Quarterly Weight Mile Tax Reporting Commerce and 2023-2026

What is the Quarterly Weight Mile Tax Reporting Commerce And

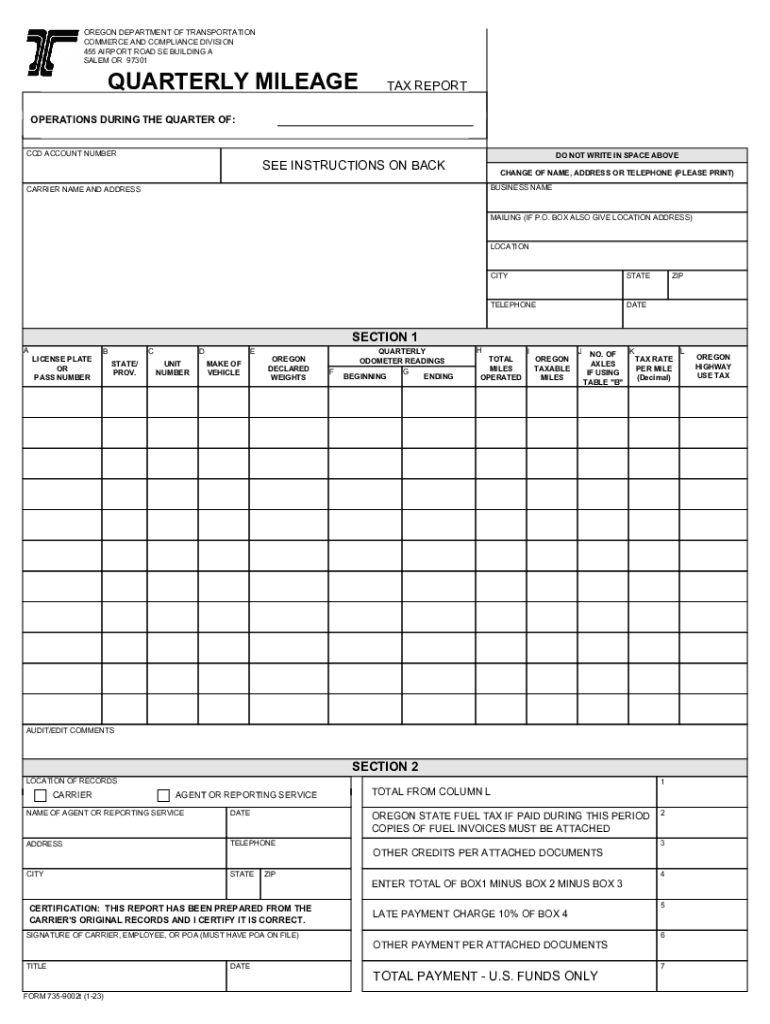

The Quarterly Weight Mile Tax Reporting Commerce And is a tax form specifically designed for businesses that operate commercial vehicles. This form is essential for reporting the mileage traveled by heavy trucks and the corresponding taxes owed to state authorities. The tax is calculated based on the weight of the vehicle and the miles driven within a specific quarter. Understanding this form is crucial for compliance with state tax regulations, ensuring that businesses fulfill their financial obligations accurately and on time.

Steps to complete the Quarterly Weight Mile Tax Reporting Commerce And

Completing the Quarterly Weight Mile Tax Reporting Commerce And involves several key steps:

- Gather Necessary Information: Collect data on the total miles driven by each commercial vehicle during the quarter, along with their weight classifications.

- Calculate Tax Owed: Use the state-specific tax rates to determine the amount owed based on the mileage and weight of the vehicles.

- Fill Out the Form: Accurately complete the form, ensuring all required fields are filled in with the correct information.

- Review for Accuracy: Double-check all entries for errors or omissions, as mistakes can lead to penalties.

- Submit the Form: Choose a submission method, whether online, by mail, or in person, and ensure it is sent before the deadline.

Legal use of the Quarterly Weight Mile Tax Reporting Commerce And

The legal use of the Quarterly Weight Mile Tax Reporting Commerce And is governed by state regulations that outline how commercial vehicle operators must report their mileage and taxes. To ensure the form is legally binding, it must be completed accurately and submitted within the designated timeframe. Compliance with these regulations not only helps avoid penalties but also supports the maintenance of public infrastructure funded by these taxes. It is essential for businesses to understand the legal implications of their reporting to remain compliant with state laws.

Filing Deadlines / Important Dates

Filing deadlines for the Quarterly Weight Mile Tax Reporting Commerce And vary by state but typically follow a quarterly schedule. Businesses must be aware of these deadlines to avoid late fees and penalties. Generally, the deadlines are as follows:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31 of the following year

It is important for businesses to keep track of these dates and ensure timely submission of their forms.

Required Documents

To complete the Quarterly Weight Mile Tax Reporting Commerce And, businesses must have several documents on hand:

- Mileage Records: Detailed logs of miles driven by each commercial vehicle during the quarter.

- Vehicle Weight Certificates: Documentation that verifies the weight classification of each vehicle.

- Tax Calculation Worksheets: Any worksheets used to calculate the tax owed based on mileage and weight.

- Previous Tax Returns: Copies of past filings may be needed for reference and accuracy.

Having these documents readily available streamlines the completion process and ensures compliance with reporting requirements.

Penalties for Non-Compliance

Failure to comply with the requirements of the Quarterly Weight Mile Tax Reporting Commerce And can result in significant penalties. Common consequences include:

- Late Fees: Businesses may incur fines for submitting their forms after the deadline.

- Interest Charges: Outstanding taxes may accrue interest, increasing the total amount owed.

- Legal Action: In severe cases, continued non-compliance can lead to legal repercussions.

Understanding these penalties emphasizes the importance of timely and accurate reporting to avoid unnecessary financial burdens.

Quick guide on how to complete quarterly weight mile tax reporting commerce and

Complete Quarterly Weight Mile Tax Reporting Commerce And effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Quarterly Weight Mile Tax Reporting Commerce And on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to alter and eSign Quarterly Weight Mile Tax Reporting Commerce And without hassle

- Locate Quarterly Weight Mile Tax Reporting Commerce And and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your alterations.

- Choose how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Modify and eSign Quarterly Weight Mile Tax Reporting Commerce And and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct quarterly weight mile tax reporting commerce and

Create this form in 5 minutes!

How to create an eSignature for the quarterly weight mile tax reporting commerce and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Quarterly Weight Mile Tax Reporting Commerce And?

Quarterly Weight Mile Tax Reporting Commerce And is a regulatory requirement for businesses that operate commercial vehicles. This process requires accurate reporting of mileage and weight to determine tax obligations. Utilizing airSlate SignNow can streamline your reporting processes, ensuring compliance and efficiency.

-

How can airSlate SignNow help with Quarterly Weight Mile Tax Reporting Commerce And?

airSlate SignNow offers an intuitive platform that simplifies the management of documents related to Quarterly Weight Mile Tax Reporting Commerce And. You can easily eSign, share, and store essential documents, eliminating the hassle of paper-based systems and enhancing collaboration among your team.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of various businesses. These plans include features that support Quarterly Weight Mile Tax Reporting Commerce And, ensuring you have the tools necessary for efficient compliance. You can review our pricing page to find the plan that best fits your operational requirements.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with various business applications, enhancing your workflow for Quarterly Weight Mile Tax Reporting Commerce And. Popular integrations include CRM systems and accounting software that allow you to synchronize data effortlessly. This capability allows for streamlined operations and better data management.

-

What benefits does airSlate SignNow provide for document management?

airSlate SignNow offers numerous benefits when managing documents related to Quarterly Weight Mile Tax Reporting Commerce And. These include improved workflow efficiency, secure document storage, and easy access from any device. Additionally, features like audit trails help ensure compliance and accountability.

-

Is airSlate SignNow user-friendly for newcomers?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to get started with features supporting Quarterly Weight Mile Tax Reporting Commerce And. The platform does not require extensive training, allowing users to quickly utilize its functionalities for their document needs.

-

Can I track the status of documents sent for eSignature?

Yes, with airSlate SignNow, you can easily track the status of documents sent for eSignature, which is essential for completing Quarterly Weight Mile Tax Reporting Commerce And. You will receive real-time notifications and updates, so you never miss a deadline. This feature ensures that your reporting remains timely and accurate.

Get more for Quarterly Weight Mile Tax Reporting Commerce And

- Durable do not resuscitate order university of virginia virginia form

- Customs number application for an individual person form

- Eqp5884 form

- Take home detention 428032989 form

- Request for autopsy report travis county texas traviscountytx form

- Statement of ordering physician group 1 support surfaces statement of ordering physician group 1 support surfaces form

- Eg assurance cancellation form

- Landlord agent agreement template form

Find out other Quarterly Weight Mile Tax Reporting Commerce And

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement