Submit Your Mileage for All Trips that Exceed 5 Miles Round Trip, If the Purpose of Form

Understanding Mileage Reimbursement in Workers Compensation

Mileage reimbursement for workers compensation refers to the compensation provided to employees for the business-related travel they undertake using their personal vehicles. This reimbursement is crucial for employees who incur costs while performing work duties away from their primary workplace. The reimbursement rate is typically based on the IRS mileage rate, which is adjusted annually to reflect changes in fuel prices and vehicle expenses. Understanding the specifics of this reimbursement can help employees navigate their rights and entitlements effectively.

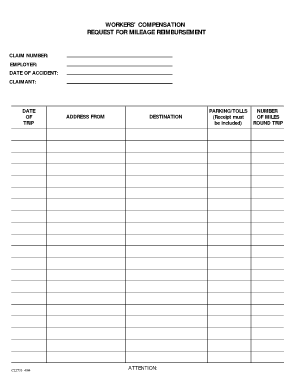

Steps to Complete the Mileage Reimbursement Form

Completing the mileage reimbursement form for workers compensation involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including dates of travel, starting and ending locations, and the purpose of each trip. Next, calculate the total mileage for each trip and multiply it by the current reimbursement rate. Fill out the form with this information, ensuring that all entries are clear and legible. Finally, submit the completed form to your employer or the designated claims department for processing.

Legal Use of Mileage Reimbursement Forms

The legal use of mileage reimbursement forms is governed by both state and federal laws. Employers are required to reimburse employees for necessary travel expenses incurred during work-related duties. It is essential that the form is filled out correctly and submitted within any specified deadlines to avoid disputes. Additionally, keeping accurate records and receipts can protect both the employee and employer in case of audits or claims. Understanding these legal obligations can help ensure compliance and fair treatment in the reimbursement process.

IRS Guidelines for Mileage Reimbursement

The IRS provides specific guidelines regarding mileage reimbursement, which employers must follow. The standard mileage rate is updated annually and is intended to cover the costs of operating a vehicle, including fuel, maintenance, and depreciation. Employees should be aware that any reimbursement exceeding the IRS rate may be considered taxable income. It is advisable for employees to keep detailed records of their mileage, including the purpose of each trip, to substantiate their claims and ensure compliance with IRS regulations.

Eligibility Criteria for Mileage Reimbursement

To be eligible for mileage reimbursement under workers compensation, employees must typically meet certain criteria. These criteria often include being on company business during the travel, using a personal vehicle, and providing accurate documentation of the trips taken. Additionally, the travel must exceed a specific distance, often set by the employer or state regulations. Understanding these eligibility requirements is crucial for employees seeking reimbursement for their travel expenses.

Common Scenarios for Mileage Reimbursement

Various scenarios may arise where mileage reimbursement is applicable. For instance, employees attending meetings, training sessions, or client visits outside their regular workplace may be eligible for reimbursement. Additionally, employees who travel between different work sites or locations as part of their job responsibilities can also claim mileage. Recognizing these scenarios can help employees maximize their reimbursement opportunities and ensure they are compensated for all relevant travel expenses.

Quick guide on how to complete submit your mileage for all trips that exceed 5 miles round trip if the purpose of

Effortlessly Prepare Submit Your Mileage For All Trips That Exceed 5 Miles Round Trip, If The Purpose Of on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary format and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Submit Your Mileage For All Trips That Exceed 5 Miles Round Trip, If The Purpose Of on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Submit Your Mileage For All Trips That Exceed 5 Miles Round Trip, If The Purpose Of effortlessly

- Find Submit Your Mileage For All Trips That Exceed 5 Miles Round Trip, If The Purpose Of and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and eSign Submit Your Mileage For All Trips That Exceed 5 Miles Round Trip, If The Purpose Of and ensure excellent communication throughout every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the submit your mileage for all trips that exceed 5 miles round trip if the purpose of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mileage reimbursement in the context of workers compensation?

Mileage reimbursement in workers compensation refers to the compensation provided to employees for travel expenses incurred while performing job-related tasks. This includes travel to medical appointments or necessary work activities, ensuring employees are reimbursed fairly for their mileage. Understanding the details of mileage reimbursement workers compensation can help both employers and employees navigate the claims process effectively.

-

How can airSlate SignNow help in managing mileage reimbursement workers compensation claims?

airSlate SignNow simplifies the process of managing mileage reimbursement workers compensation claims by allowing businesses to create, send, and eSign documents quickly and efficiently. Our platform can streamline the documentation process, reducing paperwork and enhancing communication between employees and employers. By digitizing these processes, we enhance productivity and reduce the chances of human error.

-

What features does airSlate SignNow offer for handling mileage reimbursement requests?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning, which are essential for handling mileage reimbursement requests under workers compensation. The tools ensure that all documentation is easily accessible and can be completed swiftly. This not only increases efficiency but also ensures compliance with workers compensation regulations.

-

Is there a cost associated with using airSlate SignNow for mileage reimbursement workers compensation?

Yes, airSlate SignNow operates on a subscription-based pricing model. The cost may vary depending on the plan you choose, but our services are designed to be cost-effective. By using our platform for mileage reimbursement workers compensation, businesses can save time and resources in the long run.

-

What benefits does airSlate SignNow provide for mileage reimbursement workers compensation documentation?

By using airSlate SignNow for your mileage reimbursement workers compensation documentation, you gain enhanced efficiency and accuracy in managing expenses. Our platform reduces the risk of errors and ensures that all claims are processed transparently. This can lead to faster reimbursements for employees, improving overall satisfaction and trust in the system.

-

How does airSlate SignNow integrate with existing HR systems for mileage reimbursement workers compensation?

airSlate SignNow offers seamless integrations with various HR systems, enhancing the way mileage reimbursement workers compensation claims are managed. These integrations allow for easy data transfer and documentation sharing, ensuring that all relevant information is centralized. This connectivity can lead to a smoother workflow for both HR departments and employees.

-

Can airSlate SignNow help in ensuring compliance with workers compensation regulations for mileage reimbursement?

Yes, airSlate SignNow helps ensure compliance with workers compensation regulations related to mileage reimbursement by providing templates and processes that adhere to legal standards. Our platform supports companies in maintaining proper documentation and tracking of claims. This mitigates risks and contributes to a transparent reimbursement process.

Get more for Submit Your Mileage For All Trips That Exceed 5 Miles Round Trip, If The Purpose Of

- 2 trustees form

- Michigan warranty deed form

- Warranty deed for not for profit corporation to municipality michigan form

- Michigan trustee form

- Michigan survivorship form

- Warranty deed trustees form

- Michigan warranty deed 497311770 form

- Quitclaim deed from two individuals to one individual michigan form

Find out other Submit Your Mileage For All Trips That Exceed 5 Miles Round Trip, If The Purpose Of

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document