Hawaii N 15 Form

What is the Hawaii N 15 Form

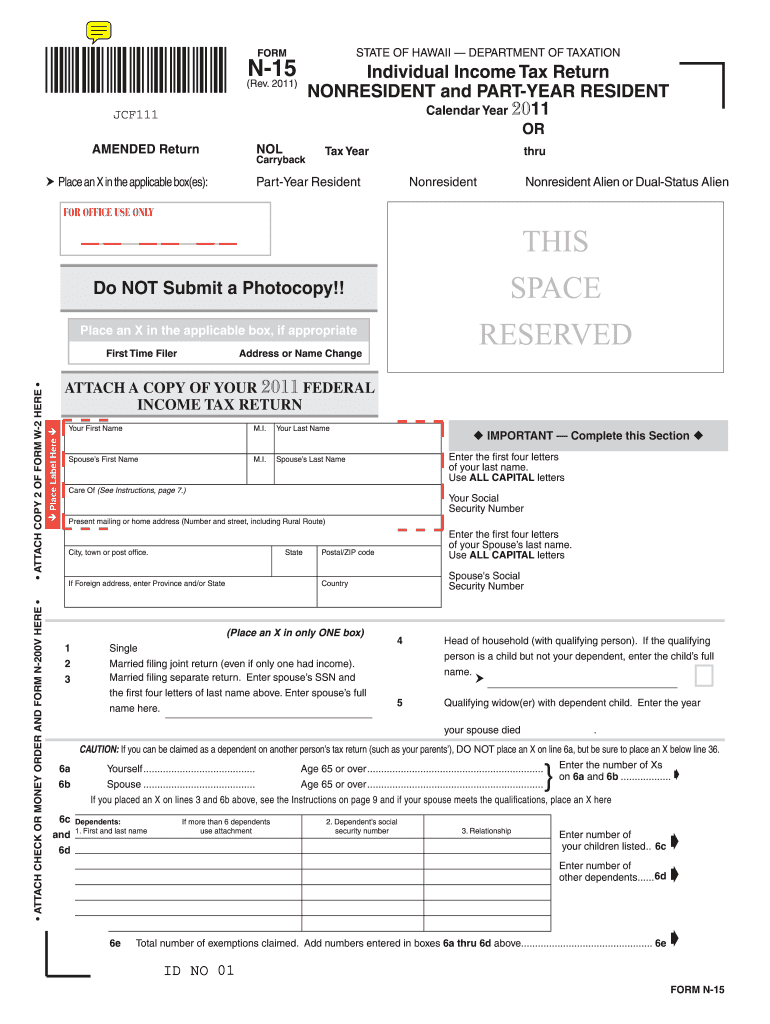

The Hawaii N 15 form is a tax document specifically designed for non-residents of Hawaii who earn income within the state. This form is essential for reporting and calculating the appropriate state income tax owed by individuals who do not reside in Hawaii but have income sourced from the state. The N 15 form allows non-residents to comply with Hawaii's tax regulations, ensuring that they fulfill their tax obligations accurately.

How to use the Hawaii N 15 Form

Using the Hawaii N 15 form involves several steps to ensure accurate reporting of income. First, gather all necessary documentation, including W-2s, 1099s, and any other income statements relevant to your earnings in Hawaii. Next, carefully fill out the form, providing details about your income, deductions, and credits applicable to your situation. It is crucial to follow the instructions provided with the form to avoid errors that could lead to delays or penalties.

Steps to complete the Hawaii N 15 Form

Completing the Hawaii N 15 form requires a systematic approach:

- Start by entering your personal information, including your name, address, and taxpayer identification number.

- Report your income earned in Hawaii, ensuring to include all sources of income.

- Calculate your deductions and credits as applicable, which can reduce your taxable income.

- Determine your tax liability based on the income reported and the applicable tax rates.

- Review the completed form for accuracy before submission.

Key elements of the Hawaii N 15 Form

The Hawaii N 15 form includes several key elements that are essential for proper completion:

- Personal Information: This section requires your name, address, and taxpayer identification number.

- Income Reporting: You must detail all income earned from Hawaii sources.

- Deductions: Identify any deductions you qualify for that can lower your taxable income.

- Tax Calculation: The form includes a section for calculating your total tax liability based on reported income.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Hawaii N 15 form to avoid penalties. Typically, the form must be filed by April 20 of the year following the tax year in question. If you need additional time, you may request an extension, but ensure that any taxes owed are paid by the original deadline to avoid interest and penalties.

Form Submission Methods

The Hawaii N 15 form can be submitted through various methods to accommodate different preferences:

- Online Submission: Many taxpayers choose to file electronically through approved e-filing services.

- Mail: You can print the completed form and send it to the appropriate tax office via postal mail.

- In-Person: Some individuals may opt to deliver their forms directly to a local tax office for processing.

Quick guide on how to complete hawaii 2011 form n 15 fillable

Accomplish Hawaii N 15 Form easily on any device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Hawaii N 15 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to alter and eSign Hawaii N 15 Form effortlessly

- Access Hawaii N 15 Form and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that task.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow caters to your document management needs in just a few clicks from your chosen device. Modify and eSign Hawaii N 15 Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

Create this form in 5 minutes!

How to create an eSignature for the hawaii 2011 form n 15 fillable

How to create an eSignature for your Hawaii 2011 Form N 15 Fillable in the online mode

How to create an eSignature for the Hawaii 2011 Form N 15 Fillable in Google Chrome

How to create an electronic signature for putting it on the Hawaii 2011 Form N 15 Fillable in Gmail

How to make an electronic signature for the Hawaii 2011 Form N 15 Fillable straight from your mobile device

How to generate an eSignature for the Hawaii 2011 Form N 15 Fillable on iOS devices

How to generate an eSignature for the Hawaii 2011 Form N 15 Fillable on Android

People also ask

-

What are the key features of airSlate SignNow related to n 15 instructions?

airSlate SignNow offers a range of features that simplify the signing process, including customizable templates, real-time tracking, and secure storage. These features help streamline the n 15 instructions workflow, enabling users to manage their documents efficiently.

-

How can airSlate SignNow improve the n 15 instructions process for my business?

By implementing airSlate SignNow, businesses can signNowly enhance the n 15 instructions process through automation and ease of use. This results in faster turnaround times, reduced paper use, and improved collaboration among team members.

-

What pricing options does airSlate SignNow offer for n 15 instructions?

airSlate SignNow provides flexible pricing plans that cater to different business needs concerning n 15 instructions. Whether you’re a small startup or a large enterprise, you can find a plan that suits your budget and volume of document transactions.

-

Can I integrate airSlate SignNow with other tools for n 15 instructions?

Yes, airSlate SignNow supports integrations with various tools and platforms that you may already use, facilitating the execution of n 15 instructions. Popular integrations include CRM systems, cloud storage, and project management software, enhancing overall productivity.

-

Is airSlate SignNow secure for managing n 15 instructions?

Absolutely! airSlate SignNow adheres to industry-leading security standards to keep your n 15 instructions data protected. With features like two-factor authentication and encrypted documents, your sensitive information remains safe throughout the signing process.

-

What benefits can my team expect from using airSlate SignNow for n 15 instructions?

Using airSlate SignNow for n 15 instructions can lead to increased efficiency and reduced operational costs. Teams benefit from faster document processing times and improved accuracy, which enhances overall workflow and productivity.

-

How user-friendly is airSlate SignNow for n 15 instructions?

airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to navigate the platform while executing n 15 instructions. The intuitive interface allows users of all tech levels to get started quickly, minimizing the learning curve.

Get more for Hawaii N 15 Form

- Annual review of driving record pdf form

- Holiday application form

- Certification of continuous active duty form

- Intervention log template form

- Electrical fire incident report sample form

- Vocabulary builder activity answer key form

- Cna final exam 100 questions pdf form

- Physical fitness certificate how to fill form

Find out other Hawaii N 15 Form

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free