K 12 Education Expense Credit Worksheet 2004-2026

What is the K 12 Education Expense Credit Worksheet

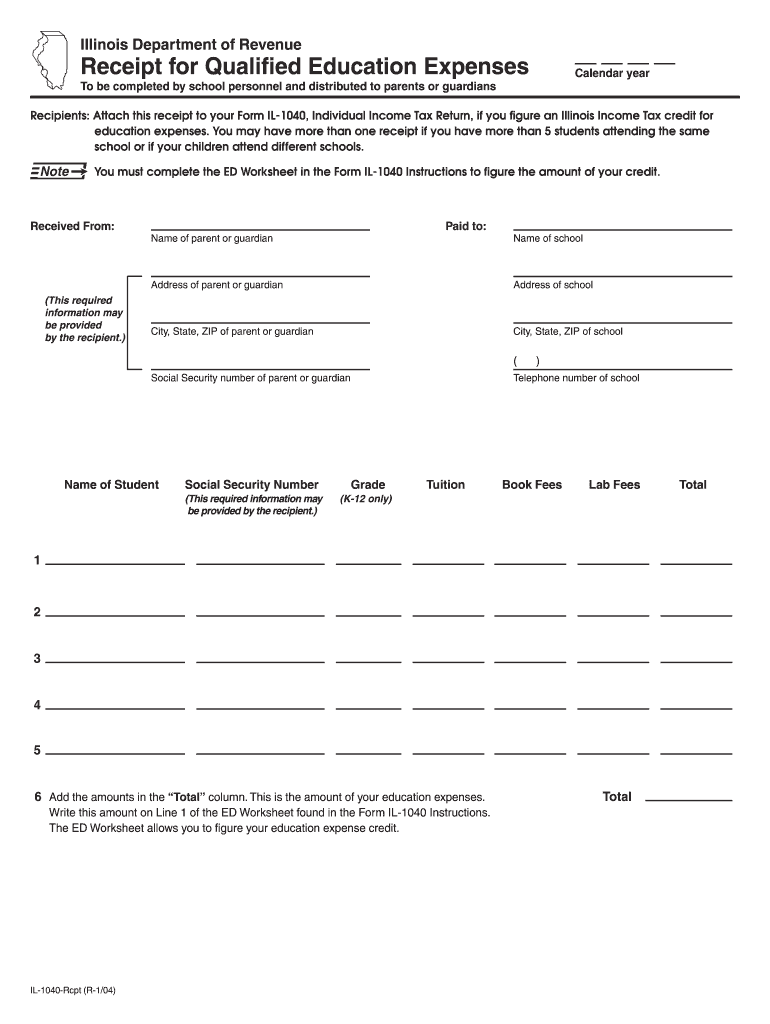

The Illinois K 12 Education Expense Credit Worksheet is a form designed to help taxpayers calculate their eligible education expenses for K-12 students. This worksheet is part of the Illinois tax system and allows parents or guardians to claim a tax credit for qualified education expenses incurred for their children attending primary or secondary school. Eligible expenses may include tuition, textbooks, and other necessary educational materials. The worksheet ensures that taxpayers can accurately report these expenses to receive the appropriate tax benefits.

How to use the K 12 Education Expense Credit Worksheet

Using the Illinois K 12 Education Expense Credit Worksheet involves a few straightforward steps. First, gather all relevant receipts for qualified K-12 education expenses, such as tuition payments and educational supplies. Next, fill out the worksheet by entering the total amounts spent in the designated sections. Be sure to follow the instructions carefully to ensure all eligible expenses are included. Once completed, the worksheet should be submitted along with your Illinois tax return to claim the credit.

Steps to complete the K 12 Education Expense Credit Worksheet

To complete the K 12 Education Expense Credit Worksheet, follow these steps:

- Collect all receipts for qualified K-12 education expenses.

- Fill in your personal information at the top of the worksheet.

- List each type of expense in the appropriate section, ensuring accuracy in the amounts reported.

- Calculate the total eligible expenses as indicated on the form.

- Review the completed worksheet for accuracy before submission.

Eligibility Criteria

To qualify for the Illinois K 12 Education Expense Credit, taxpayers must meet specific eligibility criteria. The taxpayer must have incurred qualified education expenses for a dependent child enrolled in a K-12 school. The child must be a resident of Illinois and attend a public or private school that meets state requirements. Additionally, there may be income limits that affect eligibility for the credit. It is essential to review the latest guidelines to ensure compliance with these criteria.

Required Documents

When filling out the K 12 Education Expense Credit Worksheet, certain documents are necessary to substantiate your claims. These documents typically include:

- Receipts for tuition payments.

- Invoices for educational materials and supplies.

- Any other documentation that verifies the incurred expenses related to K-12 education.

Having these documents ready will facilitate a smoother completion of the worksheet and ensure you can support your claims if required.

Form Submission Methods

The Illinois K 12 Education Expense Credit Worksheet can be submitted in various ways. Taxpayers can file their returns electronically, which is often the fastest and most efficient method. Alternatively, the completed worksheet can be mailed to the appropriate tax authority along with the Illinois tax return. In-person submission at designated tax offices is also an option for those who prefer direct interaction. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Quick guide on how to complete k 12 education expense credit worksheet

Prepare K 12 Education Expense Credit Worksheet effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage K 12 Education Expense Credit Worksheet on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign K 12 Education Expense Credit Worksheet without hassle

- Find K 12 Education Expense Credit Worksheet and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign K 12 Education Expense Credit Worksheet and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k 12 education expense credit worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois K 12 education expense credit?

The Illinois K 12 education expense credit is a tax credit designed to help families offset the costs of K-12 education. This credit allows parents or guardians to receive a refund for certain eligible educational expenses. By understanding the Illinois K 12 education expense credit, you can maximize your tax benefits while investing in your child's education.

-

Who is eligible for the Illinois K 12 education expense credit?

Eligibility for the Illinois K 12 education expense credit typically includes parents or guardians of students enrolled in K-12 schools located in Illinois. To qualify, families must incur eligible education expenses and file their state taxes accordingly. Ensure you review the specific requirements to determine your eligibility for the Illinois K 12 education expense credit.

-

What types of expenses qualify for the Illinois K 12 education expense credit?

Qualified expenses for the Illinois K 12 education expense credit can include tuition, textbooks, and necessary supplies that are directly related to your child’s education. Some other educational costs, such as fees for special education, can also be covered. It's important to keep detailed records of all expenses incurred for potential tax deductions.

-

How can I apply for the Illinois K 12 education expense credit?

To apply for the Illinois K 12 education expense credit, you need to file your Illinois state tax return and fill out the appropriate forms. You can claim the credit by detailing your eligible expenses on the tax forms designated for these credits. Consulting a tax professional can help ensure you correctly apply for the Illinois K 12 education expense credit.

-

What benefits does the Illinois K 12 education expense credit provide?

The Illinois K 12 education expense credit provides financial relief to families burdened with the costs of K-12 education. By lowering your tax bill, this credit can make quality education more accessible. Additionally, the Illinois K 12 education expense credit can encourage better educational choices for families.

-

What are the income limits for the Illinois K 12 education expense credit?

Income limits for the Illinois K 12 education expense credit can vary based on tax regulations, often affecting how much credit a family can claim. It's advisable to consult the latest state tax guidelines to understand the specific income thresholds applicable. This ensures that you are aware of how your income might impact your eligibility for the Illinois K 12 education expense credit.

-

Are there any software tools that can assist with applying for the Illinois K 12 education expense credit?

Yes, there are various tax preparation software tools that can guide you through applying for the Illinois K 12 education expense credit. These tools often include intuitive features that ensure you don’t miss deductions related to your educational expenses. Leveraging these tools can simplify the process and help maximize your credit claims.

Get more for K 12 Education Expense Credit Worksheet

- Purchase home agreement form

- Contract note purchase form

- Texas general form

- Virginia contract for sale and purchase of real estate with no broker for residential home sale agreement form

- Pennsylvania documents form

- Lease real estate agreement form

- Illinois estate form

- South carolina life documents planning package including will power of attorney and living will form

Find out other K 12 Education Expense Credit Worksheet

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney