing for a smoother probate process. It is advisable to review and update the will periodically, especially after significant life events such as marriages, divorces, or changes in financial status. Legal counsel can provide additional guidance to ensure compliance with Illinois law.

Quick guide on how to complete legal last will and testament form for single person with adult children illinois

Prepare Legal Last Will And Testament Form For Single Person With Adult Children Illinois effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents swiftly without delays. Manage Legal Last Will And Testament Form For Single Person With Adult Children Illinois on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centered task today.

How to modify and electronically sign Legal Last Will And Testament Form For Single Person With Adult Children Illinois with ease

- Find Legal Last Will And Testament Form For Single Person With Adult Children Illinois and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes seconds and has the same legal validity as an ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invite link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Legal Last Will And Testament Form For Single Person With Adult Children Illinois and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Legal Last Will And Testament Form For Single Person With Adult Children Illinois?

A Legal Last Will And Testament Form For Single Person With Adult Children Illinois is a legal document that specifies how your assets and responsibilities will be handled after your passing. This form is tailored for individuals who have adult children and ensures that their wishes are respected regarding asset distribution.

-

How can I create a Legal Last Will And Testament Form For Single Person With Adult Children Illinois using airSlate SignNow?

Creating a Legal Last Will And Testament Form For Single Person With Adult Children Illinois with airSlate SignNow is simple. You can start by choosing from customizable templates, filling in the required information, and securely signing the document online. The user-friendly interface makes completing this important document quick and easy.

-

What are the pricing options for the Legal Last Will And Testament Form For Single Person With Adult Children Illinois?

AirSlate SignNow offers various pricing plans, enabling you to create a Legal Last Will And Testament Form For Single Person With Adult Children Illinois at an affordable rate. You can opt for a monthly or annual subscription, with costs designed to accommodate both individuals and businesses, ensuring everyone can access this crucial service.

-

What features does airSlate SignNow provide for drafting a Legal Last Will And Testament Form For Single Person With Adult Children Illinois?

airSlate SignNow includes robust features for drafting a Legal Last Will And Testament Form For Single Person With Adult Children Illinois, such as customizable templates, eSigning capabilities, and secure cloud storage. This allows for flexibility in creating documents, while also ensuring that they remain legally binding and easily accessible.

-

How does airSlate SignNow ensure the security of my Legal Last Will And Testament Form For Single Person With Adult Children Illinois?

Security is a top priority for airSlate SignNow, especially regarding sensitive documents like a Legal Last Will And Testament Form For Single Person With Adult Children Illinois. The platform utilizes advanced encryption techniques, secure servers, and GDPR compliance to protect your information, giving you peace of mind.

-

Can the Legal Last Will And Testament Form For Single Person With Adult Children Illinois be shared with family members?

Yes, you can easily share your Legal Last Will And Testament Form For Single Person With Adult Children Illinois with family members or beneficiaries using airSlate SignNow. The platform allows you to send documents securely via email or link, ensuring that your loved ones are adequately informed of your wishes.

-

What are the benefits of using airSlate SignNow for my Legal Last Will And Testament Form For Single Person With Adult Children Illinois?

Using airSlate SignNow offers numerous benefits for your Legal Last Will And Testament Form For Single Person With Adult Children Illinois, including ease of use, cost-effectiveness, and legal compliance. The streamlined process enables you to create a will quickly and conveniently, ensuring that your final wishes are documented properly.

Get more for Legal Last Will And Testament Form For Single Person With Adult Children Illinois

- Domanda di attribuzione codice fiscale 304973729 form

- Medically indigent form

- Directed reading for content mastery overview forces answer key form

- Form 940 schedule ainstructions amp filing guide

- Instructions for form 990 pf instructions for form 990 pf return of private foundation or section 4947a1 trust treated as

- Form 8027 employers annual information return of tip income and allocated tips

- About form 4952 investment interest expense deduction

- Publication 4235 rev 10 form

Find out other Legal Last Will And Testament Form For Single Person With Adult Children Illinois

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word