Oregon Dmv Forms735 9002 2014

What is the Oregon DMV FormT?

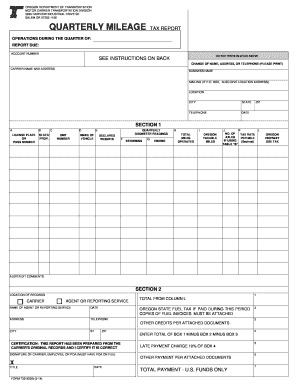

The Oregon DMV FormT, commonly referred to as the Oregon Quarterly Mileage Tax Report, is a document required by the Oregon Department of Transportation. This form is used to report the mileage driven by certain vehicles within the state for the purpose of calculating and assessing road usage taxes. It is particularly relevant for businesses and individuals who operate vehicles subject to mileage-based taxation. Completing this form accurately is essential for compliance with state regulations and to avoid potential penalties.

How to Use the Oregon DMV FormT

Using the Oregon DMV FormT involves several straightforward steps. First, gather all necessary information regarding the mileage driven during the reporting period. This includes details about the vehicle, such as its identification number and the total miles driven. Next, fill out the form with accurate data, ensuring that all required fields are completed. Once the form is filled out, it can be submitted electronically or by mail, depending on your preference. Utilizing digital tools like signNow can streamline this process, making it easier to fill out and sign the form securely.

Steps to Complete the Oregon DMV FormT

Completing the Oregon DMV FormT requires careful attention to detail. Follow these steps for efficient completion:

- Gather vehicle information, including the Vehicle Identification Number (VIN) and total mileage.

- Access the form online or obtain a physical copy from the Oregon Department of Transportation.

- Fill in the required fields, ensuring that all information is accurate and up to date.

- Review the completed form for any errors or omissions.

- Submit the form electronically through a secure platform or mail it to the designated address.

Legal Use of the Oregon DMV FormT

The legal use of the Oregon DMV FormT is governed by state regulations regarding road usage taxes. This form must be completed truthfully and accurately to ensure compliance with the law. Failure to submit the form or providing false information can result in penalties, including fines or legal repercussions. It is important to understand the legal implications of the information reported on this form and to keep records of mileage and submissions for future reference.

Required Documents for the Oregon DMV FormT

When preparing to complete the Oregon DMV FormT, certain documents may be required to support your submission. These typically include:

- Vehicle registration details.

- Records of mileage driven during the reporting period.

- Any previous tax reports related to mileage, if applicable.

Having these documents readily available can facilitate a smoother completion process and help ensure that all necessary information is included in your submission.

Form Submission Methods for the Oregon DMV FormT

The Oregon DMV FormT can be submitted through various methods, providing flexibility for users. Options include:

- Online submission via a secure digital platform, which allows for immediate processing.

- Mailing a physical copy of the completed form to the designated address provided by the Oregon Department of Transportation.

- In-person submission at local DMV offices, where assistance may be available if needed.

Choosing the right submission method can depend on personal preference and the urgency of the filing.

Quick guide on how to complete oregon dmv forms735 9002

Finish Oregon Dmv Forms735 9002 effortlessly on any gadget

Virtual document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents promptly without delays. Manage Oregon Dmv Forms735 9002 on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to modify and eSign Oregon Dmv Forms735 9002 with ease

- Obtain Oregon Dmv Forms735 9002 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Adjust and eSign Oregon Dmv Forms735 9002 and ensure superior communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oregon dmv forms735 9002

Create this form in 5 minutes!

How to create an eSignature for the oregon dmv forms735 9002

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the odot form 735 9002t and how is it used?

The odot form 735 9002t is a crucial document used in various transportation and construction projects in Oregon. It is primarily utilized for reporting and documenting project activities, ensuring compliance with state requirements. Using airSlate SignNow, you can easily eSign and send this form securely.

-

How can airSlate SignNow help me manage the odot form 735 9002t?

airSlate SignNow simplifies the management of the odot form 735 9002t by providing a user-friendly platform for electronic signatures and document management. It allows you to fill out the form, send it for signature, and track its status all in one place. This streamlines your workflow and enhances productivity.

-

Is there a cost associated with using airSlate SignNow for the odot form 735 9002t?

Yes, there is a subscription fee for using airSlate SignNow, but it’s designed to be cost-effective for businesses of all sizes. The investment in this platform for managing the odot form 735 9002t is minimal compared to the time and resources saved. Various pricing plans cater to different business needs, ensuring you find the right fit.

-

What features does airSlate SignNow offer for the odot form 735 9002t?

airSlate SignNow offers a range of features for the odot form 735 9002t, including customizable templates, real-time tracking, and secure cloud storage. These features enhance the efficiency of document handling, making it easier to access, sign, and share forms. You can also integrate with other applications for a seamless workflow.

-

Can I integrate airSlate SignNow with other software when using the odot form 735 9002t?

Absolutely! airSlate SignNow supports integration with various third-party applications, allowing you to streamline your processes involving the odot form 735 9002t. Whether you use CRM systems, project management tools, or file storage services, you can connect them effortlessly to enhance your productivity.

-

What are the benefits of using airSlate SignNow for document signing, particularly for the odot form 735 9002t?

Using airSlate SignNow for the odot form 735 9002t offers numerous benefits, including faster processing times and reduced paper usage. By transitioning to a digital solution, you can achieve a more efficient workflow and ensure that the form is signed and submitted promptly. Additionally, the platform provides a secure environment for sensitive information.

-

Is it easy to track the status of my odot form 735 9002t with airSlate SignNow?

Yes, tracking the status of your odot form 735 9002t is easy with airSlate SignNow. The platform provides real-time updates on who has viewed, signed, or completed the document. This feature enhances visibility and accountability, ensuring you always know where your forms stand.

Get more for Oregon Dmv Forms735 9002

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497308490 form

- Louisiana tenant in form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497308492 form

- Letter from landlord to tenant as notice to tenant to inform landlord of tenants knowledge of condition causing damage to 497308493

- Landlord tenant law 497308494 form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase due to violation of rent 497308495 form

- Letter tenant rent sample 497308496 form

- Louisiana letter lease form

Find out other Oregon Dmv Forms735 9002

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form