Foreign National Tax Setup Change Form

What is the Foreign National Tax Setup Change Form

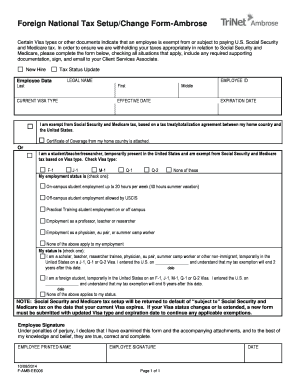

The Foreign National Tax Setup Change Form is a crucial document for individuals who are not U.S. citizens but have tax obligations in the United States. This form allows foreign nationals to update their tax status or make necessary changes to their tax information. It is essential for ensuring compliance with U.S. tax laws and regulations, particularly for those who may have changed their residency status or are adjusting their tax withholding preferences. Understanding the purpose and requirements of this form is vital for foreign nationals navigating the complexities of U.S. taxation.

Steps to Complete the Foreign National Tax Setup Change Form

Completing the Foreign National Tax Setup Change Form involves several important steps to ensure accuracy and compliance. Here are the key steps to follow:

- Gather necessary personal information, including your name, address, and tax identification number.

- Review the specific changes you need to make regarding your tax status or withholding preferences.

- Fill out the form accurately, ensuring that all required fields are completed.

- Sign and date the form to validate your submission.

- Submit the form according to the specified submission methods, whether online or by mail.

Legal Use of the Foreign National Tax Setup Change Form

The legal use of the Foreign National Tax Setup Change Form is governed by U.S. tax laws and regulations. This form must be completed accurately to ensure that the changes made are recognized by the Internal Revenue Service (IRS). Failure to properly complete or submit this form can lead to tax complications, including incorrect withholding or penalties for non-compliance. It is important to understand the legal implications of the information provided on this form to avoid any issues with tax authorities.

How to Obtain the Foreign National Tax Setup Change Form

The Foreign National Tax Setup Change Form can be obtained through various channels. Typically, it is available on the official IRS website or through tax preparation software that supports foreign national tax compliance. Additionally, tax professionals can provide the form and assist with its completion. It is advisable to ensure that you are using the most current version of the form to meet all regulatory requirements.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Foreign National Tax Setup Change Form. These guidelines outline the eligibility criteria, required information, and the importance of accurate reporting. Familiarizing yourself with these guidelines is essential for ensuring compliance and avoiding potential penalties. The IRS also offers resources and assistance for foreign nationals to help navigate their tax obligations effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Foreign National Tax Setup Change Form are critical to ensure compliance with U.S. tax laws. Generally, the form should be submitted by the end of the tax year or whenever a change in status occurs. It is important to stay informed about specific deadlines to avoid any late submission penalties. Marking these dates on your calendar can help ensure timely compliance with tax obligations.

Quick guide on how to complete foreign national tax setup change form

Effortlessly Prepare Foreign National Tax Setup Change Form on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly solution to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Foreign National Tax Setup Change Form on any device with the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The Easiest Way to Edit and eSign Foreign National Tax Setup Change Form Seamlessly

- Obtain Foreign National Tax Setup Change Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Foreign National Tax Setup Change Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the foreign national tax setup change form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a foreign national tax setup change form?

A foreign national tax setup change form is a document that allows foreign individuals to update their tax information with relevant authorities. This form is essential for ensuring compliance with tax laws and can help prevent issues such as overtaxation or improper deductions.

-

How can airSlate SignNow help with the foreign national tax setup change form?

airSlate SignNow streamlines the process of filling out the foreign national tax setup change form by providing a user-friendly platform for eSigning and document management. Our solution ensures that your form is completed accurately and securely, saving you time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for the foreign national tax setup change form?

Yes, airSlate SignNow offers a cost-effective solution for managing documents, including the foreign national tax setup change form. We provide various pricing plans tailored to meet the needs of businesses, ensuring you pay only for the features you need.

-

What features does airSlate SignNow offer for the foreign national tax setup change form?

Our platform provides several features to assist with the foreign national tax setup change form, including easy document creation, secure electronic signatures, and real-time tracking of document status. Additionally, users can integrate the platform with various other applications for enhanced efficiency.

-

Can I integrate airSlate SignNow with other tools for managing the foreign national tax setup change form?

Absolutely! airSlate SignNow offers seamless integrations with popular tools such as Google Drive, Salesforce, and Dropbox, allowing for efficient document management related to the foreign national tax setup change form. This makes it easy to organize and share your documents across different platforms.

-

What are the benefits of using airSlate SignNow for the foreign national tax setup change form?

Using airSlate SignNow for the foreign national tax setup change form provides several advantages, including enhanced security for sensitive information and the ability to complete forms remotely. Our platform also ensures compliance with regulatory requirements, giving users peace of mind.

-

Is it easy to use airSlate SignNow for the foreign national tax setup change form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to handle the foreign national tax setup change form. The intuitive interface allows users to navigate quickly, ensuring that you can complete your forms without any technical expertise.

Get more for Foreign National Tax Setup Change Form

Find out other Foreign National Tax Setup Change Form

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement